Cap-Ex on Steroids: Senate Boosts, Intel Reboots & Oracle’s Cloud Whale in AI’s Next Chapter

Welcome, AI & Semiconductor Investors,

What happens when Washington super-charges chip tax credits just as Intel retools its flagship process and Oracle lands a $30 billion AI cloud deal? Between the Senate’s bold 35 % fab incentives (and surprise energy mix shake-ups), Intel’s pivot from vanilla 18A to a streamlined 14A roadmap, and Oracle’s potential hyperscaler leap, investors are staring down a perfect storm of policy, process, and platform shifts.— Let’s Chip In

What The Chip Happened?

🏛️ Senate Super‑Charge: Tax Boosts & Energy Curveballs for Chips & AI

🔄 Intel Shifts Gears: 18A Sidelines, 14A Goes Mainstream

🚀 Oracle Bags a $30 B‑a‑Year Cloud Whale—Can It Swallow the Catch?

[Senate Tax Bill Potentially Reshapes U.S. Chips and AI Landscape]

Read time: 7 minutes

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

United States Senate (“One Big Beautiful Bill Act”)

🏛️ Senate Super‑Charge: Tax Boosts & Energy Curveballs for Chips & AI

What The Chip: The Senate passed the sweeping One Big Beautiful Bill Act on July 1, 2025, potentially raising semiconductor tax credits to 35 % and reviving full R&D expensing, but it simultaneously guts many clean‑energy incentives. The mix of bigger tech subsidies and pricier power will shape where and how fast fabs and AI data centers expand in the U.S.

The Situation Explained:

💰 Bigger Boost for Fabs: The Advanced Manufacturing Investment Credit jumps from 25 % to 35 % of qualified cap‑ex, slashing billions off the cost of new U.S. fabs for Intel, TSMC, Samsung, and tool suppliers.

🧪 R&D Cash‑Flow Win: Firms can again expense 100 % of U.S. R&D through 2029, freeing up cash for chip tape‑outs and massive AI model training.

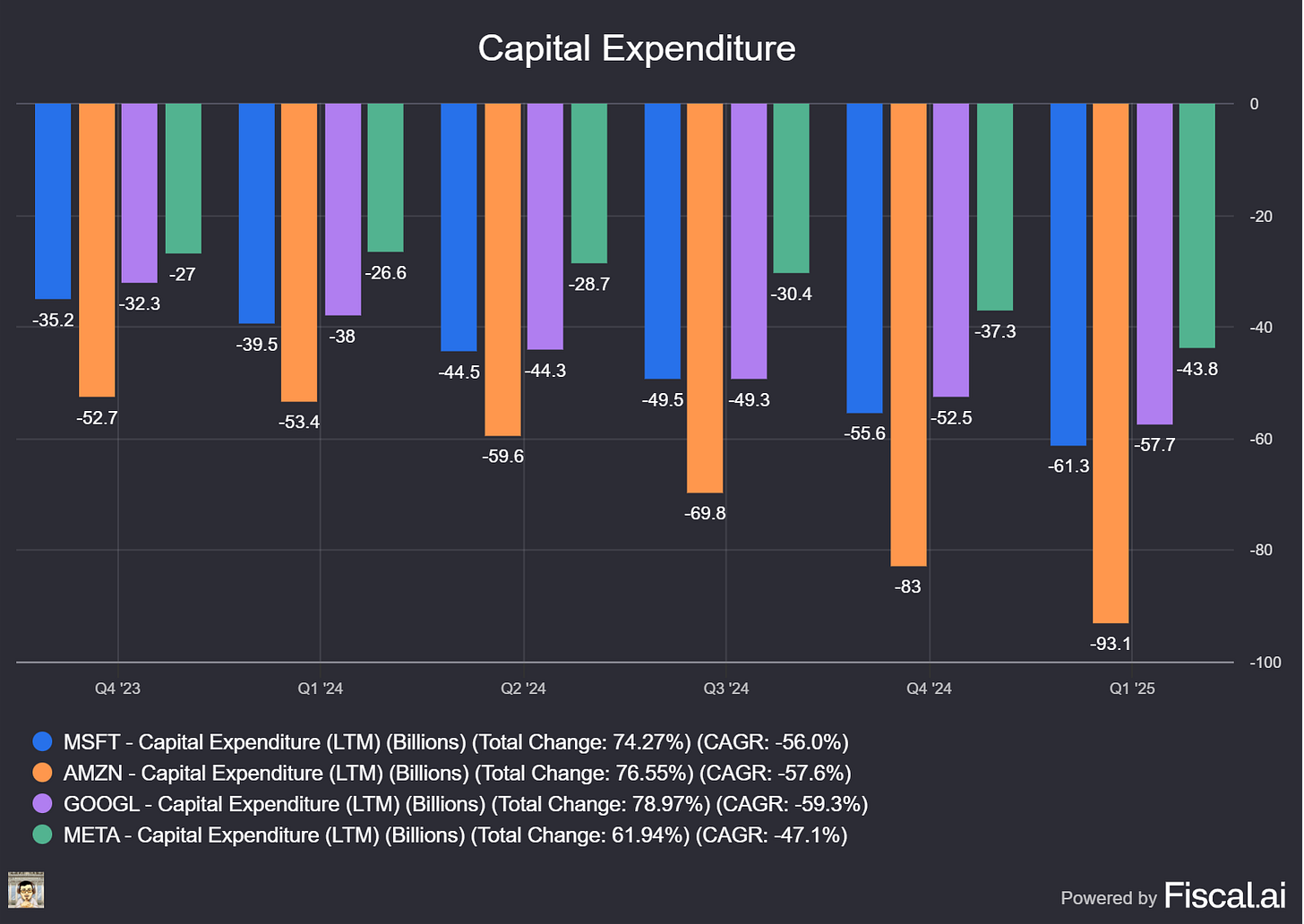

🏗️ Cap‑Ex on Steroids: Permanent 100 % bonus depreciation plus a doubled §179 limit super‑charge spending on servers, EUV scanners, and robotics gear.

📜 $1 B+ Federal AI Spend: DoD, DHS, and DOE earmark over $1 billion for AI autonomy, cybersecurity, and energy‑efficient microelectronics—fresh revenue streams for defense‑oriented AI contractors.

⚡ Renewables Rollback: Phase‑out of IRA clean‑energy credits and new excise taxes on wind/solar using Chinese parts threaten up to 4,500 planned projects—raising long‑term power costs for data‑hungry AI clouds.

☢️ Nuclear & Coal Sweeteners: Expanded nuclear credits and a quirky 2.5 % subsidy for metallurgical coal aim to keep 24/7 “firm” power on the grid—helpful for uptime, but a carbon‑image headache for ESG‑minded operators.

🗺️ No Federal AI Shield: A last‑minute vote stripped the five‑year moratorium on state AI rules, so companies must still navigate a patchwork of California privacy laws, Illinois biometrics rules, and more.

🎓 Strings on CHIPS Grants: Commerce will renegotiate existing $39 B in CHIPS awards—expect tougher U.S.-content and profit‑sharing clauses, tilting the supply‑chain further on‑shore.

Why AI/Semiconductor Investors Should Care: The bill turbo‑charges U.S. fab economics and slashes the tax bill for every GPU rack and lithography tool bought, setting up a multiyear cap‑ex boom across the chip stack.

Yet, by hobbling renewables just as AI electricity demand goes vertical, it injects real margin risk for cloud providers and data‑center REITs unless they lock in cheaper, cleaner power or embrace nuclear. Net‑net: expect higher near‑term growth and profit tailwinds for factory builders and chip equipment names, but watch energy costs and state‑level AI rules as the new swing factors for long‑run earnings quality.

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

Intel Corporation (NASDAQ: INTC)

🔄 Intel Shifts Gears: 18A Sidelines, 14A Goes Mainstream

What The Chip: On July 1, 2025, a Reuters scoop revealed Intel may stop quoting its once‑flagship 18A process for new external customers, steering future design wins toward the forthcoming 14A node. That leak merely confirms what Intel’s “Direct Connect” road‑show (Feb–Apr 2025) already signaled: vanilla 18A is now a niche stepping‑stone for in‑flight AWS, Microsoft and DoD projects, while derivatives and 14A will carry the commercial load.

The Situation Explained:

🏁 Risk start completed: Intel hit target defect density for 18A wafers in April, clearing the way for internal Panther Lake CPUs and select cloud/defense ASICs in 2H 2025.

⚡ 18A‑P up‑binned: Drop‑in design rules plus ~8 % perf‑per‑watt boost, extra voltage corners, and more mature IP libraries ease adoption headaches that plagued the original 18A.

🗜️ 18A‑PT for 3‑D stacks: Through‑silicon‑via (TSV) version targets AI accelerators and HBM base‑dies, positioning Intel Foundry to ride the chiplet boom without waiting for 14A.

🚀 14A preview: Second‑gen RibbonFET + backside power, optional High‑NA EUV; Intel touts 15–20 % perf‑per‑watt and ~30 % density gains over 18A‑P, with an “alpha” PDK already in customer hands.

🧐 External hesitation: EDA partners Synopsys and Cadence admitted in April “customers want optionality; 18A design effort used to be 3×, now industry‑standard,” underscoring lingering qual fatigue.

💰 Cap‑ex realignment: New CEO Lip‑Bu Tan launched an “operational‑efficiency review” on 24 Apr 2025, hinting he’d write down under‑utilized 18A tools to bankroll High‑NA scanners for 14A.

📉 Write‑off risk: Pivot could strand multi‑billion‑dollar PowerVia equipment and trigger CHIPS‑Act claw‑backs if production milestones tied to 18A volumes slip.

🛡️ Defense lines safe: DoD SHIP/RAMP‑C programs keep 18A pilot lines alive, insulating classified workloads from roadmap churn—but any 14A divergence adds schedule risk.

Why AI/Semiconductor Investors Should Care: Intel just simplified its foundry story: one mainstream node (14A) for high‑volume commercial silicon, plus 18A derivatives for specialty 3‑D and government work. Failure, however, would cement the narrative that Intel overpromises and under‑delivers, saddling shareholders with write‑offs and customers with yet another roadmap reset.

Oracle (NYSE: ORCL)

🚀 Oracle Bags a $30 B‑a‑Year Cloud Whale—Can It Swallow the Catch?

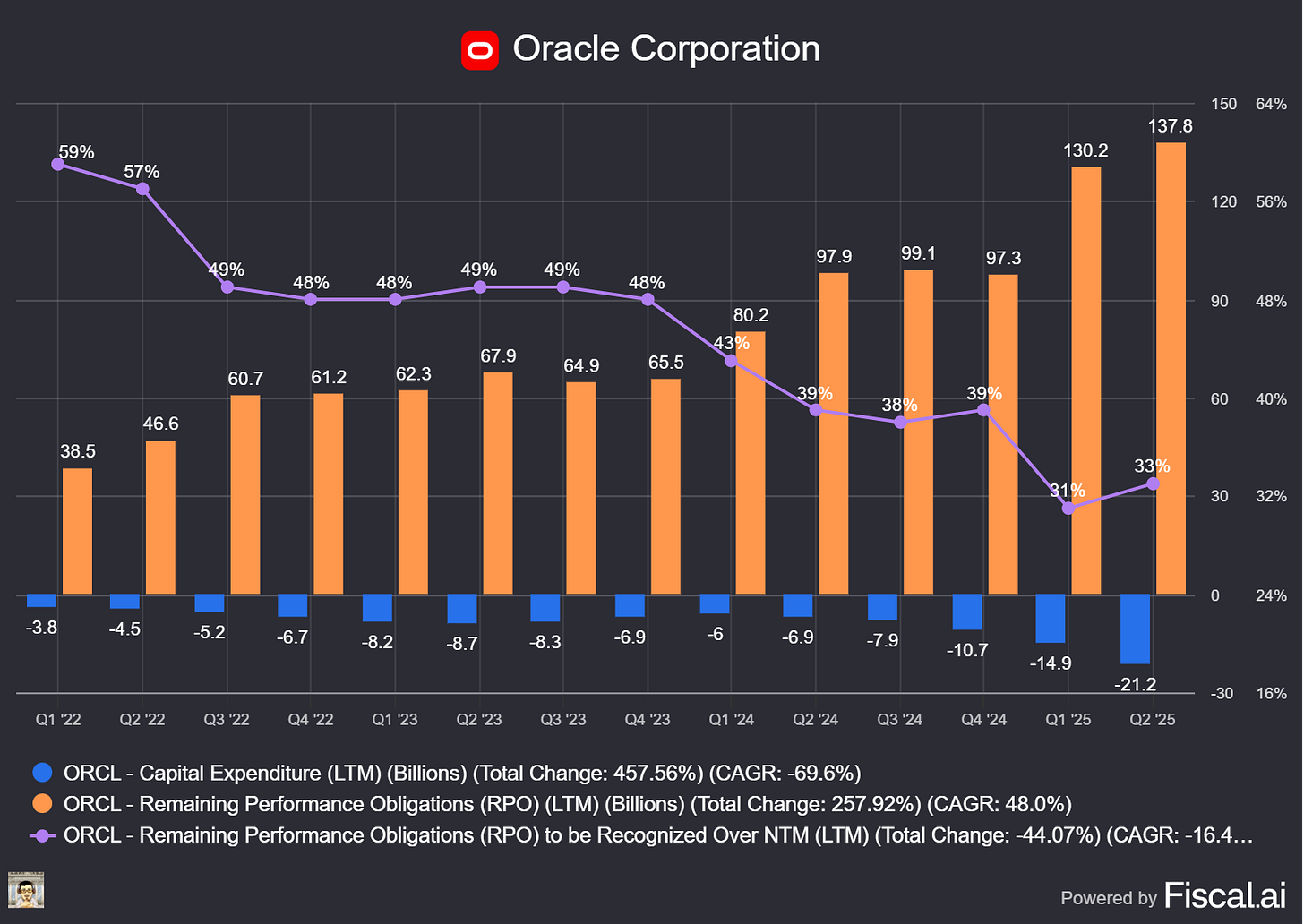

What The Chip: In a July 1, 2025, Form 8‑K, CEO Safra Catz told employees Oracle has “signed multiple large cloud‑services agreements, including one that is expected to contribute more than $30 billion in annual revenue starting in FY 2028.” The company stressed that FY 2026 guidance remains unchanged, flagging execution and supply‑chain risks.

The Situation Explained:

💰 $30 B+ anchor contract begins FY 2028. That single customer could boost Oracle’s FY 2025 revenue base by roughly 52 % and more than double today’s OCI run‑rate.

📝 Oracle disclosed the deal via a Reg FD 8‑K and kept FY 2026 targets intact, reminding investors that actual revenue “could vary” if datacenter capacity, power, or chip supply slip.

📈 Backlog momentum accelerates: Remaining Performance Obligations already hit $138 B, up 41 % YoY; this contract could eventually rival that backlog on its own.

🏗️ Management plans ~$25 B of CapEx in FY 2026—up from ~$16 B—to build >70 new regions plus several 1‑gigawatt “Stargate‑class” AI campuses.

🤖 Separate but related: Reuters reports Oracle will spend $40 B on Nvidia GB200 GPUs to power the project, leasing compute back to the unnamed customer on a 15‑year term.

🔍 Market chatter pins the counter‑party on OpenAI/SoftBank’s “Stargate” or UAE‑backed G42. Either link would expand Oracle’s international political‑risk footprint.

🚧 Risks stack up: Delivering multi‑gigawatt AI campuses demands huge power blocks, liquid‑cooling, and flawless logistics; concentration could push >10 % of revenue to one client.

Why AI/ Semiconductor Investors Should Care: If Oracle turns this memorandum into recognized revenue, it jumps overnight from cloud challenger to hyperscale peer, tightening competition with AWS, Azure, and Google. The deal also underscores insatiable demand for advanced GPUs—good news for Nvidia but a fresh test for global chip supply. Investors should track construction milestones, GPU shipment timetables, and any slippage in Oracle’s ambitious CapEx plans; delays could defer the promised $30 B windfall and pressure margins just as Oracle stretches its balance

Youtube Channel - Jose Najarro Stocks

X Account - @_Josenajarro

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

Disclaimer: This article is intended for educational and informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

The overview above provides key insights every investor should know, but subscribing to the premium tier unlocks deeper analysis to support your Semiconductor, AI, and Software journey. Behind the paywall, you’ll gain access to in-depth breakdowns of earnings reports, keynotes, and investor conferences across semiconductor, AI, and software companies. With multiple deep dives published weekly, it’s the ultimate resource for staying ahead in the market. Support the newsletter and elevate your investing expertise—subscribe today!

[Paid Subscribers] Senate Tax Bill Potentially Reshapes U.S. Chips and AI Landscape

Date of Event: July 1, 2025

Executive Summary

*Reminder: We do not talk about valuations, just an analysis of the earnings/conferences

Executive Summary

The U.S. Senate’s razor‑thin approval of the 800‑page “One Big Beautiful Bill Act” materially alters the cost structure and growth trajectory of the domestic semiconductor and artificial‑intelligence (AI) industries. The legislation:

Raises the Advanced Manufacturing Investment Credit for chip fabs to 35 percent and restores full, same‑year expensing of U.S. research and development (R&D) through 2029.

Commits more than $1 billion in new federal AI funding across the Departments of Defense (DoD), Energy (DOE), Commerce, and Homeland Security.

Rolls back most Inflation Reduction Act clean‑energy incentives, which could push electricity prices higher just as AI compute demand soars.

Abandons a proposed federal moratorium on state AI regulation, leaving firms to navigate a patchwork of state‑level rules.

Management commentary accompanying the vote framed the bill as “a bet on American technological leadership,” yet senators on both sides warned that higher public debt and energy‑price volatility could offset the near‑term stimulus.

Growth Opportunities

Domestic fab boom. A 35 percent tax credit, uncapped in size, now applies to qualified semiconductor property placed in service after 2025. For a leading‑edge fab with an estimated $20 billion price tag, after‑tax outlays drop by roughly $2 billion compared with today’s 25 percent credit. Expect acceleration of projects already announced by Intel, TSMC, Samsung, and GlobalFoundries, as well as fresh capacity plans intended to qualify before the incentive potentially sunsets.