CPU Uprising to Connectivity Breakthrough: AMD, Astera Labs & Super Micro Lead the AI Charge

Welcome, AI & Semiconductor Investors,

Can AMD match Nvidia’s AI dominance while hyperscalers reengineer their data-center fabrics? This issue breaks down AMD’s blockbuster Q2, $7.7 billion revenue powered by MI350 ramps and EPYC share gains, Astera Labs’ record-setting 150% growth as PCIe 6 “Scorpio” switches hit volume production, and Super Micro’s bold $33 billion FY-26 sales target tied to its modular DCBBS racks.— Let’s Chip In

What The Chip Happened?

🚀 AMD’s MI350 Ramps, CPUs Soar, China Still on Hold

💥 Scorpio Stings the Street: Astera Labs’ AI‑Connectivity Switches Power Record Q2

💡 Rack‑Ready & Revenue‑Roaring: Super Micro targets $33 Billion in FY‑26

[AMD’s Q2 2025: Record Revenue, MI350 Ramp, and Rising CPU Demand]

Read time: 7 minutes

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

Advanced Micro Devices (NASDAQ: AMD)

🚀 “MI350 Ramps, CPUs Soar, China Still on Hold”

What The Chip: AMD’s Q2 2025 results (reported Aug 5, 2025) smashed expectations with revenue up 32% YoY to $7.7 billion and record free cash flow, even as U.S. export rules sidelined China GPU sales. CEO Lisa Su credits blockbuster EPYC and Ryzen demand plus an early ramp of the next‑gen Instinct MI350 AI accelerator.

The Situation Explained:

💰 Record topline & cash: Revenue hit $7.7 B, free cash flow topped $1 B, and non‑GAAP gross margin would have been 54 % without an $800 M inventory write‑down tied to China export controls.

🖥️ CPU engine firing: EPYC server chips delivered a 14 % YoY segment jump—AMD gained server share for the 33rd straight quarter as hyperscalers such as Google and Oracle launched ~100 new EPYC cloud instances.

🎮 Client & Gaming boom: Client/Gaming revenue leapt 69 % YoY to $3.6 B. Desktop Ryzen 9000 CPUs and Radeon 9000 GPUs both set sales records; console SoC shipments rebounded ahead of the holiday build.

🤖 AI pivot accelerates: Early volume shipments of MI350 started in June. AMD claims MI355 “matches or exceeds” Nvidia’s B200 and beats GB200 on $/token for inference. Seven of the top‑10 model builders now deploy Instinct GPUs.

🌐 Sovereign AI tailwind: Multibillion‑dollar deal with Saudi Arabia’s HUMAIN plus 40 + other government engagements expand a lucrative “sovereign compute” pipeline for 2026 and beyond.

🏗️ MI400 & Helios on deck: Next‑gen MI400 GPUs promise 40 PFLOPS FP4 and a 72‑GPU “Helios” rack aiming for 10× performance leap in 2026. The ZT Systems acquisition brings in‑house rack‑scale design expertise.

⚠️ China uncertainty: Export‑restricted MI308 inventory forced the write‑down; licenses remain under U.S. review, so no China GPU revenue is included in Q3 guidance.

📉 Margin math: AI GPUs still trail corporate gross margin, yet AMD reiterated a path back to ~54 % in Q3 via richer CPU mix and operational gains.

Why AI/Semiconductor Investors Should Care: AMD just proved it can grow core CPU franchises while scaling a credible alternative to Nvidia in AI acceleration. The MI350‑to‑MI400 road map, sovereign deals, and sturdy CPU attach rates position AMD to chase “tens of billions” in annual AI sales by 2026, even if China licenses lag.

For investors, earnings leverage will hinge on how fast Instinct margins converge with the corporate average and whether EPYC keeps compounding share against Intel’s delayed 18A products. Watch GPU production ramps, export‑control headlines, and Q4 console seasonality for the next data points.

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

Astera Labs (NASDAQ: ALAB)

💥 “Scorpio Stings the Street: Astera Labs’ AI‑Connectivity Switches Power Record Q2”

What The Chip: Astera Labs smashed Q2‑25 expectations on August 5, 2025, posting triple‑digit revenue growth and the fastest product ramp in its history as PCIe 6 “Scorpio” switches moved into volume production. Management doubled‑down on its vision for “AI Infrastructure 2.0,” flagging scale‑up connectivity and the open UALink standard as the next multibillion‑dollar wave.

The Situation Explained:

🚀 Revenue rocketed 150 % YoY to $191.9 million, +20 % QoQ, beating guidance on broad strength across Aries retimers, Taurus AEC modules and new Scorpio fabric switches.

🦂 “Scorpio exceeded 10 % of total revenue, making it the fastest‑ramping product line in Astera history,” CEO Jitendra Mohan said. Volume PCIe 6 P‑Series wins set a new baseline for growth.

🤝 Company logged 10 + Scorpio X design‑ins with hyperscalers & AI platform providers; management expects X‑Series scale‑up revenue to outgrow P‑Series and anchor racks shipping in 2026.

📈 Non‑GAAP gross margin climbed to 76 % (+110 bps QoQ) and operating margin hit 39.2 % as mix and scale improved; Q2 EPS reached $0.44 on $135 million in operating cash flow.

💰 Balance sheet stays fortress‑like with $1.07 billion in cash, giving Astera ample fire‑power to fund R&D for CXL memory controllers and the open‑standard UALink roadmap.

🌧️ Margin watch: Q3 GM guided to 75 % as lower‑margin Taurus hardware ramps; a July tax‑law change spikes the Q3 tax rate to 20 %, trimming EPS guidance to $0.38‑0.39.

🗺️ Mohan pegs scale‑up connectivity for AI racks as a “~$5 billion TAM by 2030,” with UALink promising lower latency than Ethernet and an open, multi‑vendor ecosystem.

⚠️ Risk lens: dependence on hyperscaler AI capex cycles, potential Ethernet‑based alternatives from Broadcom, and tariff volatility on Asian cable assemblies could pressure pricing.

Why AI/Semiconductor Investors Should Care: Astera Labs sits at the heart of the AI server—inside every link that lets GPUs, custom ASICs and CXL memory talk at PCIe 6/7 speeds. Surging Scorpio adoption shows hyperscalers want merchant silicon to avoid single‑vendor lock‑in, a secular tailwind as racks migrate to open UALink fabrics.

Yet mix shifts to hardware modules and higher taxes remind us profitability is not on autopilot. If management executes on the 2026 Scorpio X and 2027 UALink ramps, Astera could double dollar‑content per accelerator and cement itself as the indispensable “plumbing” of AI Infrastructure 2.0.

Super Micro Computer (NASDAQ: SMCI)

💡 “Rack‑Ready & Revenue‑Roaring: Super Micro targets $33 Billion in FY‑26”

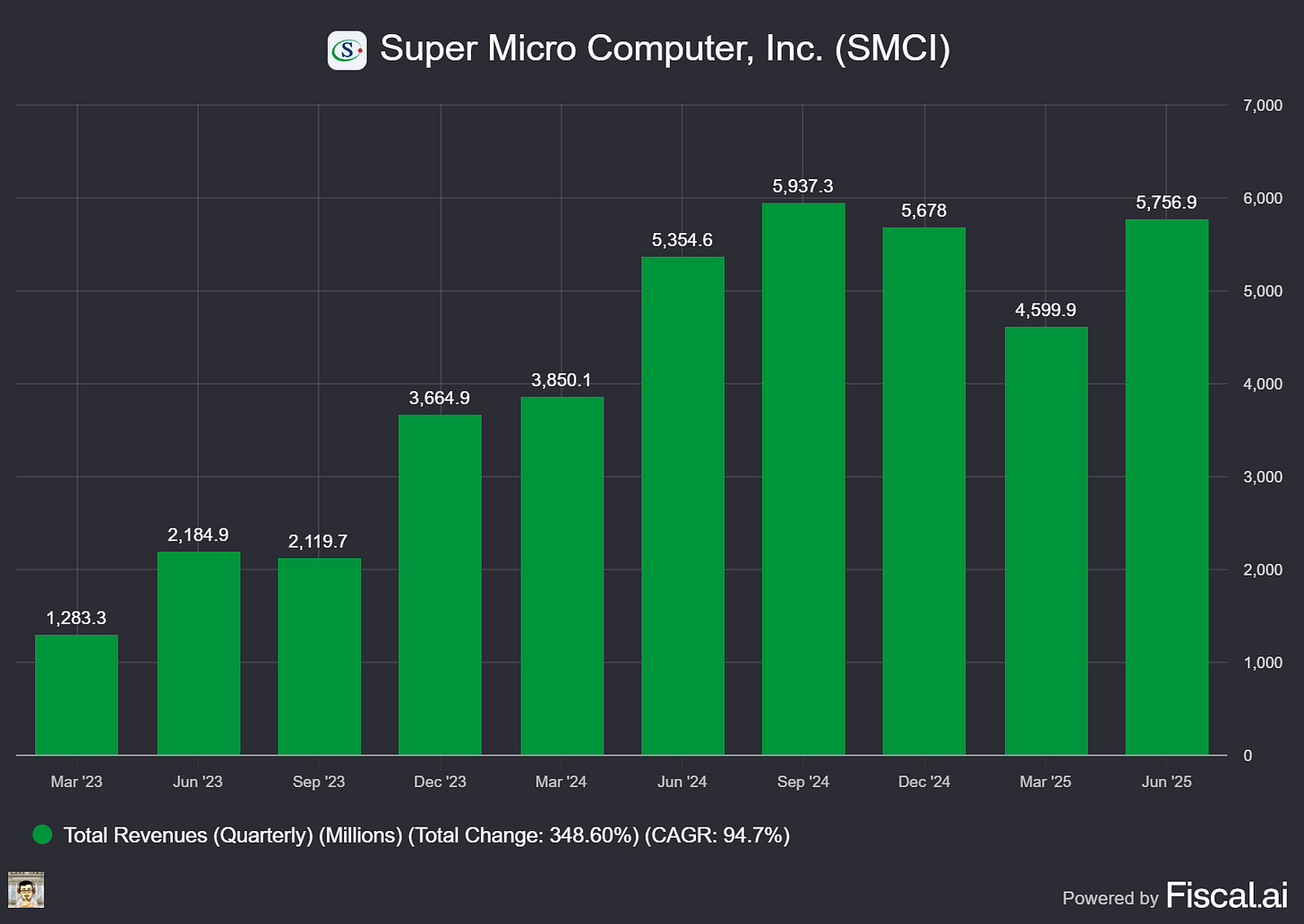

What The Chip: Super Micro’s August 5, 2025, earnings call revealed Q4 FY‑25 revenue of $5.8 billion (up 25 % Q/Q) and full‑year revenue of $22 billion (up 47 % Y/Y). CEO Charles Liang paired the results with an aggressive FY‑26 sales target of at least $33 billion, betting on new AI platforms and its just‑launched Data‑Center Building Block Solution (DCBBS).

The Situation Explained:

🔌 DCBBS debut – A “one‑stop‑shop” of modular racks, liquid‑to‑air sidecars, in‑rack CDUs, power shelves, and BBU backup aims to cut AI‑data‑center build‑outs from 2–3 years to 18 months (or as little as 3–6 months for retrofits). Liang: “Customers can finish building a liquid‑cooled AI data center in just 18 months instead of three years.”

🚀 Next‑gen GPU line‑up – Platforms optimized for NVIDIA B300/GB300 and AMD MI350/MI355X will ship “as soon as silicon is available,” with Super Micro promising the same fastest‑to‑market edge it had on B200.

📈 Guidance lifts – Management projects Q1 FY‑26 revenue of $6‑$7 billion and maintains gross margins “similar to Q4’s” 9.6 %, despite chip allocation constraints easing.

💰 Four 10 %‑plus hyperscale customers – Up from one last year, driving 60 % of FY‑25 sales; enterprise channel revenue still grew 38 % Y/Y.

🌍 Geographic shift – Asia revenue surged 91 % Y/Y (now 42 % of sales) while U.S. sales fell 33 % amid tariff friction. A new Malaysia plant and global routing are expected to blunt future tariff risk.

📉 Margin pressure continues – FY‑25 non‑GAAP gross margin slipped to 11.2 % (from 13.9 %) on customer mix and tariffs; Liang targets a long‑term return to 15 – 17 % via higher‑value DCBBS, software, and services.

💸 Balance‑sheet fire‑power – Raised $2.3 billion via converts, ending Q4 with $5.2 billion cash and $412 million net cash; a new $1.8 billion receivables facility adds working‑capital flexibility.

Why AI/ Semiconductor Investors Should Care: Super Micro is morphing from a high‑volume server vendor into a full data‑center integrator. If DCBBS ramps as promised, every rack sale layers higher‑margin services on top of hardware, potentially reversing the recent gross‑margin slide.

The FY‑26 revenue goal implies 50 % growth, ambitious but achievable if NVIDIA’s Blackwell chips and sovereign‑AI deals flow on schedule. Watch margins: sustained improvement toward the 15 %+ target would confirm that Super Micro’s “rack‑plus‑services” model merits a premium valuation, while further erosion would expose investors to downside despite the topline boom.

Youtube Channel - Jose Najarro Stocks

X Account - @_Josenajarro

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

Disclaimer: This article is intended for educational and informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

The overview above provides key insights every investor should know, but subscribing to the premium tier unlocks deeper analysis to support your Semiconductor, AI, and Software journey. Behind the paywall, you’ll gain access to in-depth breakdowns of earnings reports, keynotes, and investor conferences across semiconductor, AI, and software companies. With multiple deep dives published weekly, it’s the ultimate resource for staying ahead in the market. Support the newsletter and elevate your investing expertise—subscribe today!

[Paid Subscribers] AMD’s Q2 2025: Record Revenue, MI350 Ramp, and Rising CPU Demand

Date of Event: August 5, 2025

Executive Summary

*Reminder: We do not talk about valuations, just an analysis of the earnings/conferences

Advanced Micro Devices (AMD) posted its strongest second‑quarter results to date, generating $7.7 billion in revenue, a 32 % year‑over‑year increase. Non‑GAAP gross margin landed at 43 %, while free cash flow reached a record $1.2 billion. The quarter was shaped by two contrasting forces: swelling demand for EPYC™ server processors and Ryzen™ PC chips, and an $800 million inventory write‑down tied to U.S. export controls on Instinct™ MI308 data‑center GPUs. Despite that headwind, AMD reported $872 million in GAAP net income and $0.54 diluted EPS.

Chief Executive Officer Dr. Lisa Su highlighted the pivotal drivers during the earnings call: “We are seeing robust demand across our computing and AI product portfolio and are well positioned to deliver significant growth in the second half of the year, driven by the ramp of our AMD Instinct MI350 series accelerators and ongoing EPYC and Ryzen processor share gains.” Chief Financial Officer Jean Hu emphasized disciplined execution, noting, “We achieved 32 % year‑over‑year revenue growth and generated record free cash flow this quarter.”

Growth Opportunities

AI acceleration and CPU share gains dominate AMD’s growth narrative. Management expects the recently launched Instinct MI350 GPUs to scale rapidly through 2H25, filling demand for generative‑AI training and “agentic” inference workloads. Parallel momentum in 5th‑Gen EPYC “Turin” CPUs—now adopted across all major hyperscalers—continues to erode incumbent share in cloud and enterprise servers.