AI Giants Double Down: Alphabet's $85B Cloud Bet, Tesla’s Robotaxi Gamble, and ServiceNow’s Explosive Growth

Welcome, AI & Semiconductor Investors,

Can Alphabet’s unprecedented $85 billion AI infrastructure bet solidify its dominance, or will supply chain hurdles trip its ambitions? Tesla’s robotaxi vision is hitting the streets, but with automotive margins under pressure and cash flow dwindling, will investors withstand Elon Musk's “rough quarters” ahead? Meanwhile, ServiceNow’s rapid AI monetization is outperforming expectations, quietly reshaping enterprise software. — Let’s Chip In

What The Chip Happened?

🤖 Robotaxis Roll, Margins Stall—Tesla’s Q2 2025 AI Pivot

🚀 AI Control Tower Lifts ServiceNow to New Heights

📊 CapEx to the Moon: Google Doubles‑Down on AI Cloud

[Alphabet’s Q2 2025: AI Builds Bigger Moats and Bigger Numbers]

Read time: 7 minutes

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

Tesla (NASDAQ: TSLA)

🤖 Robotaxis Roll, Margins Stall—Tesla’s Q2 2025 AI Pivot

What The Chip: On July 23, 2025, Tesla posted Q2 revenue of $22.5 billion (‑12 % Y/Y) and adjusted EPS of $0.40, missing the low end of consensus. CEO Elon Musk offset the weak print with a bold autonomy pitch: commercial robotaxi service is live in Austin and could reach half of the U.S. population by year‑end—yet he also warned, “we probably could have a few rough quarters.

The Situation Explained:

🚕 Robotaxi milestone. Paying customers have logged more than 7,000 driver‑free miles in Austin; Tesla is seeking approvals for the Bay Area, Nevada, Arizona, and Florida to hit “½ of the U.S. population by YE 2025.”

🖥️ 67 k‑GPU training cluster. Tesla added 16,000 NVIDIA H200s, boosting its “Cortex” super‑cluster to ≈67,000 H100‑equivalent GPUs—one of the world’s largest AI training footprints.

🏭 Dojo 2 on deck. Management targets 100 k H100‑equivalent performance when Dojo 2 enters volume service in 2026, aiming to own the full AI stack and curb future GPU purchases.

🤖 Optimus Gen 3 hype. Musk called the next‑gen humanoid robot “an exquisite design” and repeated that it “will be the biggest product ever,” with a few‑hundred pilot units due late 2025 and mass production in 2026.

💸 Financial pressure. Automotive revenue slid to $16.7 billion on lower ASPs; free cash flow shrank to $146 million as Tesla plowed cash into AI and robotics CapEx that will exceed $9 billion this year.

⚡ Energy bright spot. Megapack deployments hit 9.6 GWh and energy gross margin reached ≈30 %, providing $846 million of gross profit to help fund AI expansion.

🛡️ Balance‑sheet buffer. Tesla closed the quarter with $36.8 billion in cash versus $7.0 billion in total debt, giving it runway to absorb near‑term earnings volatility.

⚠️ Headwinds ahead. Musk flagged expiring U.S. EV incentives and new tariffs, conceding “we could have a few rough quarters” while the autonomy business scales.

Why AI/Semiconductor Investors Should Care: Tesla now ranks among the world’s top buyers of advanced AI silicon, driving incremental demand for NVIDIA’s H‑series GPUs today even as it races to replace them with in‑house Dojo chips tomorrow.

Its pivot toward data‑center‑class compute, fleet‑derived training data, and vertically integrated robotics could create a high‑margin software and services flywheel, if regulators approve robotaxis and Dojo delivers on cost‑per‑token promises. Conversely, the heavy AI CapEx and shrinking auto margins make cash flow execution critical; any delays in autonomy or Optimus could force fresh capital raises. In short, Tesla has become a leveraged bet on real‑world AI, one whose success or failure will ripple across the entire semiconductor value chain.

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

ServiceNow (NYSE: NOW)

🚀 AI Control Tower Lifts ServiceNow to New Heights

What The Chip: ServiceNow crushed Q2 FY‑25 (reported July 23) expectations, as AI‑powered subscription revenue hit $3.113 billion (+22.5 % y/y) and management lifted full‑year guidance. CEO Bill McDermott summed it up: “We don’t live in a SaaS neighborhood—we live in an enterprise AI neighborhood on a one‑platform model.”

The Situation Explained:

✨ AI Everywhere. Now Assist appeared in 18 of the top 20 deals; one customer signed a $20 million+ Assist contract, and 21 firms bought five or more Assist modules.

📈 $1 B ACV in Sight. Management still targets $1 billion Now Assist ACV by 2026 and says the current ramp is ahead of plan.

🤖 Control Tower & Agent Fabric. New AI Control Tower beat its full‑year ACV goal in just 60 days, orchestrating “any cloud, any data source, any LLM, any agent.”

💼 CRM & SecOps Expansion. Creator Now Assist average deal size quadrupled y/y; SecOps + Risk net‑new ACV doubled q/q.

🔗 Partnership Flywheel. NVIDIA’s Nemotron 15B cuts inference costs, AWS delivers bidirectional workflow automation, while Cisco and UKG extend security and HR reach.

🛒 M&A Muscle. Closed data.world for cataloging, integrated Logik.ai CPQ (nine deals in June), and aims to absorb Moveworks ($2.9 b) by Q4.

⚙️ Efficiency Gains. Internal AI saved an estimated $350 million in 2025 and boosted non‑GAAP operating margin to 29.5 % (+250 bp).

📊 Raised Outlook. FY‑25 subscription‑revenue guide now $12.78–$12.80 b (+20 % y/y); cRPO climbed to $10.92 b, beating guidance by ~$0.2 b.

Why AI/Semiconductor Investors Should Care: ServiceNow is morphing from workflow vendor to agentic‑AI operating system for the Global 2000. Early monetization proves enterprises will pay for turnkey AI orchestration, and internal productivity wins show margin leverage is real. Risks—premium valuation, large‑cohort renewals, Moveworks integration—merit monitoring, yet the combination of 20 %+ growth, rising margins, and a deepening NVIDIA‑AWS ecosystem positions ServiceNow as a core layer in the enterprise‑AI stack.

Alphabet (NASDAQ: GOOG)

📊 CapEx to the Moon: Google Doubles‑Down on AI Cloud

What The Chip: On July 23, 2025, Alphabet reported blow‑out Q2 results, $96.4 billion revenue and $2.31 EPS, both ahead of Street views, while hiking 2025 capital‑expenditure plans to ≈ $85 billion to meet surging AI‑cloud demand. CEO Sundar Pichai called AI “positively impacting every part of the business.

The Situation Explained:

🏗 Cap‑ex surge & pipeline: Q2 spend hit $22.4 billion ( +70 % YoY); management lifted the full‑year target from $75 billion to $85 billion, with “the vast majority” earmarked for AI‑optimized data‑centers and custom TPU clusters.

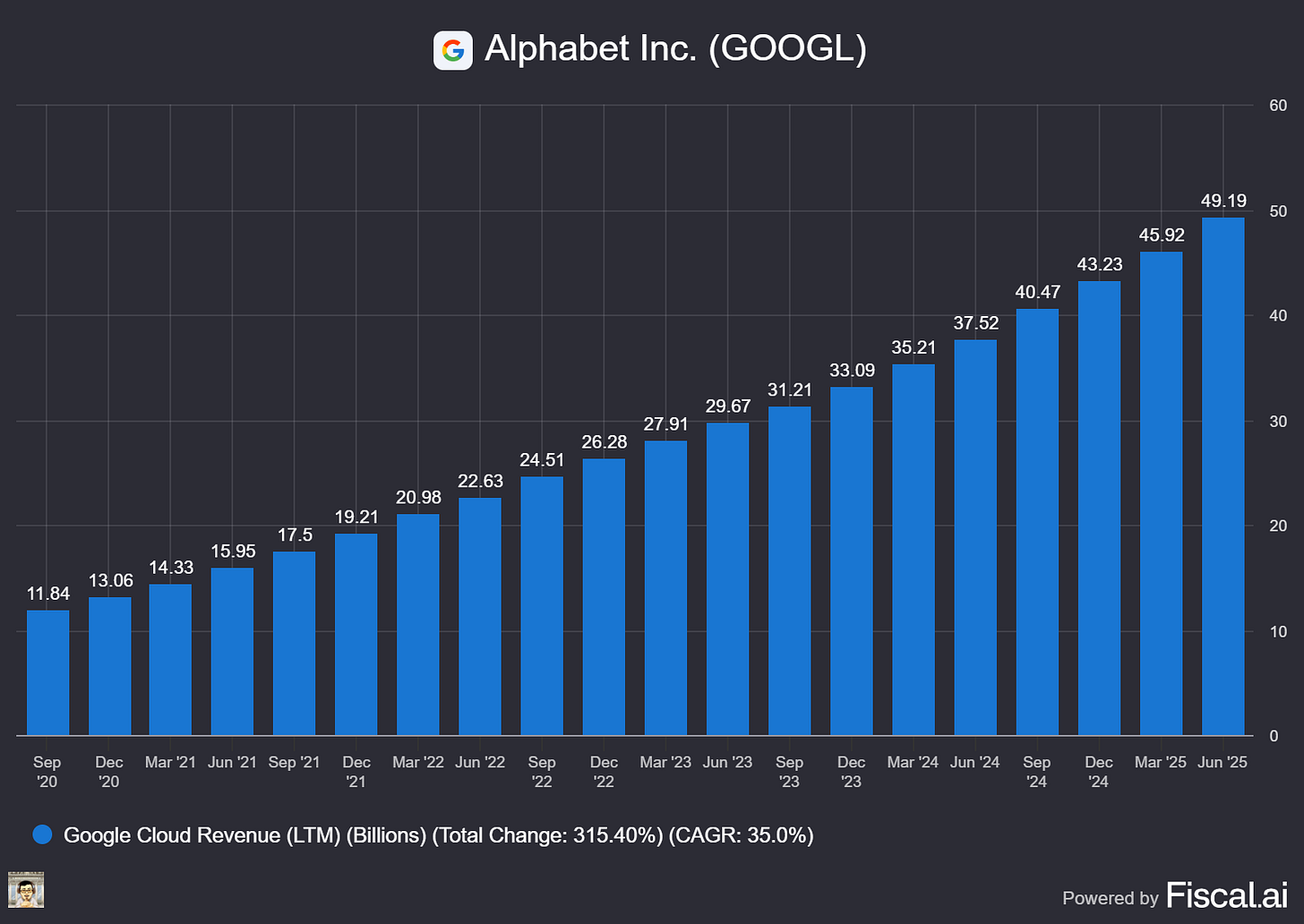

☁️ Cloud crosses $50 b run‑rate: Google Cloud revenue jumped 32 % YoY to $13.6 billion and operating margin expanded to 20.7 %—nearly doubling last year’s 11 %. Backlog exploded 38 % YoY to $106 billion, with billion‑dollar deals in 1H 2025 already matching all of 2024.

🤖 Gemini adoption snowballs: 9 million developers and 85 k enterprises now build on Gemini; monthly token processing leapt to ≈ 980 billion, up 2× since Google I/O in May.

🔍 AI‑first Search rollout: “AI Overviews” appear in 40 languages and over 200 countries, lifting query volume by 10 % where shown, while the new “AI Mode” already tops 100 million MAUs in the U.S. and India.

🎬 Content & video AI: Users generated 70 million+ videos with Veo since May; in the U.S., YouTube Shorts now match in‑stream ad revenue per watch‑hour and exceed it in some regions.

💵 Earnings beat & resilient margins: Total revenue beat consensus by ≈$2.4 billion and EPS by 6 %, while group operating margin held at 32 % despite heavier depreciation from the cap‑ex wave.

⚙️ Demand > supply through 2026: Management warned the cloud remains “capacity‑constrained,” with incremental racks coming online only late‑2025; depreciation growth is set to accelerate in Q3.

Why AI/ Semiconductor Investors Should Care: Alphabet just staked an unprecedented $85 billion on owning the AI‑compute stack—servers, custom TPUs, and global fiber. If Cloud keeps compounding above 30 % with rising 20 %+ margins, those outlays can turbo‑charge free‑cash‑flow and widen the moat against Microsoft and Amazon.

Conversely, any stumble, be it supply‑chain snags, slower AI monetization in Search, or adverse antitrust remedies, would amplify depreciation drag and compress valuation multiples. In short, Alphabet’s bet offers asymmetrical upside for believers in hyperscale AI infrastructure, but demands vigilance on cap‑ex productivity and regulatory headwinds through 2026.

Youtube Channel - Jose Najarro Stocks

X Account - @_Josenajarro

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

Disclaimer: This article is intended for educational and informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

The overview above provides key insights every investor should know, but subscribing to the premium tier unlocks deeper analysis to support your Semiconductor, AI, and Software journey. Behind the paywall, you’ll gain access to in-depth breakdowns of earnings reports, keynotes, and investor conferences across semiconductor, AI, and software companies. With multiple deep dives published weekly, it’s the ultimate resource for staying ahead in the market. Support the newsletter and elevate your investing expertise—subscribe today!

[Paid Subscribers] Alphabet’s Q2 2025: AI Builds Bigger Moats and Bigger Numbers

Date of Event: July 23, 2025

Executive Summary

*Reminder: We do not talk about valuations, just an analysis of the earnings/conferences

Alphabet’s second‑quarter 2025 report largely validated the company’s AI‑first strategy. Revenue rose 14 % year over year to $96.4 billion, while diluted earnings per share climbed 22 % to $2.31. Management credited “robust growth across the company,” pointing to double‑digit increases in Google Search, YouTube, subscriptions, and a 32 % surge in Google Cloud.

Operating margin held steady at 32.4 % despite a sharp step‑up in capital outlays. “AI is positively impacting every part of the business,” Chief Executive Sundar Pichai told investors, highlighting record engagement for new AI‑powered search modes and a cloud backlog that has swelled to $106 billion.

Growth Opportunities

Alphabet’s near‑term expansion hinges on translating generative‑AI leadership into durable revenue streams:

Search reinvention. AI Overviews now reach more than 2 billion monthly users and are “driving over 10 % more queries globally” for the categories in which they appear. Early data show younger users search more frequently once they test AI Mode, paving the way for incremental ad inventory without diluting the core experience.