AI Compute Chess: Nvidia’s China Comeback, ASML’s High-NA Litmus Test & TSMC’s Guidance Crush

Welcome, AI & Semiconductor Investors,

Can Nvidia really reclaim billions in China with a pared-down “Blackwell Lite,” or is it just stoking headline risk? This week, we’ll see if ASML’s first High-NA EUV tools can validate its €30 billion capital expenditure cycle and whether TSMC’s Q2 blowout cements its AI-compute moat, setting the tone for margins, geopolitics, and the next leg of the semiconductor supercycle.— Let’s Chip In

What The Chip Happened?

🛡️ “Blackwell Lite”: Nvidia’s B30 sneaks under Washington’s Restrictions

🚀 ASML: High‑NA Lift‑Off or False Start?

🎯 TSMC’s Sales Crush Guidance—Can Margins Keep Up?

[Aehr Test Systems Leans Into AI Burn‑In Market After Mixed FY25 Results]

Read time: 7 minutes

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

Nvidia (NASDAQ: NVDA)

🛡️ “Blackwell Lite”: Nvidia’s B30 sneaks under Washington’s Restrictions

What The Chip: Nvidia is readying a stripped‑down “B30” Blackwell accelerator for mainland China after April 2025 export rules killed its H20. Leaks on May 24 and follow‑up reports through July 14 say the B30 downgrades memory bandwidth and inter‑GPU links so it can legally ship as soon as late Q3 2025.

The Situation Explained:

🔧 HBM out, GDDR7 in – Swapping high‑bandwidth memory for cheaper GDDR7 eliminates scarce CoWoS packaging and slashes bill‑of‑materials costs.

🚀 ~75 % of H20 speed – Early silicon reportedly delivers three‑quarters of the canned H20’s throughput—good enough for LLM inference and small‑model fine‑tuning.

💲List price drops to $6,500‑8,000 versus H20’s $10‑12 k, widening the customer pool but trimming average selling prices.

🌐 PCIe 6.0 / ConnectX‑8 SuperNIC replaces NVLink, giving clusters ~1.2 TB/s of aggregate bandwidth—well above most domestic rivals yet safely below U.S. thresholds.

📦 Big first order: A large unnamed Chinese internet group (“Company A”) inked a $1 bn order for “hundreds of thousands” of B30s in late June; millions of units are targeted by year‑end.

🏛️ Politics heating up:

• July 11 – Bipartisan senators warned CEO Jensen Huang not to meet firms tied to the PLA on his Beijing trip.

• July 10 – Huang met President Trump at the White House a day before departure—an unmistakable risk‑management stop.

💬 Huang’s stance: “I’ve told all of our investors and shareholders that, going forward, our forecasts will not include the China market,” he told CNN on June 12, underscoring how uncertain the revenue stream remains.

Why AI/Semiconductor Investors Should Care: Nvidia had effectively zero‑based China in guidance after an expected $8 bn hit from H20’s ban. If even half the rumoured B30 demand converts, the chip could refill 35‑45 % of that revenue hole—yet at lower gross margins and under a political microscope. The design proves Nvidia can “engineer to the edge” of U.S. controls, but every new revision forces extra R&D spend and hands rivals like Huawei and Biren time to close the gap. Expect mix‑driven margin pressure and headline‑sensitive volatility until Washington and Beijing set clearer, more durable rules.

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

ASML Holding N.V. (NASDAQ: ASML)

🚀 ASML: High‑NA Lift‑Off or False Start?

What The Chip: ASML drops its Q2 FY‑2025 results pre‑market on Wednesday, 16 July 2025. Wall Street models a healthy revenue and earnings bounce, but CEO Christophe Fouquet warned in April that “recent tariff announcements have increased uncertainty in the macro environment.” All eyes now turn to whether bookings, margins, and the first High‑NA sales can prove the recovery is real.

The Situation Explained:

📊 Street bar is high. Analysts see $8.7 bn revenue and $5.80 EPS, roughly +30 % and +35 % YoY respectively.

🏗️ Company guide is cautious. Management steers investors to €7.2‑7.7 bn sales and a wide 50‑53 % gross‑margin band, citing start‑up costs on the new High‑NA platform.

🔬 High‑NA ramp in focus. S&P Global expects High‑NA EUV revenue to triple to €1.7 bn in 2025; Intel already has tools for 14A, while TSMC is “still evaluating” the cost/benefit.

📦 Orders need to bounce. Q1 bookings slumped to €3.9 bn; bulls want a rebound toward €6 bn to validate the 2025‑26 growth story.

🇨🇳 China mix shrinking. Management now expects China to contribute ~20% of 2025 sales, down from 36% in 2024 — any further cut would fuel the bear case.

💰 Buybacks keep humming. ASML repurchased 90,860 shares for €61.5 m in the week to 11 July; the AGM also authorised cancelling up to 10 % of shares outstanding.

⚠️ Sentiment headwinds. Jefferies cut the stock to Hold with a €690 PT, and ASML dropped U.S. diversity quotas to comply with new rules—minor, but headline noise nonetheless.

🔓 IP security spotlight. A Dutch court jailed a former engineer last week for leaking ASML know‑how to Russia, reminding investors of the company’s invaluable—and vulnerable—technology edge.

Why AI/Semiconductor Investors Should Care: ASML controls the lithography chokepoint that enables every cutting‑edge AI chip. If Wednesday brings a bookings rebound and margins at the top of guidance, it bolsters confidence in the €30‑35 bn 2025 sales target and the industry’s broader AI‑driven cap‑ex cycle. Conversely, weak orders or a China‑driven guide‑down would echo Jefferies’ call that 2026 revenue could undershoot consensus by 17 %, pressuring the entire wafer‑fab equipment complex.

TSMC (NYSE: TSM)

🎯 Sales Crush Guidance—Can Margins Keep Up?

What The Chip: Taiwan Semiconductor reports Q2 FY‑2025 earnings on 17 July 2025 (14:00 Taipei). Pre‑announced revenue of T$933.8 bn (US$31.9 bn) blew past its own forecast, setting investors up for a “beat‑and‑raise” moment—unless rising overseas costs or tariffs dent profitability.

The Situation Explained:

📈 Record top line. Street now models US $31.4‑31.9 bn in revenue and EPS of $2.28‑2.37, ~+39 % and +54 % YoY respectively, after the July 10 sales surprise.

🏭 CoWoS bottleneck in focus. CEO C.C. Wei has told analysts he is “working hard to double our CoWoS capacity in 2025” to satisfy AI‑server demand; reports say Nvidia has locked up ~60 % of that output.

💰 CapEx watch. Will CFO Wendell Huang reiterate a US $38‑42 bn 2025 capital budget? —70 % for leading‑edge nodes, 10‑20 % for advanced packaging—but investors speculate spending could climb toward $50 bn by 2027.

⚠️ Tariff cloud. A new 30 % U.S. levy on EU/Mexico imports raises the stakes for geographic diversification and could color management’s outlook.

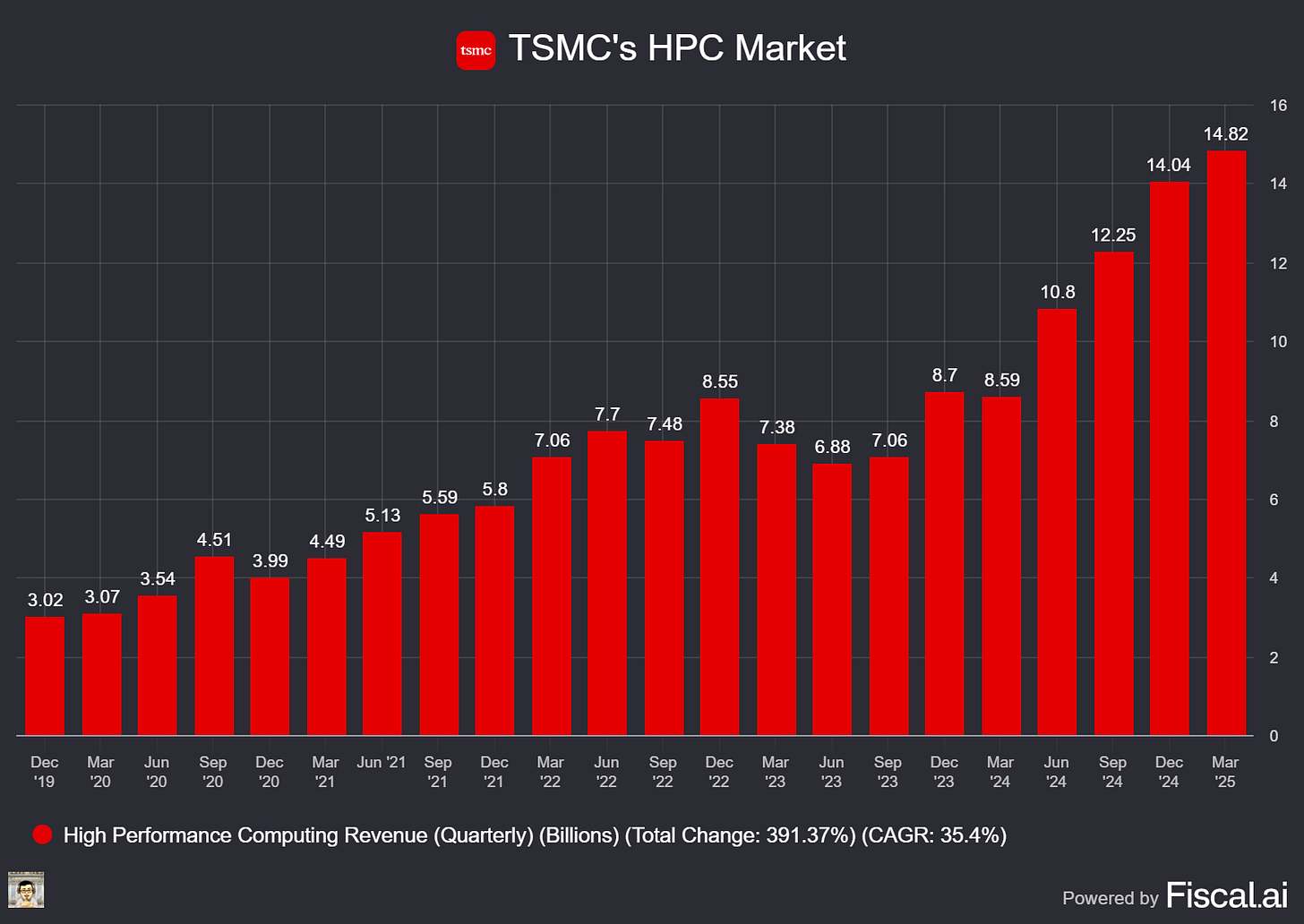

🔄 End‑market mix. HPC/AI already tops 45 % of sales; bulls want confirmation of sustained smartphone rebound after a two‑year lull.

Why AI/ Semiconductor Investors Should Care: TSMC sits at the center of the AI‑compute super‑cycle: a confirmed revenue beat paired with reassurances that CoWoS capacity and 2‑nm risk production stay on schedule would justify its premium multiple. Conversely, any hint that overseas fab costs or tariffs will erode its vaunted gross margin could trigger profit‑taking in a stock that already outran the SOX index. Thursday’s commentary on CapEx and advanced‑packaging throughput will therefore shape both near‑term price action and long‑term conviction.

Youtube Channel - Jose Najarro Stocks

X Account - @_Josenajarro

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

Disclaimer: This article is intended for educational and informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

The overview above provides key insights every investor should know, but subscribing to the premium tier unlocks deeper analysis to support your Semiconductor, AI, and Software journey. Behind the paywall, you’ll gain access to in-depth breakdowns of earnings reports, keynotes, and investor conferences across semiconductor, AI, and software companies. With multiple deep dives published weekly, it’s the ultimate resource for staying ahead in the market. Support the newsletter and elevate your investing expertise—subscribe today!

[Paid Subscribers] Aehr Test Systems Leans Into AI Burn‑In Market After Mixed FY25 Results

Date of Event: July 8, 2025

Executive Summary

*Reminder: We do not talk about valuations, just an analysis of the earnings/conferences

Aehr Test Systems (Nasdaq: AEHR), a specialist in semiconductor test and burn‑in equipment, finished fiscal 2025 with lower revenue but a broader growth roadmap. Fourth‑quarter revenue fell 15 percent year‑over‑year to $14.1 million, and the company reported a GAAP net loss of $2.9 million (‑$0.10 per diluted share). For the full year, revenue slipped 11 percent to $59 million, and Aehr swung to a GAAP loss of $3.9 million after posting a tax‑boosted profit in fiscal 2024.

Despite the downturn, bookings grew 24 percent to $61.1 million, and backlog stood at $15.2 million on May 30, with another $1.1 million of orders booked in early Q1 FY26. Chief Executive Officer Gayn Erickson called FY25 “a transformative year … to expand our total addressable market, diversify our customer base, and enhance our product portfolio.” More than one‑third of revenue now comes from artificial‑intelligence (AI) processors—a segment that contributed nothing a year ago—while silicon‑carbide (SiC) wafer burn‑in dropped below 40 percent of sales.

Growth Opportunities

AI wafer‑level burn‑in (WLBI). Aehr delivered the industry’s first production WLBI system tailored for high‑power AI processors. The FOX‑XP platform can stress nine 300 mm wafers simultaneously—each wafer drawing several thousand watts—eliminating the need to screen devices after packaging. Management disclosed that an unnamed AI customer has moved from feasibility tests to a volume‑evaluation phase. “If this evaluation is successful, they intend to transition to high‑volume production wafer‑level testing,” Erickson said, highlighting a potential multiyear revenue stream.