AI’s Trillion-Dollar Showdown: Meta, Microsoft, & Amazon Ignite CapEx Battle

Welcome, AI & Semiconductor Investors,

Will Meta’s bold quest for superintelligence redefine AI dominance, or will ballooning spending spook investors before returns materialize? With Microsoft strained by GPU shortages even amid record revenues, and Amazon racing ahead with custom silicon, the trillion-dollar AI arms race is entering uncharted territory. Here’s what chip investors must know about the massive bets shaping the semiconductor market’s future. — Let’s Chip In

What The Chip Happened?

🚀 Meta Goes “All‑In” on Superintelligence & Mega CapEx

💥 Copilots Soar, Capacity Strains: Microsoft Posts Record Q4 FY‑25

📦 Amazon Prime Power + AI Engines Fuel Record Q2

[Meta’s Q2 2025: AI Investments Fuel 22 % Revenue Surge]

Read time: 7 minutes

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

Meta Platforms (NASDAQ: META)

🚀 Meta Goes “All‑In” on Superintelligence & Mega CapEx

What The Chip: Meta’s 2Q 25 earnings call (July 30, 2025) delivered a 22 % revenue jump and unveiled “Meta Superintelligence Labs,” a new moon‑shot to build AI that outthinks humans in every domain. CEO Mark Zuckerberg’s message was clear: Meta will pour record cash into compute clusters, talent, and AI‑first products to keep that vision on track.

The Situation Explained:

💰 $47.5 B in revenue (+22 % Y/Y) fueled by AI‑optimized ads; operating margin hit 43 %. “Our business continues to perform very well, which enables us to invest heavily in our AI efforts,” Zuckerberg said.

🤖 Meta Superintelligence Labs formed—led by Scale AI founder Alexandr Wang, ex‑GitHub CEO Nat Friedman, and scientist Shengjia Zhao—to push LLama 4.1/4.2 and next‑gen frontier models.

⚡ Building Prometheus (>1 GW) and Hyperion (scales to 5 GW) GPU clusters; several more “titan” clusters in the pipeline.

📈 New AI ad engines (Andromeda, GEM, Lattice) lifted conversions ~5 % on Instagram and 3 % on Facebook; over 2 M advertisers now use Meta’s gen‑AI creative tools.

🕶️ Ray‑Ban Meta smart‑glasses demand “outstripping supply”; new Oakley Meta HSTN sports model adds higher‑res camera & longer battery. Reality Labs revenue rose 5 % to $370 M but logged a $4.5 B loss.

🏗️ 2025 CapEx guided to $66‑72 B (mid‑point +$30 B Y/Y); management warns of “similarly significant” CapEx growth in 2026 as AI capacity ramps. Possible $100B next year.

⚠️ Regulatory overhang: EU scrutiny of “Less‑Personalized Ads” could “significantly” dent European revenue as early as 3Q 25.

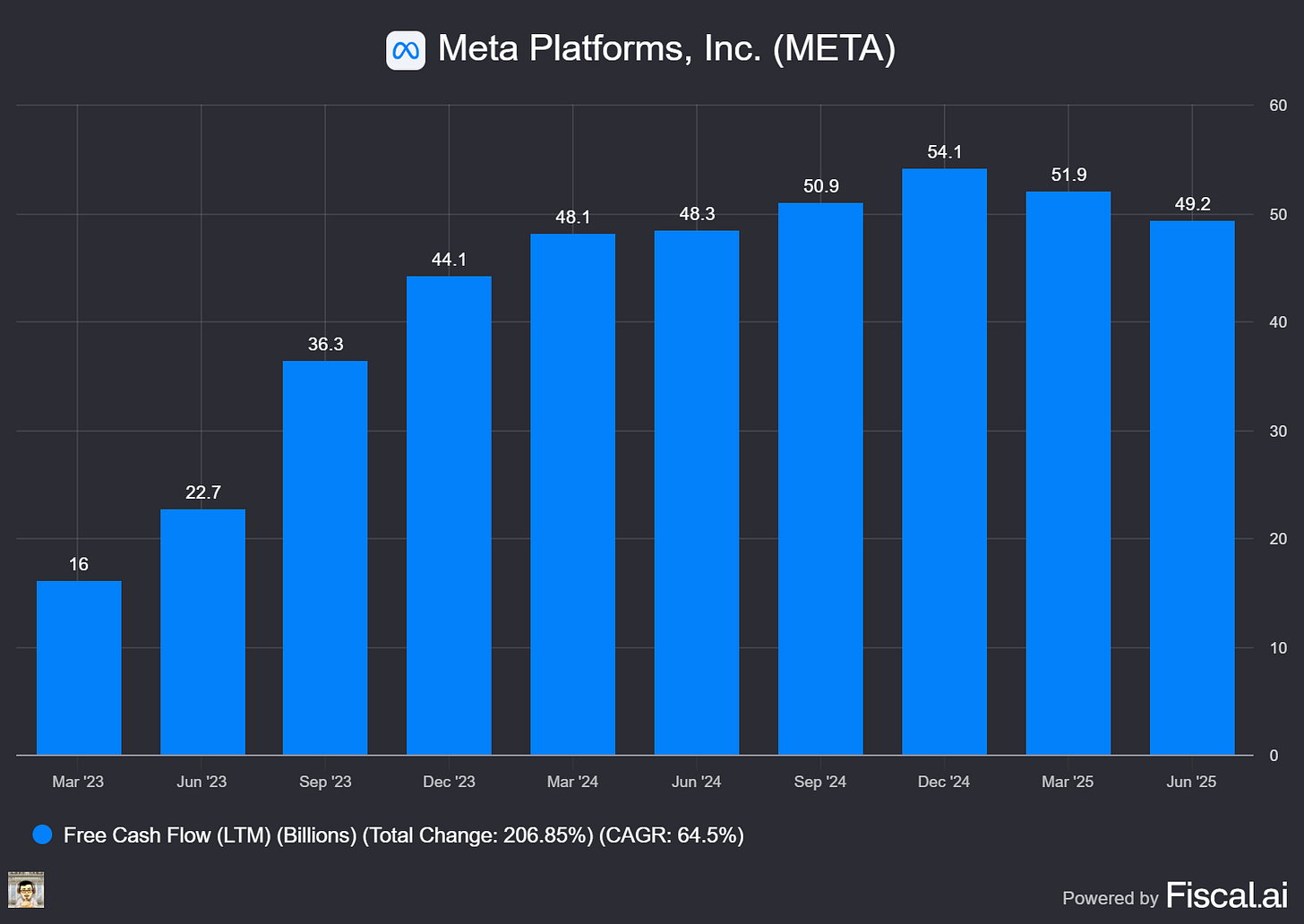

💵 Capital returns continue—$9.8 B in share buybacks, $1.3 B dividend—while cash sits at $47.1 B.

Why AI/Semiconductor Investors Should Care: Meta just joined the trillion‑dollar compute‑arms race, planning multi‑gigawatt GPU farms that will soak up silicon from Nvidia, AMD, ASIC, and their foundry partners for years. The company’s willingness to sacrifice margins today, as CapEx is set to double in two years, signals robust downstream demand for advanced chips, optics, and power infrastructure.

Yet ballooning spend and European regulatory risk underline a key bear case: ROI must materialize before investors tire of the burn.

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

Microsoft (NASDAQ: MSFT)

💥 Copilots Soar, Capacity Strains: Microsoft Posts Record Q4 FY‑25

What The Chip: On July 30, 2025, Microsoft closed a record fiscal year with $76.4 billion in Q4 revenue and an eye‑popping 27 % cloud growth, fueled by relentless AI and Azure momentum, even as management warned that demand still outstrips GPU supply.

The Situation Explained:

🚀 Azure tops $75 billion, growing 34 % YoY and adding >2 GW of new AI‑ready datacenter capacity in 12 months—Microsoft now runs 400+ sites across 70 regions.

🤖 Copilot family hits 100 million MAUs; overall Microsoft products now tally 800 million monthly AI users. Barclays will deploy 100k Copilot seats after successful pilots, and UBS is going all‑in across its workforce.

📈 Microsoft Cloud revenue reached $168 billion (+23 %) for FY‑25; quarterly cloud gross margin slipped 2 pp to 68 % as GPU build‑outs weighed on costs.

💰 Commercial backlog swells to $368 billion (+37 %)—but management says GPUs remain “capacity‑constrained through 1H FY‑26,” implying sustained CapEx.

🏗️ CapEx hit $24.2 billion this quarter (over half long‑lived sites), with Q1 FY‑26 spend guided “over $30 billion.” CFO Amy Hood: “Even accelerating spend, demand keeps improving.”

📊 Microsoft Fabric revenue jumped 55 % YoY to become the fastest‑growing data product in company history, as customers seek integrated data lakes for AI context engineering.

🛡️ Security scale: nearly 1.5 million customers and 100+ new features; Entra now governs identities for human and agent users alike.

⚠️ Watch‑outs: gross‑margin pressure from AI infrastructure, inventory‑heavy Windows OEM channel, and a flat FY‑26 operating‑margin outlook despite higher FX tailwinds.

Why AI/Semiconductor Investors Should Care: Microsoft is proving that AI demand drives multi-layer revenue expansion, from silicon to software subscriptions. At the same time, its unmatched global datacenter footprint and $368 billion backlog create a formidable moat. Yet the company must balance GPU supply, CapEx intensity, and margin preservation; any delay in unlocking higher‑margin AI services (Copilot, Fabric, Security) could compress returns. Still, with Azure seizing share each quarter and management confident in “decade‑long arcs,” the stock remains a bellwether for the entire AI‑hardware value chain.

Amazon.com, Inc. (NASDAQ: AMZN)

🚀 Amazon Prime Power + AI Engines Fuel Record Q2

What The Chip: On July 31, 2025, Amazon posted Q2 revenue of $167.7 billion (+12 % Y/Y) and operating income of $19.2 billion (+31 % Y/Y). Management highlighted a blockbuster Prime Day, rapid generative‑AI adoption in AWS, and continued efficiency gains across its global logistics network—all while flagging tariff and power‑supply uncertainties for the second half.

The Situation Explained:

💰 Profit surge despite margin mix. North America margin hit 7.5 % (+190 bps Y/Y) while International climbed to 4.1 % (+320 bps) thanks to faster delivery and denser inventory placement. CFO Brian Olsavsky noted outbound shipping grew 6 % vs. 12 % unit growth, underscoring structural cost wins.

📦 Prime Day = new milestone. CEO Andy Jassy: “This year’s Prime Day was our biggest ever, with record sales, items sold, and Prime sign‑ups.” More first‑time customers bought perishables, signaling fresh runway for high‑frequency categories.

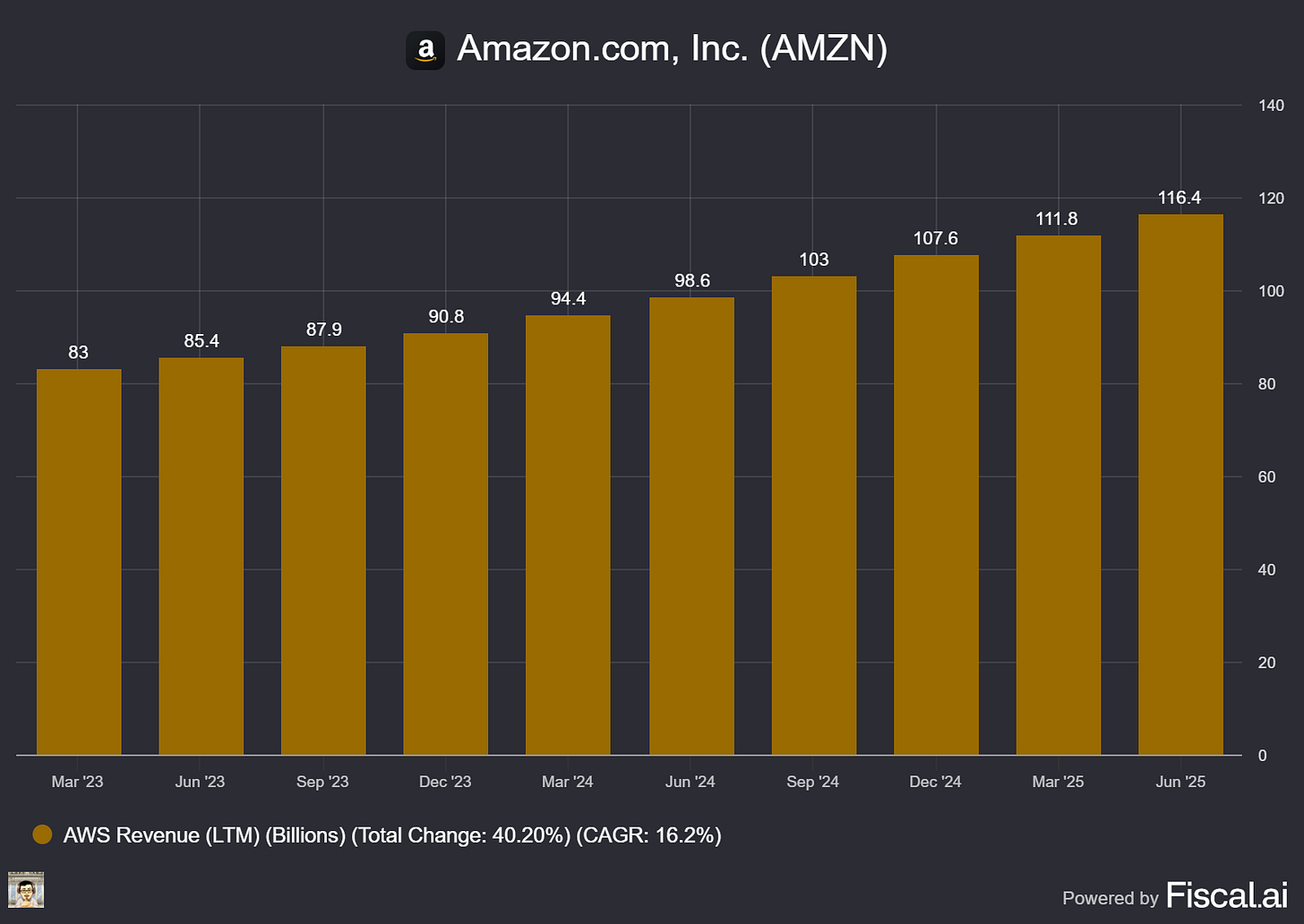

🤖 AI & custom silicon momentum. AWS revenue reached $30.9 billion (+17.5 %); its Trainium2 chips now power Anthropic’s Claude‑4 training and drive “30–40 % better price‑performance” for inference workloads. AWS booked $195 billion backlog (+25 %) but faces near‑term capacity constraints—“power is the single biggest bottleneck.”

🏎️ Advertising is still in overdrive. Ad sales rose 22 % to $15.7 billion on the strength of Sponsored Products and a new Roku DSP partnership that unlocks 80 million CTV households.

📶 Project Kuiper nearing lift‑off. Despite launch‑vehicle delays, pre‑commercial demand from enterprises and governments is “impressive,” leveraging AWS integration for edge‑to‑cloud analytics.

🗣️ Alexa+ shows real traction. Millions of U.S. users now have the generative‑AI upgrade; engagement, multi‑turn interactions, and device usage are “meaningfully higher,” laying groundwork for future subscription and ad monetization.

⚠️ Watch the warning lights. AWS operating margin slipped to 32.9 % (‑660 bps Q/Q) on stock‑based comp seasonality and higher depreciation; supply‑chain power limits could cap AI upside. Management also reiterated tariff visibility is “limited,” with potential consumer‑price pressure in 2H‑25.

🏗️ CapEx keeps climbing. Cash cap‑ex hit $31.4 billion in Q2 and is expected to hold that pace through year‑end, directed primarily to AI datacenters, custom chips, and same‑day fulfillment nodes.

Why AI/ Semiconductor Investors Should Care: Amazon just posted its highest quarterly profit ever while simultaneously pouring record capital into custom silicon, power‑hungry datacenters, and robotics. Trainium2’s adoption by Anthropic and Bedrock signals tangible traction for Amazon‑designed AI accelerators—good news for margin protection as GPU supply stays tight. Yet power constraints, depreciation drag, and tariff fog could temper near‑term AWS growth and cash flow. For investors, the set‑up is a classic Amazon equation: willingness to stomach elevated spend today in exchange for outsized AI infrastructure, advertising, and subscription revenue tomorrow.

Youtube Channel - Jose Najarro Stocks

X Account - @_Josenajarro

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

Disclaimer: This article is intended for educational and informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

The overview above provides key insights every investor should know, but subscribing to the premium tier unlocks deeper analysis to support your Semiconductor, AI, and Software journey. Behind the paywall, you’ll gain access to in-depth breakdowns of earnings reports, keynotes, and investor conferences across semiconductor, AI, and software companies. With multiple deep dives published weekly, it’s the ultimate resource for staying ahead in the market. Support the newsletter and elevate your investing expertise—subscribe today!

[Paid Subscribers] Meta’s Q2 2025: AI Investments Fuel 22 % Revenue Surge

Date of Event: July 20, 2025

Executive Summary

*Reminder: We do not talk about valuations, just an analysis of the earnings/conferences

Meta Platforms (NASDAQ: META) turned in another robust quarter, underscoring how quickly its generative‑artificial‑intelligence push is translating into higher engagement and stronger monetisation.

Top‑line acceleration. Revenue reached $47.5 billion, up 22 % year over year, as ad conversions climbed on the back of new AI‑powered retrieval and ranking models. Operating income jumped 38 % to $20.4 billion, widening margin to 43 %.

Global reach. More than 3.48 billion people used at least one Meta app each day in June, a 6 % increase. Video time on Instagram and Facebook grew by “more than 20 % year over year,” according to Chief Financial Officer Susan Li.

Management’s north star. Chief Executive Officer Mark Zuckerberg reiterated Meta’s aim to “build personal super‑intelligence for everyone” and disclosed formation of Meta Superintelligence Labs to accelerate large‑language‑model (LLM) research.

Together, these data points show a company balancing near‑term operating leverage with once‑in‑a‑generation capex commitments to compute and talent.

Growth Opportunities

AI‑enhanced advertising efficiency. Meta’s new Andromeda retrieval architecture and the GEM ranking system raised ad conversions roughly 5 % on Instagram and 3 % on Facebook in the quarter. Long‑sequence modelling doubled the behavioural history each model can consider, lifting relevance while lowering cost per conversion for advertisers.