Broadcom’s Record-Breaking AI Surge, AMD’s Data Center Dominance, and onsemi’s Hidden Turnaround Play

Welcome, AI & Semiconductor Investors,

Are semiconductor investors underestimating the scale of Broadcom’s AI breakout? A fresh $10 billion order and record backlog suggest otherwise. Meanwhile, AMD is making quiet but powerful moves with MI350 ramping now—and major sovereign deals loading up for 2026. And don’t sleep on onsemi’s methodical march back toward 50% margins, waiting patiently as tariffs and JIT ordering clouds clear. — Let’s Chip In

What The Chip Happened?

🚀 Broadcom: Record Q3, a New AI Customer, and Bigger FY26 Ambitions

🧮 AMD: MI350 Ramp Now, MI400 Next—Sovereign AI Loading

🛣️ onsemi: “Stabilization, Not Recovery” — Mapping the Road Back to 50% Margins

[Broadcom Q3 FY25: AI Surge, VMware Momentum, $7B FCF]

Read time: 7 minutes

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

Broadcom (NASDAQ: AVGO)

🚀 Broadcom: Record Q3, a New AI Customer, and Bigger FY26 Ambitions

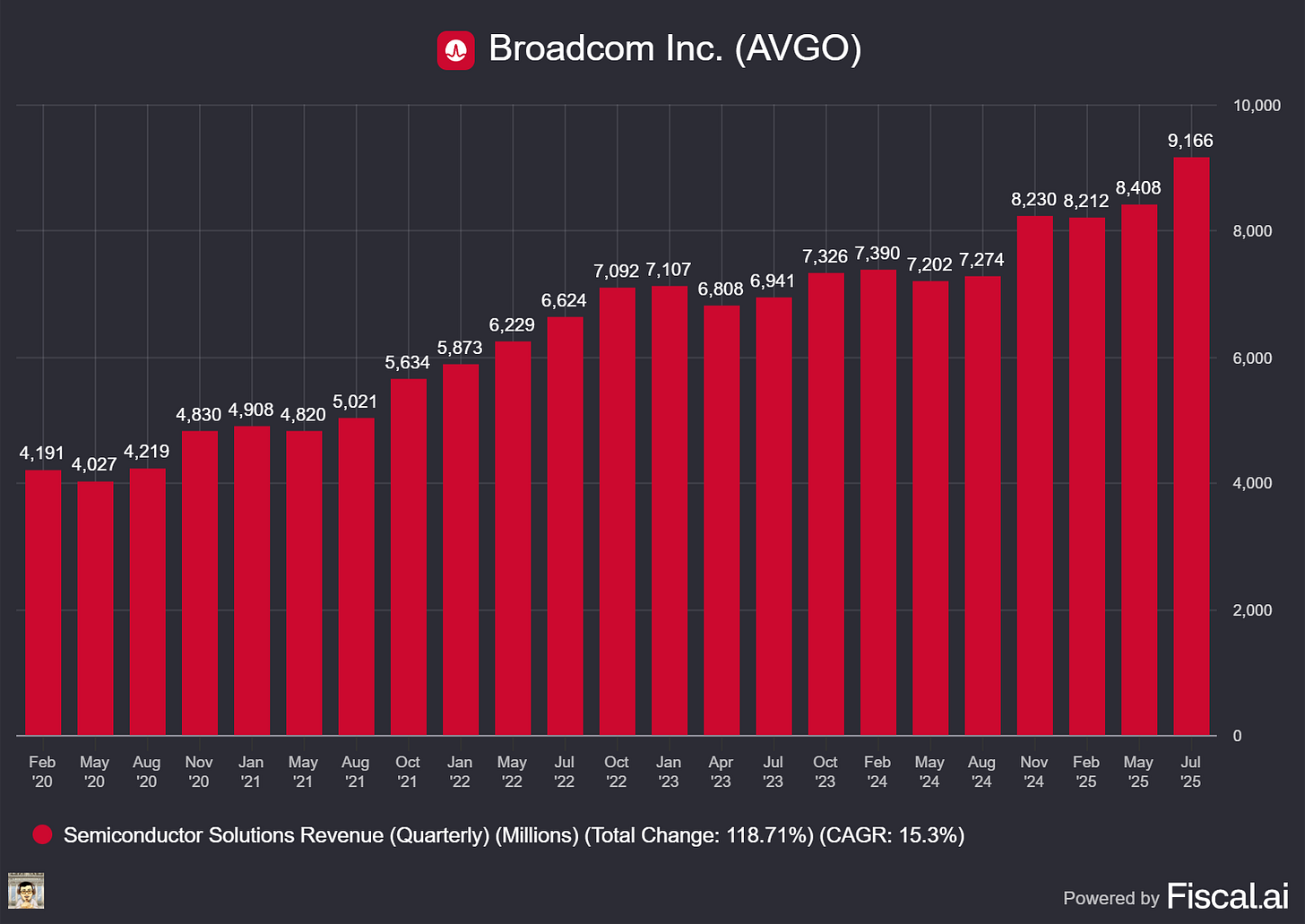

What The Chip: On September 4, 2025, Broadcom posted Q3 FY25 revenue of $16.0B (+22% y/y) on strength in custom AI accelerators (XPUs), Ethernet networking, and VMware—and guided Q4 revenue to ~$17.4B (+24% y/y) with Adjusted EBITDA ~67%. Management also declared a $0.59 quarterly dividend and flagged a record $110B consolidated backlog.

Details:

📊 Results snapshot. Adjusted EBITDA $10.7B (67% margin, +30% y/y); GAAP net income $4.14B; non‑GAAP net income $8.40B; GAAP EPS $0.85; non‑GAAP EPS $1.69. Gross margin 78.4%; operating margin 65.5%.

🤖 AI keeps compounding. Q3 AI semiconductor revenue hit $5.2B (+63% y/y); Broadcom guides Q4 AI to ~$6.2B (+66% y/y). CEO Hock Tan: “AI revenue grew 63% to $5.2B; we expect $6.2B in Q4 as customers keep investing.”

🧩 Fourth XPU customer + $10B order. XPUs (custom AI accelerators) rose to ~65% of AI revenue. Broadcom added a 4th XPU customer and secured >$10B of AI rack orders, which management expects to fulfill in Q3 FY26—a clear step‑up for next year’s growth.

🕸️ Ethernet networking moat. As clusters scale up/out/across, Broadcom launched Tomahawk 6 (102 Tbps) to flatten fabrics to two tiers and Jericho4 (51.2 Tbps) for deep‑buffered scale‑across beyond 200k nodes. Tan: “The network is the computer”—and it’s Ethernet.

☁️ Software/VMware execution. Infrastructure software revenue $6.8B (+17% y/y) with ~77% operating margin. After two years of work by 5,000 developers, Broadcom shipped VMware Cloud Foundation 9.0, positioned as a “real alternative to public cloud” for on‑prem and cloud‑carried AI workloads. Management said >90% of the top 10,000 VMware accounts bought VCF licenses.

💸 Cash engine, returns, balance sheet. Free cash flow $7.0B (44% of revenue) on $7.17B CFO and $142M capex; cash $10.7B; gross debt $66.3B (fixed 3.9% avg coupon). Q3 dividend outlay $2.8B; next dividend $0.59/share payable Sept 30 (record Sept 22). CFO Kirsten Spears: “Free cash flow was a record $7.0B… we returned $2.8B through dividends.”

📦 Backlog & non‑AI cycle. Backlog reached ~$110B; management sees non‑AI bookings up ~23% y/y but still a U‑shaped recovery: Q4 non‑AI semis ~$4.6B (low double‑digit q/q), with broadband the bright spot.

⚠️ Mix headwinds ahead. Broadcom guides Q4 gross margin down ~70 bps q/q on higher XPU and wireless mix; modeling notes: 14% non‑GAAP tax rate and ~4.97B diluted shares in Q4. Leadership continuity: Hock Tan agreed to remain CEO through 2030.

Why AI/Semiconductor Investors Should Care

Broadcom is converting AI enthusiasm into measurable dollars—accelerating XPU ramps across four hyperscale/LLM customers, stacking >$10B of incremental orders for FY26, and tying that silicon to an open‑Ethernet networking stack (Tomahawk/Jericho) that scales where closed fabrics struggle. At the same time, VMware Cloud Foundation 9.0 deepens a high‑margin software base that can host AI workloads on‑prem, diversifying cash flows. Watch near‑term margin mix (more XPUs and wireless), the non‑AI cyclical recovery pace, and macro wildcards (export controls/tariffs)—but the setup for AI‑led growth into FY26 just strengthened.

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

Advanced Micro Devices (NASDAQ: AMD)

🧮 AMD: MI350 Ramp Now, MI400 Next—Sovereign AI Loading

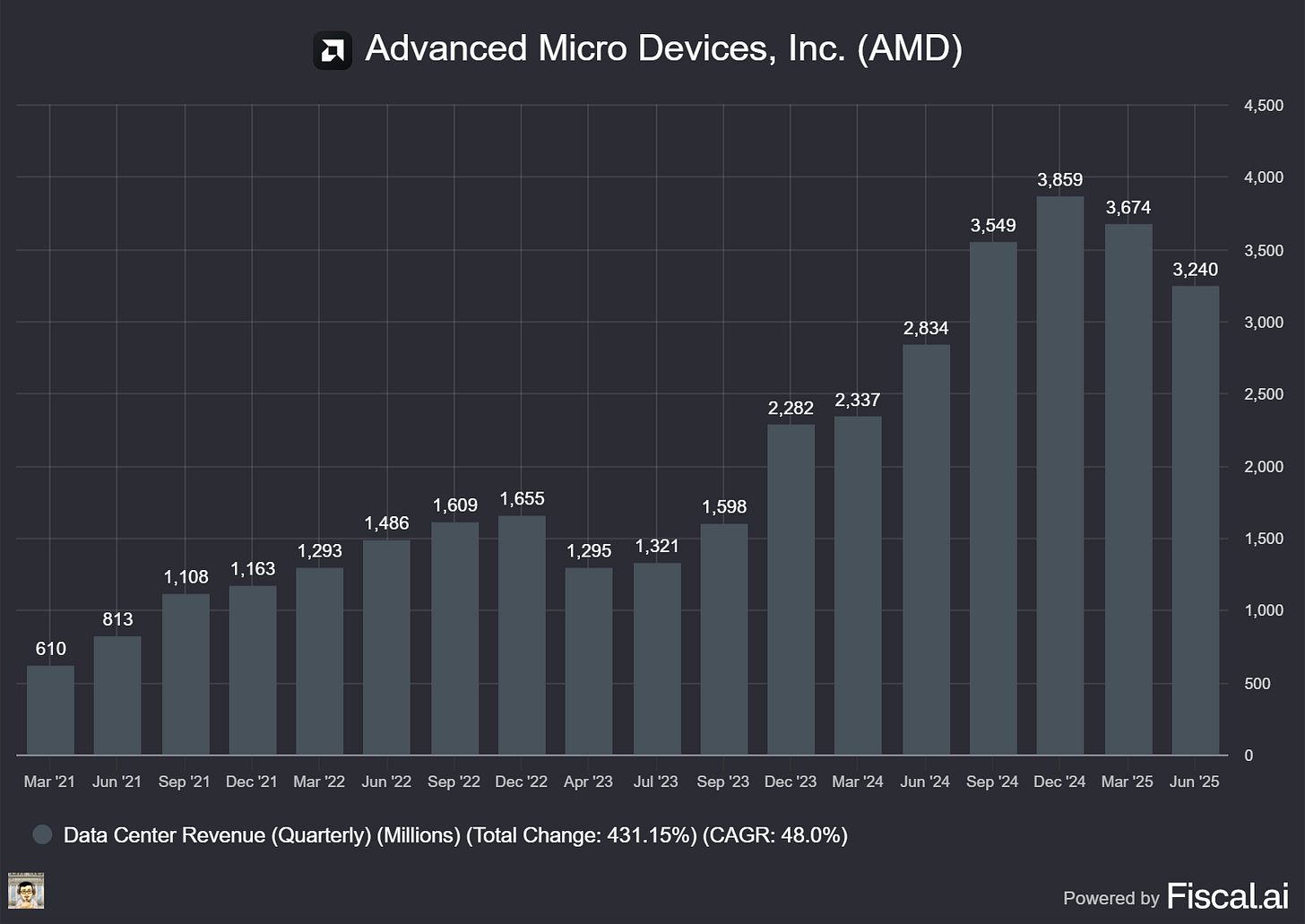

What The Chip: At Citi’s 2025 Global Technology Conference on September 3, 2025, CFO Jean Hu and VP Matthew Ramsay said AMD’s AI engine is accelerating: Q2 revenue hit $7.7B (+32% YoY), Q3 is guided to $8.7B (+28% YoY), and Data Center is set to grow double‑digits QoQ as MI350 moves into volume—before MI400 lands in 2026 and MI500 in 2027.

Details:

📈 Numbers first. Data Center revenue reached $3.2B in Q2 (+14% YoY) despite zero MI308 China shipments; EPYC posted record server sales. Q3 Data Center is guided up double digits sequentially, “primarily… driven by MI350 ramp,” said Hu.

🚀 Roadmap cadence locked. AMD reiterated an annual cadence: MI350 ramping now, MI400 in 2026, MI500 in 2027. Ramsay highlighted “train‑to‑train” deployments on MI355 (a MI350‑series part) for Tier‑2/Tier‑3 training to prepare customers for larger MI400 rollouts.

🤝 Logos & concentration. Existing hyperscalers (Microsoft, Meta, Oracle) are growing, with new customers like Tesla and X now engaged. AMD counts “7 of the top 10 spenders” as customers, per Ramsay—helpful for scale, but it means near‑term revenues remain concentrated.

🧠 Why AMD says it wins inference. More HBM (high‑bandwidth memory) and higher memory bandwidth—thanks to AMD’s chiplet designs—boost large‑context inference performance. In plain English: more on‑package memory = faster answers at lower cost for production workloads.

🏗️ Supply chain still tight. Advanced‑node wafers and HBM remain constrained. AMD says it is one of TSMC’s largest customers, working closely on CoWoS packaging and lining up memory and other rack‑level components to support 2026 deployments.

🌍 Sovereign AI = incremental demand. AMD announced a multibillion‑dollar collaboration with HUMAIN (Saudi) and is pursuing 40+ active sovereign engagements. Hu expects more impact in 2026 as licenses clear with U.S. regulators.

💸 Margins & pricing. “The gross margin of our Data Center GPU business… is below corporate average,” Hu said. AMD is prioritizing TCO (total cost of ownership) and market share now, aiming to expand margins over time as scale improves. BOM (especially HBM) rises each generation, and ASPs rise accordingly; customers get double‑digit TCO gains to offset switching costs.

🧮 TAM & architecture mix. AMD frames AI infrastructure TAM as “a good bit more than $500B by 2028.” Ramsay expects ~20–25% served by ASICs (e.g., custom chips), with the majority led by programmable GPU platforms where AMD competes.

Why AI/Semiconductor Investors Should Care

AMD is turning the MI350 ramp into near‑term revenue while laying a clear 2026–2027 roadmap (MI400/MI500) that could broaden training wins beyond inference. If AMD continues to secure scarce HBM/CoWoS capacity, convert sovereign AI pipelines (40+ nations) into shipments, and deliver TCO advantages, it can gain share against entrenched rivals—even if near‑term margins run below corporate average and customer concentration keeps volatility high. Watch for Q3 Data Center sequential growth, HBM supply updates, and concrete MI400 customer deployments as the next catalysts.

ON Semiconductor Corporation (NASDAQ: ON)

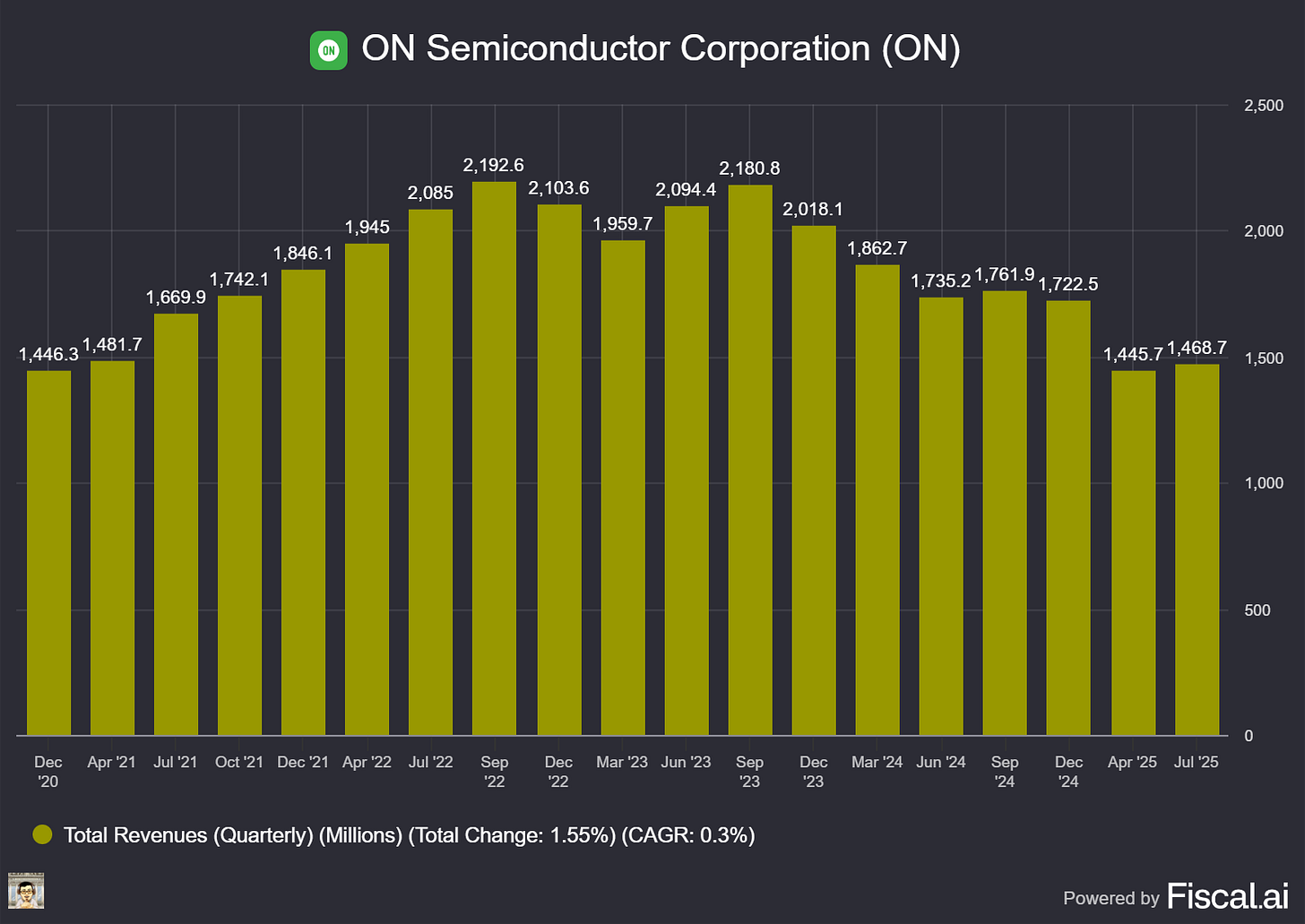

🛣️ onsemi: “Stabilization, Not Recovery” — Mapping the Road Back to 50% Margins

What The Chip: On September 3, 2025, CEO Hassane El‑Khoury and CFO Thad Trent told Citi’s Global Tech crowd that the downturn is stabilizing, not recovering yet. Auto bottomed in Q2 and is up in Q3, H2 should beat H1, and the path back to low‑50% gross margins remains intact—driven by utilization, mix, and footprint actions. “I will call what I see, not what I hope to see,” El‑Khoury said.

Details:

📈 Demand & Bookings: Management sees stability after inventory drain. onsemi entered the current quarter “more booked” than the last two, needing fewer in‑quarter turns. H2 revenue should outperform H1; Auto is up in Q3 after a Q2 bottom. El‑Khoury drew a hard line: “stabilization ≠ recovery.”

🚧 Tariffs Freeze Replenishment: Direct tariff impact on onsemi is minimal today, but customers are cautious and ordering just‑in‑time. Short lead times—usually bullish—are, this time, a sign of uncertainty, not a demand snap‑back. “Customers are paralyzed right now,” Trent said. The replenishment cycle hasn’t begun.

🏭 Utilization Drives Margin Math: Fabs are running at ~68% utilization, creating roughly 900 bps of non‑cash underutilization headwind to gross margin. Cost‑down from “fab‑right” actions should add ~200 bps, and insourcing work previously tied to divested capacity adds ~200 bps more, plus mix tailwinds—“you start adding all that up and you’re getting up into the 50% range,” Trent said.

🪓 Restructuring & Capacity: onsemi took 12% of front‑end capacity offline in Q1 and has completed ~two‑thirds of that plan; more to come. Margin improvements typically lag by ~two quarters as higher‑cost inventory rolls off. El‑Khoury on targets: “Build the plan.”

📦 Inventory Positioning: Base inventory sits at 121 days; distribution channel at 9–11 weeks (fully visible and managed). Many Auto Tier‑1s carry only ~2 weeks—“dangerously low,” El‑Khoury warned—setting up a potential snap‑back if demand ticks up. onsemi holds most inventory in die bank, enabling “a few weeks” conversion to finished goods.

🛡️ Pricing & Portfolio Discipline: Pricing is “normalized.” onsemi refuses to chase competitors’ aggressive discounting in non‑core lines: “We will exit that business,” El‑Khoury said. This continues the multi‑year plan to shrink $800–$900M of lower‑value legacy exposure and protect margins.

🧮 2026 Non‑Repeat Headwind (Already Flagged): About $300M (~5% of 2025 revenue) will not repeat in 2026: ~$100M from non‑core exits, $50–$100M from repositioning image sensing toward machine vision, and the balance from EOL product runoff. Management says this mix shift should be roughly neutral to 2026 gross margin because the pieces removed sit near the corporate average today.

⚡ Auto & Silicon Carbide (SiC) Share Gains: Share gains span China, North America, and Europe. onsemi highlighted new EV and plug‑in hybrid (PHEV) design‑wins moving from IGBTs to SiC (higher efficiency = longer range, smaller systems). Named Chinese OEMs include Xiaomi, BYD, Li Auto, and NIO. El‑Khoury framed China EVs as a global phenomenon (not just domestic), while noting Europe > North America near‑term.

Layman’s note: SiC is a tougher, more efficient semiconductor for EV power electronics—less energy lost as heat, so you get faster charging and better range.

Why AI/Semiconductor Investors Should Care

This is a classic operating‑leverage setup. If replenishment starts once tariff clarity arrives, rising utilization can quickly remove ~900 bps of GM drag, while footprint actions (+~400 bps) and mix push toward low‑50% margins—even before a full demand recovery. Near‑term risk sits with policy uncertainty (tariffs/Section 232), JIT ordering, and the $300M 2026 revenue headwind, but onsemi’s diverse fab footprint (U.S./Japan/Europe) and SiC design‑in momentum provide structural advantages. Add management’s FCF‑funded buybacks (“cash is king”) and the setup skews favorable if stabilization graduates to replenishment.

Youtube Channel - Jose Najarro Stocks

X Account - @_Josenajarro

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

Disclaimer: This article is intended for educational and informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

The overview above provides key insights every investor should know, but subscribing to the premium tier unlocks deeper analysis to support your Semiconductor, AI, and Software journey. Behind the paywall, you’ll gain access to in-depth breakdowns of earnings reports, keynotes, and investor conferences across semiconductor, AI, and software companies. With multiple deep dives published weekly, it’s the ultimate resource for staying ahead in the market. Support the newsletter and elevate your investing expertise—subscribe today!

[Paid Subscribers] Broadcom Q3 FY25: AI Surge, VMware Momentum, $7B FCF

Date of Event: September 4, 2025

Executive Summary

*Reminder: We do not talk about valuations, just an analysis of the earnings/conferences

Broadcom Inc. (Nasdaq: AVGO) posted record third‑quarter fiscal 2025 results driven by accelerating demand for custom artificial intelligence (AI) silicon and continued traction in infrastructure software following the VMware acquisition. Revenue rose 22% year over year to $15,952 million. The company reported GAAP net income of $4,140 million and non‑GAAP net income of $8,404 million. Adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) reached $10,702 million, or 67% of revenue, underscoring strong operating leverage. Free cash flow climbed 47% to $7,024 million (44% of revenue), and the Board declared a $0.59 per‑share quarterly dividend. Management guided Q4 FY25 revenue to ~$17.4 billion** (up 24% YoY) with Adjusted EBITDA at 67% of revenue. CEO Hock Tan highlighted AI momentum: “Q3 AI revenue growth accelerated to 63% year‑over‑year to $5.2 billion… We expect growth in AI semiconductor revenue to accelerate to $6.2 billion in Q4,” adding that customers “continue to strongly invest.”

Growth Opportunities

Custom AI accelerators and Ethernet networking are the growth flywheels. Broadcom’s AI semiconductor revenue hit $5.2 billion in Q3, up 63% year over year, marking 10 consecutive quarters of growth; the company expects $6.2 billion in Q4, which would make it 11 consecutive quarters. The thrust comes from XPUs—custom AI accelerators that hyperscale and model‑builder customers design with Broadcom to run training and inference for large language models (LLMs). Management said XPUs comprised 65% of AI revenue this quarter. Beyond Broadcom’s three established XPU customers, a fourth prospect placed production orders, and Broadcom “secured over $10 billion of orders of AI racks based on our XPUs,” with shipments slated to begin in fiscal 2026. Hock Tan characterized the overall demand picture with a single line: “The network is the computer,” as customers scale clusters beyond 100,000 compute nodes—a shift that increases the value of Broadcom’s Ethernet‑based data‑center networking.

On the software side, VMware continues to expand the total addressable market for Broadcom’s platform strategy. The company released VMware Cloud Foundation (VCF) 9.0, developed over two years by 5,000+ engineers, to deliver an integrated private‑cloud stack that runs traditional virtual machines and modern containerized workloads—including AI. Q3 software bookings reached $8.4 billion in total contract value, and software revenue grew 17% to $6.8 billion. As enterprises weigh private‑cloud economics and data governance for AI, VCF’s on‑prem and carrier‑cloud deployment flexibility could support durable bookings.

Key Products and Tech

XPUs (custom AI accelerators). Broadcom’s XPU roadmap underpins its AI share gains. These are customer‑specific chips co‑designed to optimize performance, cost, and power for training and inference at massive scale. Management noted share gains across the three original customers and a new fourth customer moving directly into substantial deployments starting in Q3 FY26.