AI Megatrend Fuels TSMC Boom, ASML Faces Tariff Shock, Micron Dips—What Investors Need to Know Now

Welcome, AI & Semiconductor Investors,

TSMC just posted explosive Q2 growth, driven by a relentless AI demand that's maxing out its advanced node capacities. Meanwhile, ASML stunned markets by warning that looming tariffs might derail its 2026 growth trajectory, causing shares to plunge 11% in a single session. Micron, despite solid fundamentals, slid 8% on fears of softer memory pricing—raising the question: are these market jitters justified, or do they signal a buying opportunity for savvy semiconductor investors?— Let’s Chip In

What The Chip Happened?

🚀 AI Demand Still Outruns Capacity — TSMC Lifts 2025 Outlook After a Blow‑Out Quarter

🌩️ Tariff Turbulence Trips ASML, the Litho King

🔻 Demand Cloudy, HBM Still Sunny – Micron’s 8 % Slide Raises Cyclical Jitters

[ASML Q2 2025: €7.7 B Sales, 53.7 % Margin, High‑NA Debut]

Read time: 7 minutes

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

Taiwan Semiconductor Manufacturing (NYSE: TSM)

🚀 AI Demand Still Outruns Capacity — TSMC Lifts 2025 Outlook After a Blow‑Out Quarter

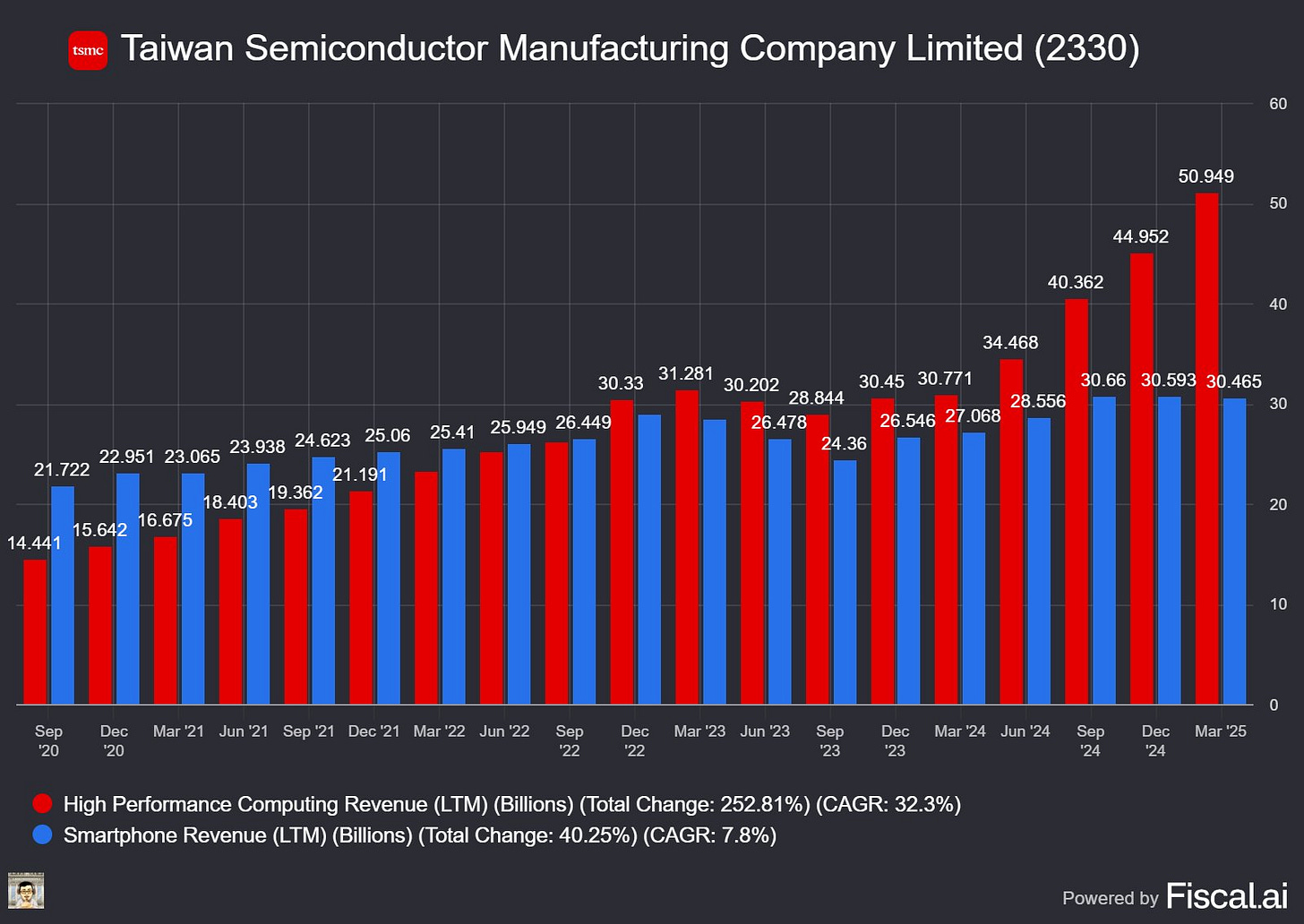

What The Chip: On July 17, 2025, TSMC said surging AI and high-performance computing (HPC) orders pushed second‑quarter sales and margins well above guidance, prompting management to raise full‑year revenue growth to ≈30 % in U.S.‑dollar terms. CEO C.C. Wei called the AI up‑cycle “a megatrend” that is “getting stronger and stronger,” with capacity tight across every leading‑edge node.

The Situation Explained:

📊 HPC = 60 % of revenue, up 14 % QoQ — the clearest signal that generative‑AI silicon now dominates TSMC’s mix.

🧠 Advanced nodes (<7 nm) deliver 74 % of wafer revenue; 3 nm already 24 % and 5 nm 36 %, showing rapid migration to bleeding‑edge tech.

✂️ Wei says first‑two‑year tape‑outs on 2 nm will exceed both 3 nm and 5 nm, driven by smartphones and data‑center AI.

📦 CoWoS advanced‑packaging lines remain oversubscribed into 2026; TSMC is adding capacity but “narrowing the gap” is the best it can promise.

⚡ Upcoming A16 platform boosts power efficiency ≈20 %, vital as hyperscalers wrestle with data‑center electricity limits.

🏭 Cap‑ex keeps ballooning: $165 billion earmarked for six Arizona fabs, two advanced‑packaging plants, and a major U.S. R&D hub.

🌐 Sovereign‑AI projects pile on extra demand, while edge‑AI dies are swelling 5‑10 % even though unit growth is “still mild.”

🤖 One customer predicts humanoid‑robot silicon demand could be “10× that of EVs,” hinting at another massive wave once the technology matures.

Why AI/Semiconductor Investors Should Care: TSMC sits at the choke‑point of the AI supply chain: demand is compounding mid‑40 % annually, yet every node from 7 nm down is sold out. Tight capacity supports pricing power and margin resilience even as the firm spends record cap‑ex. At the same time, investors must watch execution risk—huge U.S. fab outlays, a persistent CoWoS bottleneck, and fierce node‑shrink economics mean any delay or yield miss could dent returns. Still, with AI now 60 %+ of sales and expanding, TSMC remains the purest large‑cap play on the silicon backbone of the AI era.

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

ASML (NASDAQ: ASML)

🌩️ Tariff Turbulence Trips ASML, the Litho King

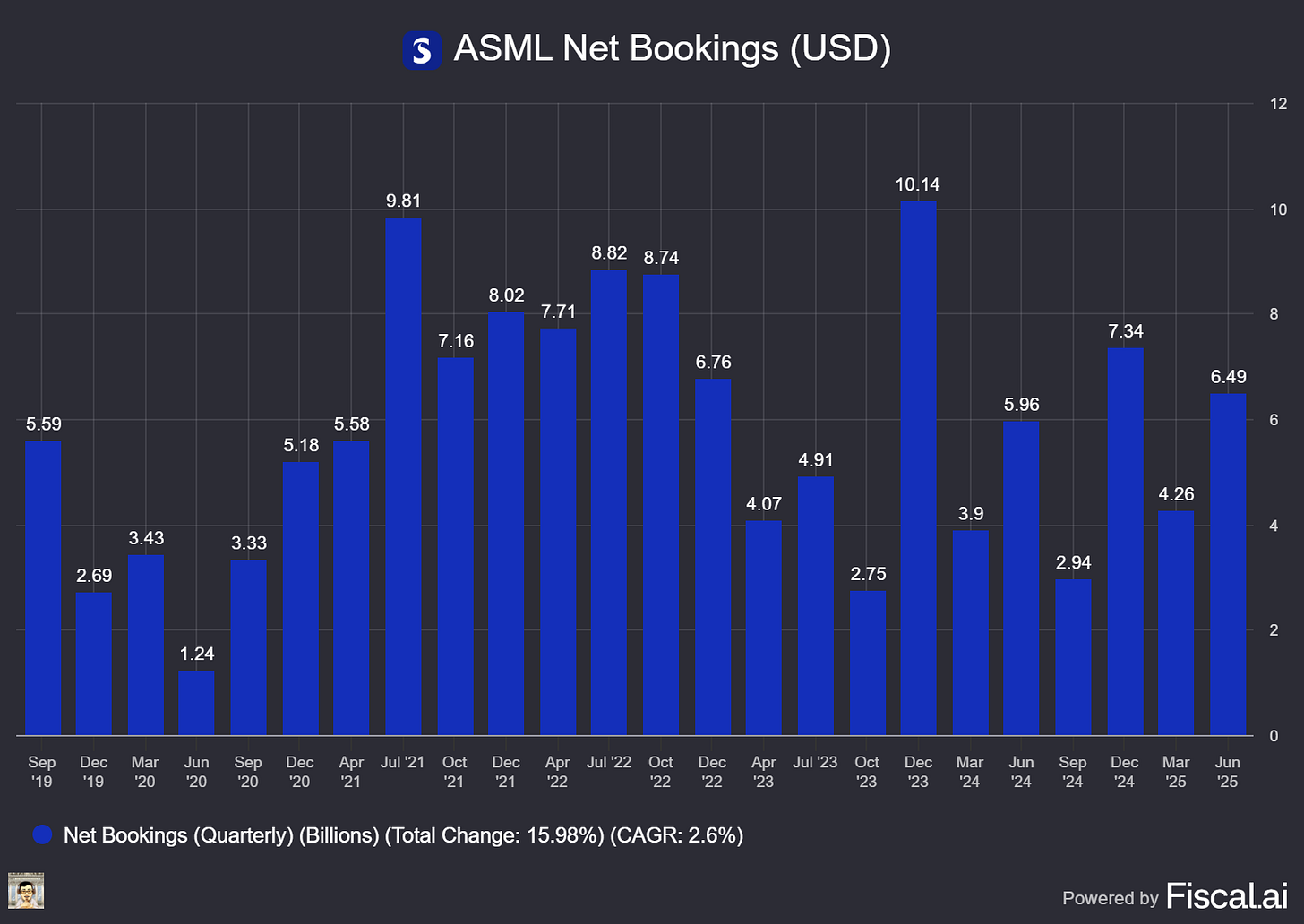

What The Chip: ASML crushed Q2 2025 expectations on July 16, 2025, posting revenue at the top of guidance and a gross‑margin beat—yet the stock crashed 11 % in a single session after management warned it “cannot confirm” 2026 growth until the U.S.–EU tariff cloud clears.

The Situation Explained:

💰 Beat & raise (sort of) – Q2 revenue €7.69 bn (+23 % Y/Y) and GM 53.7 % both topped consensus; FY‑25 sales growth ~15 % and GM ~52 % reiterated.

📈 Bookings boom – Net bookings €5.54 bn (+40 % Q/Q); 42 % EUV as AI logic and HBM‑hungry DRAM fabs lock in tools early.

🛫 High‑NA lifts off – First EXE:5200B shipped; productivity target 175 wph gives customers a path to single‑exposure 1‑4 nm nodes.

⚠️ Tariff trip‑wire – Proposed 30 % import tariff on EU litho gear for U.S. fabs pushes TSMC AZ & Intel Ohio decisions to the right; an EUV scanner could jump to ~€325 m.

🏗️ Capex digestion – After 2023‑24 mega‑builds, chipmakers are pausing to absorb €250‑400 m tool spends; Barclays says 2026 backlog coverage is at a 3‑yr low.

🇨🇳 China still accounts for 27 % of system revenue – Mature-node DUV demand hums, but export-control risk lingers.

🐂 Street stance mixed – JPM keeps Overweight but trims PT, wants “clearer 2027 visibility”; UBS stays Neutral, calls 2026 view “insufficient to signal a turn.”

📉 Market reaction – ADRs and Amsterdam shares slid 10‑11 % on 16 July, the worst day since Oct‑2024, erasing ~$30 bn in value; peers ASM Intl., BESI, Soitec fell in sympathy.

Why AI/Semiconductor Investors Should Care: EUV remains the bottleneck for every advanced AI GPU, custom accelerator and HBM‑rich DRAM die. ASML’s near‑term business is humming, but its premium valuation assumes unbroken compounding; any wobble in 2026 growth—or a tariff that inflates tool costs—hits sentiment fast. Watch the Aug 1 tariff decision, High‑NA demo results at Intel 18A/TSMC A16, and CHIPS‑Act grant timing: they will determine whether this sell‑off is a bargain entry or the first crack in the lithography growth story.

Micron Technology (NASDAQ: MU)

🔻 Demand Cloudy, HBM Still Sunny – Micron’s 8 % Slide Raises Cyclical Jitters

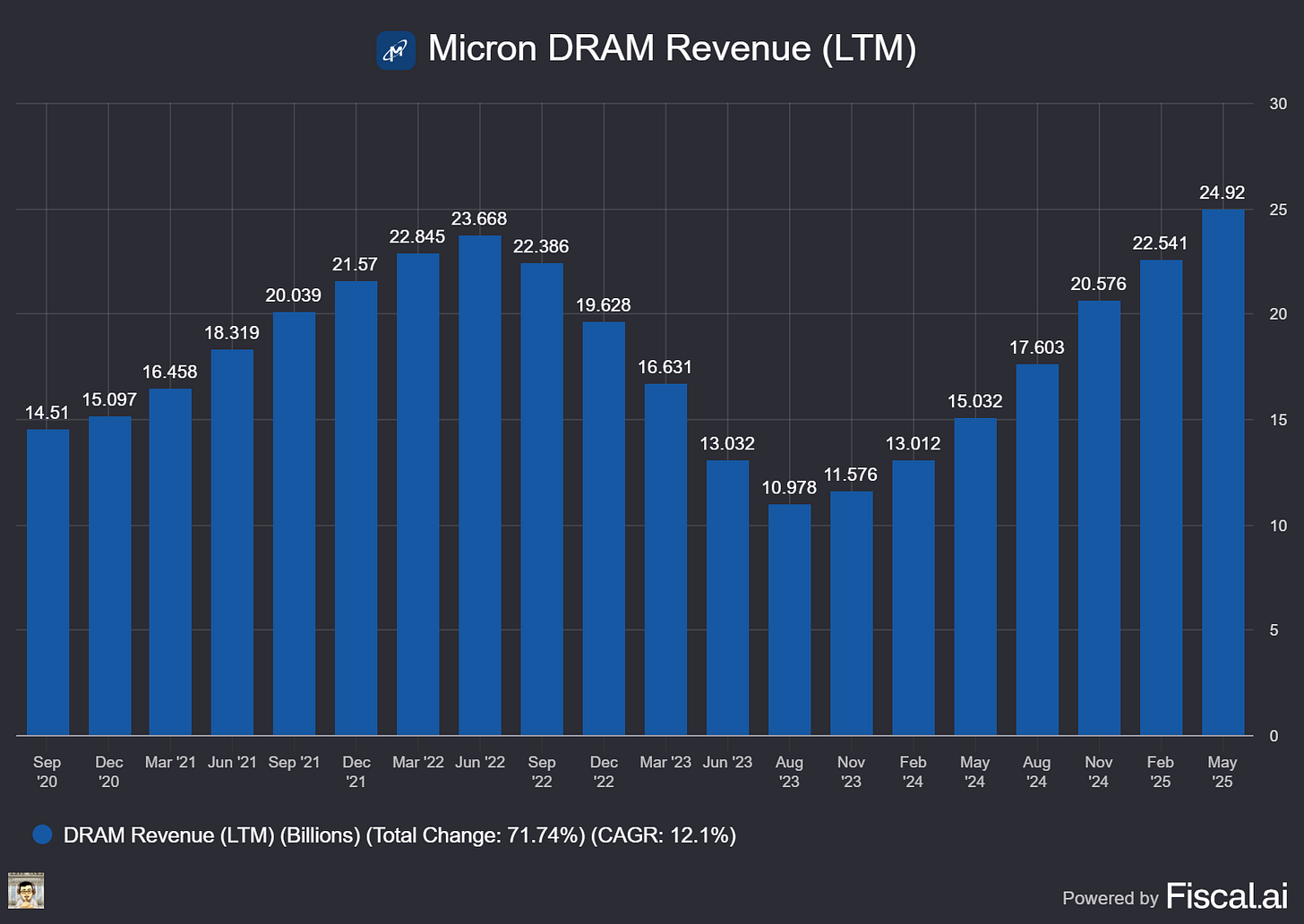

What The Chip: Micron shares dropped about 8 % between July 14 – 17, 2025, sliding from the mid‑$120s to roughly $113 even as the broader market rose. The pull‑back followed fresh sell‑side notes flagging possible DRAM & NAND softness in 2H 25 and a Goldman‑Sachs downgrade of rival SK Hynix, which spooked investors about high‑bandwidth‑memory (HBM) pricing.

The Situation Explained:

🌩 Edgewater sparks fear: A July 14 note warned that PC and smartphone orders “could weaken,” implying DRAM/NAND pricing may soften later this year.

📉 Follow‑through downgrades: BofA’s Vivek Arya stuck to a “cautious” stance on July 15‑16; Goldman cut SK Hynix on July 17, warning HBM prices might fall in 2026, and traders extrapolated the risk to Micron.

🔄 Profit‑taking & options flow: Shares had rallied ~40 % YTD to a $129.85 record (June 26); negative gamma in options exaggerated the reversal during expiration week.

📈 Street still bullish: Consensus sits at 26 Buys / 5 Holds / 1 Sell with an average $146 target (≈ 29 % upside). Evercore ISI even raised its target to $150 on July 17—the very day the stock fell.

💾 Management counters the bears: CEO Sanjay Mehrotra told investors on the June 25 call, “HBM is sold out for calendar 2025 and most 2026 allocation is already under discussion.”

🚀 Numbers talk: Fiscal Q3 revenue hit $9.3 bn (+37 % Y/Y); Micron guides Q4 to $10.7 bn (+15 % Q/Q) with 41 % gross margin, and raised CY25 DRAM bit‑demand outlook to “high‑teens.”

⚖ Supply discipline: Micron plans sub‑industry bit growth in commodity DRAM/NAND and cut NAND wafer capacity 10 % YoY, supporting firmer pricing.

🗓 Next catalysts: Late‑September FY‑Q4 results and any 2026 HBM contract disclosures (e.g., Nvidia, AMD) will test both bull and bear theses.

Why AI/ Semiconductor Investors Should Care: This three‑day swoon looks sentiment‑driven, not fundamental. Micron’s sold‑out HBM, tightening supply, and accelerating revenue suggest demand remains robust in AI data‑center memory—the company’s highest‑margin product line.

If you believe HBM pricing stays firm into 2026 and PC/handset weakness proves manageable, the dip may offer a more attractive entry ahead of a potential record FY‑25 finish. Still, monitor upcoming PC shipment data and HBM pricing chatter: renewed signs of end‑market slack or unexpected price cuts could extend volatility.

Youtube Channel - Jose Najarro Stocks

X Account - @_Josenajarro

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

Disclaimer: This article is intended for educational and informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

The overview above provides key insights every investor should know, but subscribing to the premium tier unlocks deeper analysis to support your Semiconductor, AI, and Software journey. Behind the paywall, you’ll gain access to in-depth breakdowns of earnings reports, keynotes, and investor conferences across semiconductor, AI, and software companies. With multiple deep dives published weekly, it’s the ultimate resource for staying ahead in the market. Support the newsletter and elevate your investing expertise—subscribe today!

[Paid Subscribers] ASML Q2 2025: €7.7 B Sales, 53.7 % Margin, High‑NA Debut

Date of Event: July 16, 2025

Executive Summary

*Reminder: We do not talk about valuations, just an analysis of the earnings/conferences

ASML Holding N.V. reported second‑quarter 2025 net sales of €7.7 billion and net income of €2.3 billion, landing at the top of management’s range. Gross margin reached 53.7 %, helped by one‑off cost reductions and a strong flow of productivity upgrades. Quarterly net bookings climbed to €5.5 billion, including €2.3 billion for extreme ultraviolet (EUV) systems, while the total order backlog stood near €33 billion.

Chief Executive Officer Christophe Fouquet highlighted “continued progress in lithography intensity, particularly in DRAM,” and confirmed shipment of the first TWINSCAN EXE:5200B high‑numerical‑aperture (High NA) EUV scanner. Management guided third‑quarter revenue of €7.4 – €7.9 billion, a gross margin of 50 – 52 %, and full‑year 2025 sales growth of roughly 15 % with a gross margin near 52 %.

Growth Opportunities

AI‑driven demand in logic and memory: Customers that manufacture advanced processors for artificial intelligence workloads are expanding capacity on leading‑edge “2 nanometer‑class” nodes and accelerating their transition to high‑bandwidth memory (HBM). Fouquet noted that DRAM makers “recently mentioned an increase in the number of EUV layers on their latest and future nodes,” underlining stronger lithography intensity.