🚨 Don’t Miss the Shift: Navitas & ON Semiconductor Chase NVIDIA’s 800-V AI Wave, Palantir Hits Billion-Dollar Breakthrough

Welcome, AI & Semiconductor Investors,

Are semiconductors ready for the AI power surge? Navitas is ditching phone chargers to power NVIDIA’s next-gen data centers, aiming squarely at a $2.6 billion AI power market by 2030. Meanwhile, ON Semiconductor quietly doubled its data-center revenue with NVIDIA’s backing, targeting explosive growth in 800-volt AI infrastructures. With Palantir blasting past its first billion-dollar quarter, it’s clear that the AI landscape isn’t just heating up. — Let’s Chip In

What The Chip Happened?

⚡️ Betting on 800‑Volt Brains – Navitas Pivots From Phone Chargers to AI Powerhouses

🔌 Powering Through the Dip: ON Targets AI, EV & Cash Returns

🚀 “Palantir Tops $1 Billion Quarter—U.S. Commercial Revenue Rockets 93 % YoY”

[Navitas Sharpens Focus on AI Data Centers After Mixed Q2]

Read time: 7 minutes

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

Navitas Semiconductor Corporation (NASDAQ: NVTS)

⚡️ “Betting on 800‑Volt Brains” – Navitas Pivots From Phone Chargers to AI Powerhouses

What The Chip: On August 4 2025, Navitas reported Q2 results and revealed a decisive shift: the GaN/Silicon‑Carbide specialist will slash lower‑margin mobile charger exposure and chase the 800‑V AI data‑center boom—with NVIDIA already on board.

The Situation Explained:

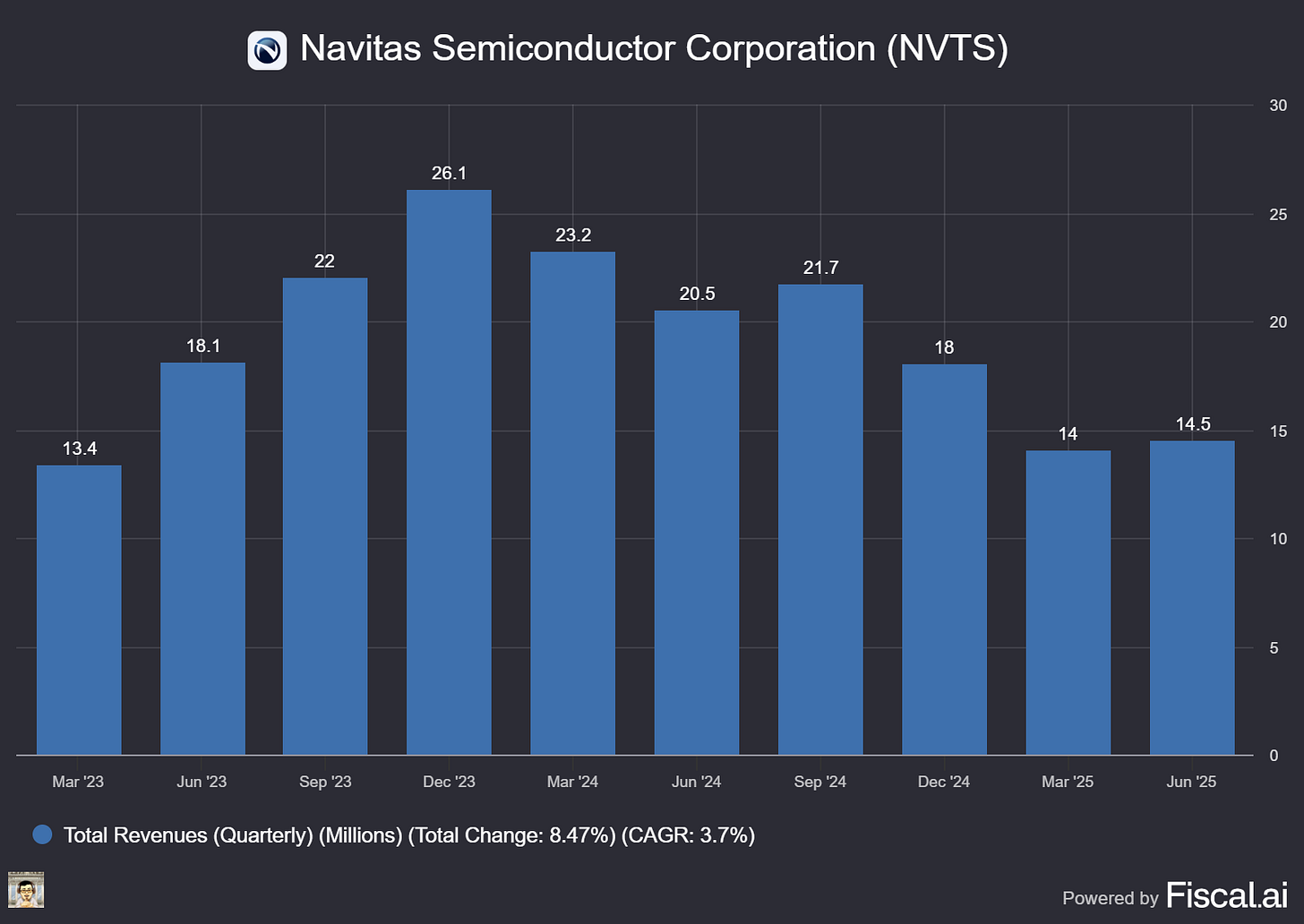

💰 Revenue $14.5 million (mid‑guidance) amid a classic semi downturn; solar, EV and industrial demand remain soft.

🏦 Raised $97 million (ATM offering) and ended the quarter with $161 million cash and zero debt, funding the pivot without stretching the balance sheet.

🤝 NVIDIA selected Navitas to co‑engineer power solutions for next‑gen 800‑V data centers, a market Navitas sizes at $2.6 billion by 2030. CEO Gene Sheridan put it plainly: “We’re at the right time, in the right place, with the right technology to solve the data‑center’s looming multi‑gigawatt power problem.”

🏭 New Powerchip 8‑inch GaN foundry boosts die-per‑wafer by ≈80 % versus current 6‑inch lines at TSMC—lower cost, higher capacity, and a clear path to >50 % gross margin (Q2 GM: 38.5 %).

🔌 Rolling out mid‑voltage 80‑200 V GaN and ultra‑high‑voltage (2.3–6.5 kV) SiC to cover all three AI‑power stages:

Solid‑state transformers (grid → 800 V)

800 V → 48 V board converters

48 V → GPU core converters

✂️ Exiting sub‑65 W China charger SKUs; guidance for Q3 revenue $10 million (± $0.5 M) [much lower than the market expected due to the shift out of lower margin products, while holding opex to $15.5 million—a conscious near‑term dip to protect margins.

🇺🇸 U.S.‑based SiC wafer capacity shields key AI and infrastructure customers from tariff risk that is currently denting China SiC sales.

Why AI/Semiconductor Investors Should Care: AI server power demand could leap 10× to 70 GW by 2030; moving from today’s 48 V racks to 800 V architectures slashes distribution losses and unlocks megawatt‑class racks. Navitas is one of very few vendors offering a full GaN + SiC stack—and its small size means focus, speed, and potentially outsized upside if early NVIDIA traction turns into multi‑stage design wins. Near‑term revenue will wobble, but the cash‑rich balance sheet, U.S. fab advantage, and expanding TAM position Navitas as a leveraged play on the power side of the AI explosion.

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

ON Semiconductor (NASDAQ: ON)

🔌 Powering Through the Dip: ON Targets AI, EV & Cash Returns

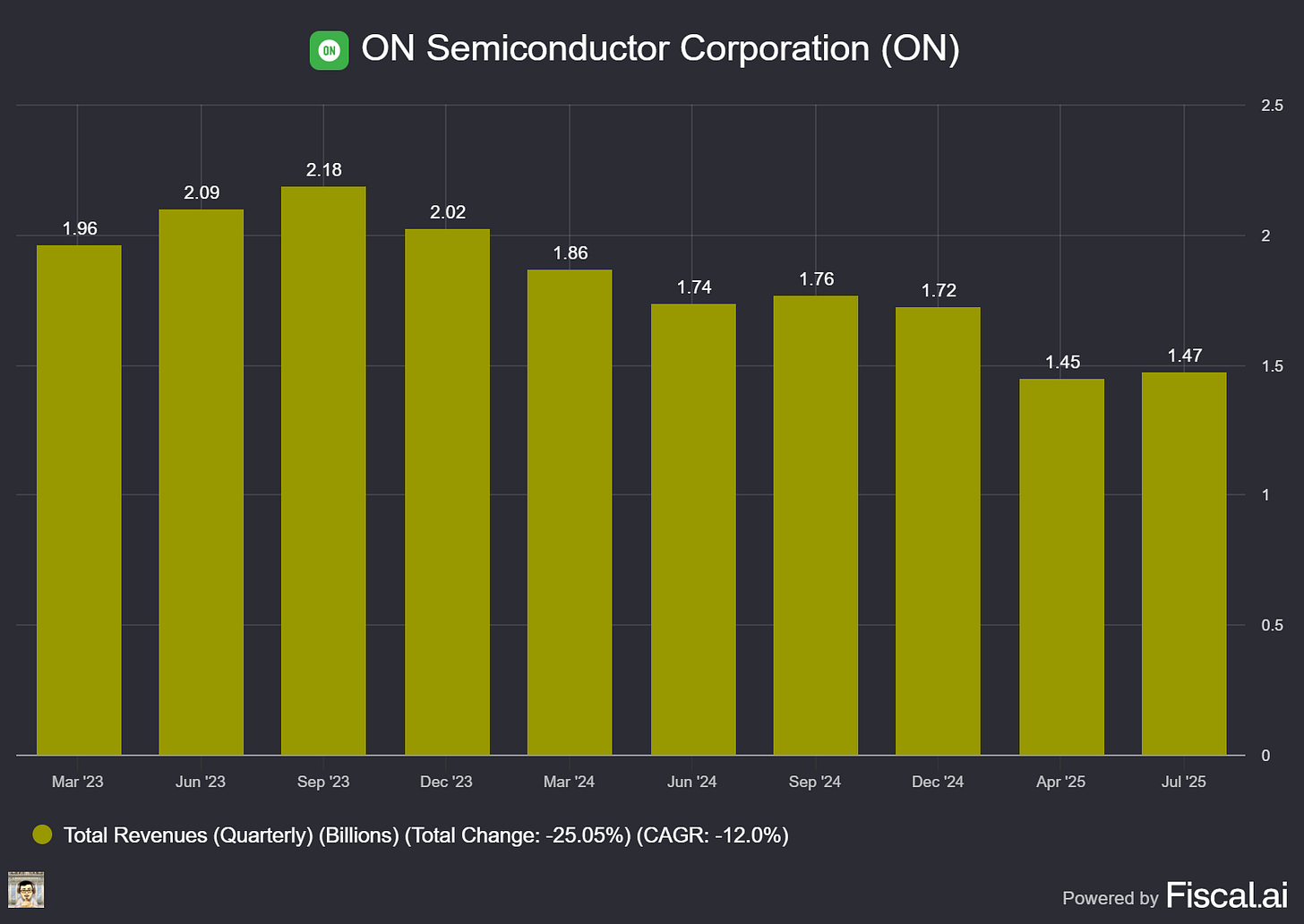

What The Chip: ON Semiconductor beat Q2‑25 guidance on August 4, 2025, posting $1.47 billion in revenue and $0.53 non‑GAAP EPS while steering investors toward a recovery story built on silicon‑carbide EV wins, AI‑data‑center power stages, and aggressive share buybacks.

The Situation Explained:

🚗 EV resilience in China. Automotive sales fell 4 % q/q, yet China EV revenue jumped 23 % sequentially as Xiaomi’s SU7 SUV adopted ON’s 1,200 V EliteSiC M3e devices for longer range. CEO Hassane El‑Khoury said, “China remains a growth driver with strong traction in both BEV and PHEV platforms.”

⚡️ Next‑gen power for AI racks. Data‑center revenue nearly doubled YoY; ON is sampling a dual Smart‑Power‑Stage (SPS) in a 5 × 5 mm package and co‑developing 800‑V DC architectures with NVIDIA to slash conversion losses.

📉 Utilization is still pinched. Gross margin held at 37.6 %, but 900 bp of under‑utilization charges linger as fabs run ~68 % loaded. Every 1 % uptick could add 25–30 bp to margin.

💸 Cash to shareholders. ON repurchased $300 million in Q2, pushing YTD buybacks to 107 % of free cash flow and pledging to keep 2025 repurchases at 100 % FCF.

🏭 Fab‑Right & exits. Management will retire legacy, low‑margin products equal to ≈5 % of 2025 revenue, close more non‑core lines, and transfer output into higher‑margin internal fabs.

🖼️ ISG pivots to machine vision. The image‑sensor business is abandoning low‑value “human vision” cameras (e.g., back‑up cams) to focus on ADAS and industrial machine vision, trimming $50‑100 million of 2026 revenue but lifting mix.

🛠️ Treo platform gains steam. Design funnel doubled q/q and shipments topped 5 million units from the newly acquired East Fishkill fab, proving ON can scale analog “SoC‑like” power platforms quickly.

🧐 Cautious Q3 guide. Revenue outlook $1.465–1.565 billion (+0–6 % q/q) and EPS $0.54–0.64 assume no tariff pull‑ins; Auto, Industrial and Other all expected to tick up low‑ to mid‑single digits.

Why AI/Semiconductor Investors Should Care: ON Semiconductor is quietly repositioning itself from a cyclical analog supplier into a pure‑play on two structural growth trends—vehicle electrification and AI power delivery. While near‑term margins remain hostage to fab loading and a soft U.S./EU auto market, the company’s SiC design wins, AI SPS roadmap, and Fab‑Right savings offer a clear path back to its 53 % gross‑margin target. Add an unwavering commitment to return every free‑cash‑flow dollar to shareholders, and ON offers both an efficiency turnaround and an upside call on the hottest end‑markets in semis.

Palantir Technologies (NYSE: PLTR)

🚀 “Palantir Tops $1 Billion Quarter—U.S. Commercial Revenue Rockets 93 % YoY”

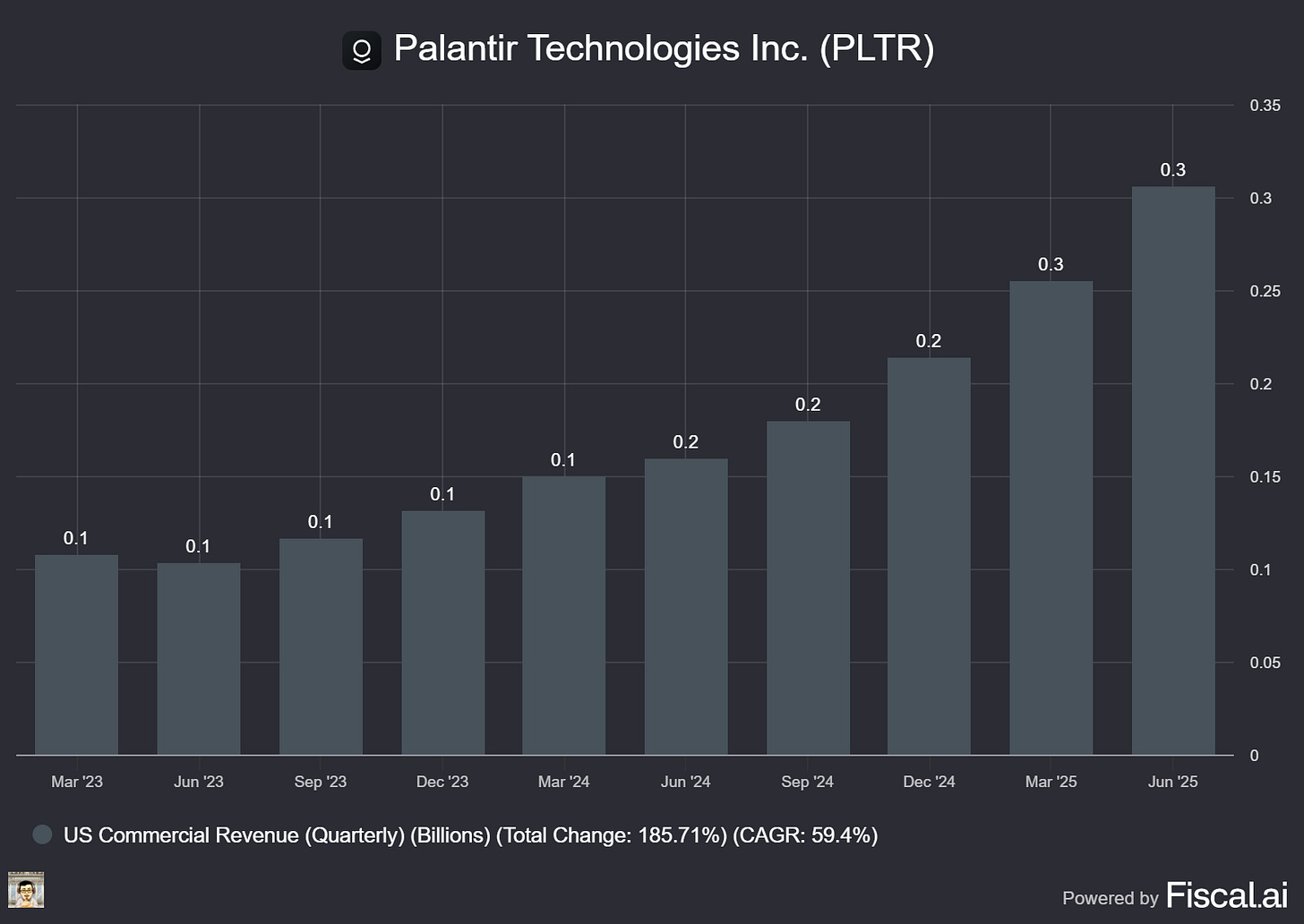

What The Chip: Palantir reported its first $1.004 billion revenue quarter on August 4, 2025, blasting past guidance with 48 % year‑over‑year growth and an industry‑leading Rule‑of‑40 score of 94. Management raised full‑year guidance and showcased blockbuster U.S. commercial momentum, arguing that “LLMs simply don’t work in the real world without Palantir.” — Ryan Taylor, CRO.

The Situation Explained:

🟢 Revenue engine firing: U.S. commercial sales soared 93 % YoY (20 % QoQ) to $306 M, while U.S. government climbed 53 % YoY to $426 M; America now accounts for 73 % of total revenue.

💰 Big‑ticket wins: Record $2.3 B total‑contract value and $684 M ACV booked; a 10‑year U.S. Army framework worth up to $10 B consolidates 75 contracts, and Space Force added $218 M.

📈 Margin muscle: Adjusted operating margin expanded to 46 %, free‑cash‑flow margin hit 57 % ($569 M), fueling a robust balance sheet with $6 B in cash & U.S. Treasuries.

🦾 Customer proof‑points:

• Citibank cut KYC onboarding from 9 days to seconds.

• Fannie Mae slashed mortgage‑fraud detection from 2 months to seconds.

• Nebraska Medicine boosted discharge‑lounge use 2,100 %, coining a “Palantir unit of time.”

⚙️ Product moat: Management doubled down on its ontology‑driven AIP stack, clients like Lear and TeleTracking are “re‑platforming” onto Palantir to reach production 10× faster, according to CTO Shyam Sankar.

📊 Guidance lifted: FY‑2025 revenue midpoint raised to $4.146 B (≈45 % YoY); U.S. commercial revenue now expected to exceed $1.302 B (≥85 % YoY).

⚠️ Watch‑outs: International commercial revenue slipped 3 % YoY; seasonally heavy Q3 hiring will lift expenses, and stock‑based comp remains sizable at $160 M this quarter.

Why AI/ Semiconductor Investors Should Care: Palantir’s ability to pair foundational AI software (ontology + LLM orchestration) with mission‑critical government and blue‑chip commercial contracts is translating into hyper‑growth without sacrificing profitability, a rare feat in enterprise AI.

The Army’s potential $10 B deal validates Palantir as an embedded infrastructure play, while cash‑flow strength gives optionality for buybacks or acquisitions. Risks, including international softness and comp expense, are worth monitoring. However, the company’s outsized U.S. momentum and sticky, high-margin platform suggest this is a clear winner in the AI race. Analysts still believe valuations are questionable, though.

Youtube Channel - Jose Najarro Stocks

X Account - @_Josenajarro

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

Disclaimer: This article is intended for educational and informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

The overview above provides key insights every investor should know, but subscribing to the premium tier unlocks deeper analysis to support your Semiconductor, AI, and Software journey. Behind the paywall, you’ll gain access to in-depth breakdowns of earnings reports, keynotes, and investor conferences across semiconductor, AI, and software companies. With multiple deep dives published weekly, it’s the ultimate resource for staying ahead in the market. Support the newsletter and elevate your investing expertise—subscribe today!

[Paid Subscribers] Navitas Sharpens Focus on AI Data Centers After Mixed Q2

Date of Event: August 4, 2025

Executive Summary

*Reminder: We do not talk about valuations, just an analysis of the earnings/conferences

Navitas Semiconductor Corporation (Nasdaq: NVTS), a pure‑play provider of gallium nitride (GaN) power integrated circuits and silicon carbide (SiC) devices, reported second‑quarter 2025 revenue of $14.5 million, down 29 percent year‑over‑year but flat sequentially. Non‑GAAP operating loss narrowed to $10.6 million from $13.3 million a year earlier, while gross margin held at 38.5 percent. Chief Executive Officer Gene Sheridan framed the quarter as a “strategic inflection,” citing an intensified push into artificial‑intelligence (AI) data‑center and energy‑infrastructure markets in partnership with ecosystem leaders such as NVIDIA. To fund that pivot, Navitas raised $97 million of net equity proceeds, boosting cash and equivalents to $161 million.

“We were successful in creating an all‑new market for GaN mobile chargers over the past five years, and now we intend to create an even bigger new market encompassing both GaN and SiC for AI data centers,” Sheridan told investors.

Growth Opportunities

AI data‑center power architecture. NVIDIA selected Navitas for collaborative development of next‑generation 800‑volt server‑rack infrastructure. Management sizes the total addressable market (TAM) for GaN and SiC content in AI data centers at $2.6 billion by 2030, driven by a projected 10× increase in processor power demand between 2023 and 2030. Navitas will target three conversion stages: