Intel's $2B SoftBank Boost, AMAT’s Record Stumbles, Alchip Eyes 3nm Surge—Who's Winning the Semiconductor Race?

Welcome, AI & Semiconductor Investors,

Intel just scored a $2 billion vote of confidence from SoftBank at $23/share, but does fresh capital mean the foundry turnaround is truly back on track? Meanwhile, Applied Materials posted record Q3 results yet stumbled on China uncertainty and uneven demand timing, clouding its near-term visibility. And don’t overlook Alchip: quietly taping out its crucial 3nm AI accelerator as 2026 promises explosive growth. Can Intel and AMAT navigate policy pitfalls, and is Alchip poised to become the dark horse in custom AI silicon? — Let’s Chip In

What The Chip Happened?

💴 Intel x SoftBank: $2B at $23/share

⚙️ AMAT Record Q3, Softer Q4: China Digestion & Leading‑Edge Timing Weigh

🚀 Alchip Tapes Out 3nm—2026 Ramp Becomes the Story

[Applied Materials Q3 FY25: Record Sales, Cautious Q4 Guide]

Read time: 7 minutes

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

Intel (NASDAQ: INTC)

💴 Intel x SoftBank: $2B at $23/share

What The Chip: On Aug 18, 2025, SoftBank Group signed a definitive agreement to invest $2B in Intel via a primary issuance at $23/share—about ~87M new shares for just under 2% ownership. Intel shares jumped ~6% pre‑market on Aug 19 after the news.

Details:

💵 Terms & quotes: Intel and SoftBank confirmed the $23/share price and customary closing conditions. SoftBank CEO Masayoshi Son: “This strategic investment reflects our belief that advanced semiconductor manufacturing and supply will further expand in the United States, with Intel playing a critical role.” Intel CEO Lip‑Bu Tan: “I appreciate the confidence [Masa] has placed in Intel with this investment.”

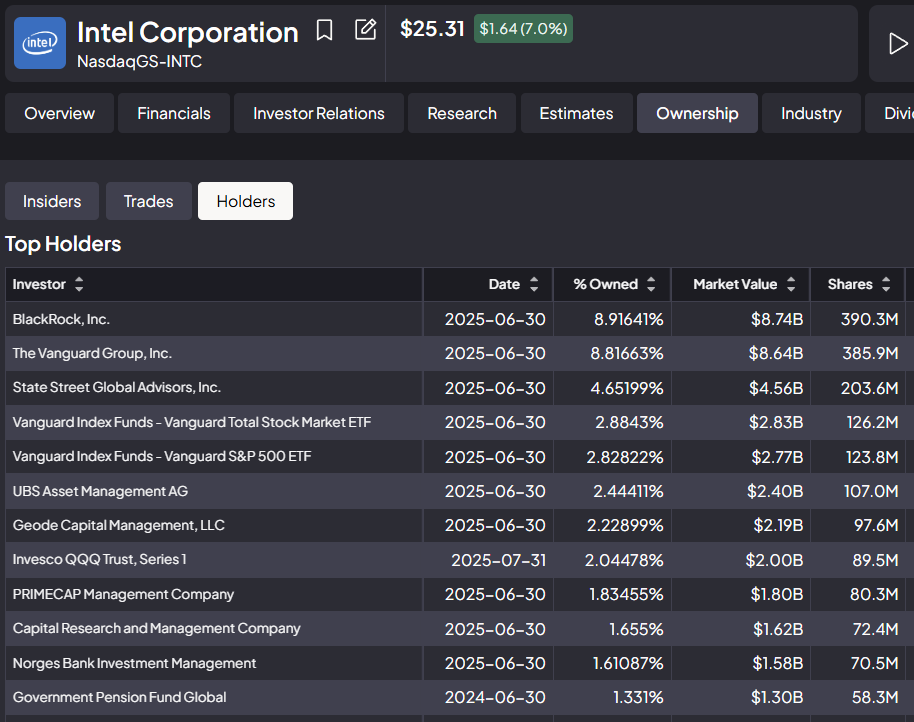

🪙 Stake math & structure: The deal is a primary share issuance of roughly ~87M shares, making SoftBank a top‑10 shareholder with <2% ownership—no board seat and no chip‑purchase commitment attached. That’s modest dilution (~2%) but clean capital.

🧬 Arm ecosystem angle (why this could matter later): Intel and Arm already have a multi‑generation collaboration to enable Arm‑based SoCs on Intel 18A; design‑services firm Faraday announced an Arm Neoverse platform targeting Intel 18A. SoftBank’s equity link increases incentives—though not guarantees—for Arm licensees to try Intel nodes.

🧱 Policy backdrop: The U.S. government is discussing a 10% Intel stake by converting some CHIPS Act support into equity—another potential capital backstop if it happens. Intel also remains central in 2025 tariff and onshoring narratives.

🛰️ SoftBank’s AI push: Reuters notes SoftBank’s broader bets—including financing around the mega‑scale “Stargate” AI compute project—suggesting long‑run alignment with advanced U.S. manufacturing and packaging. (No Intel volume commitments today.)

🚩 Risks & reality check: Intel still needs anchor foundry customers and timely 18A/14A ramps; the SoftBank deal doesn’t change execution risk, China policy exposure, or near‑term margin pressure. It’s a signal, not a shortcut.

🧑💼 Arm’s in‑house chip push (watch‑item): Separate from this deal, Arm hired Amazon’s AI‑chip director Rami Sinno, strengthening its in‑house chip/chiplet ambitions—another reason an Arm‑Intel foundry lane could be strategically useful.

Why AI/Semiconductor Investors Should Care

This is fresh capital + credibility for Intel’s foundry pivot at a time when the market questions its customer pipeline and node timing. The SoftBank link also tightens the bridge into the Arm ecosystem just as Arm expands into full chips/chiplets, which could funnel future 18A/14A tape‑outs to Intel if the economics and PPA hold. Still, with no board seat, no volume commitments, and persistent policy/tariff and execution risks, the upside hinges on actual design wins and clarity on the rumored U.S. 10% equity stake.

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

Applied Materials (NASDAQ: AMAT)

⚙️ Record Q3, Softer Q4: China Digestion & Leading‑Edge Timing Weigh

What The Chip: On Aug 14, 2025, Applied Materials posted record Q3 revenue of $7.30B (+8% y/y) and record non‑GAAP EPS of $2.48 (+17% y/y), but guided Q4 lower on China digestion, a backlog of export licenses, and non‑linear leading‑edge demand. CEO Gary Dickerson said the firm remains “on track to deliver our sixth consecutive year of revenue growth,” even as policy and tariff dynamics cut near‑term visibility.

Details:

📈 Beat & mix: Q3 non‑GAAP gross margin 48.9% (+150 bps y/y); operating margin 30.7% (+190 bps). Semi Systems revenue $5.43B (+10% y/y) with 36.4% non‑GAAP OI margin; AGS $1.60B; Display $263M (23.6% margin).

🧭 Guide down: Q4 outlook: revenue $6.7B ± $0.5B, non‑GAAP GM ~48.1%, EPS $2.11 ± $0.20. CFO Brice Hill: “We’re expecting a decline in revenue in the fourth quarter driven by digestion in China and non‑linear demand from leading‑edge customers given market concentration and fab timing.”

🇨🇳 China reset: China was ~35% of Q3 revenue; AMAT guides ~29% in Q4 and expects China to run ~15–20% below 2024 levels “for several more quarters.” The company holds a large backlog of export‑license applications and assumes none are approved in Q4.

🧪 Leading‑edge logic (GAA & backside power): AMAT trimmed 2025 GAA‑related purchases to “just over $4.5B” (from ~$5B) on order timing, not strategy. Management still sees ~30% higher AMAT revenue per equivalent fab as gate‑all‑around + backside power ramp starting 2H26–2027, and expects share gains. AMAT estimates ~100k WSPM of GAA capacity in the field today, with runway toward ~300k WSPM at scale.

🧠 DRAM/HBM remains a tailwind: Leading‑edge DRAM revenue is up ~50% in FY25; Q3 etch revenue topped $1B for the first time. Hill noted ~15% of DRAM capacity is already allocated to HBM, supporting durable tool demand into FY26.

📦 Advanced packaging = bright spot: AMAT’s highest‑share business is on track to more than double to >$3B “over the next few years,” aided by HBM and heterogeneous integration (including integrated hybrid bonding). Importantly, management does not see packaging constrained by the leading‑edge timing hiccup.

⚡ Power & infrastructure: AMAT sees data‑center power semis reaching ~$9B by 2030. The firm is tracking >100 new fabs/major expansions globally (~10% increase y/y). It plans >$200M investment in Arizona for specialized component manufacturing and continues to build the EPIC Center (Silicon Valley) for high‑velocity co‑innovation (operations start: spring 2026).

💸 Cash & returns (resilient despite tariffs): Q3 free cash flow ~$2.0B; $1.4B returned to shareholders ($1.0B buybacks, $368M dividends) with $14.8B remaining on the repurchase authorization. AMAT cited pricing actions that offset tariff headwinds in Q3 GM.

Why AI/Semiconductor Investors Should Care

AMAT sits at the material‑science choke points for AI—GAA/backside power, HBM/DRAM, and advanced packaging—areas that expand its wallet share per fab and support above‑WFE growth once leading‑edge orders normalize. Near term, policy/tariff frictions and China digestion (plus concentrated leading‑edge customers) introduce quarterly lumpiness and cap Q4, but structural AI demand, HBM‑driven memory capex, and packaging should underpin multi‑year growth. Watch order linearity into FY26, export‑license outcomes, and the pace of GAA ramps—key swing factors for margins, cash returns, and multiple.

Alchip Technologies (TWSE: 3661)

🧩 Open‑Ecosystem Playbooks + N3/N2 Pipeline: Flat ’25, Set Up for a 2026–2029 Ramp

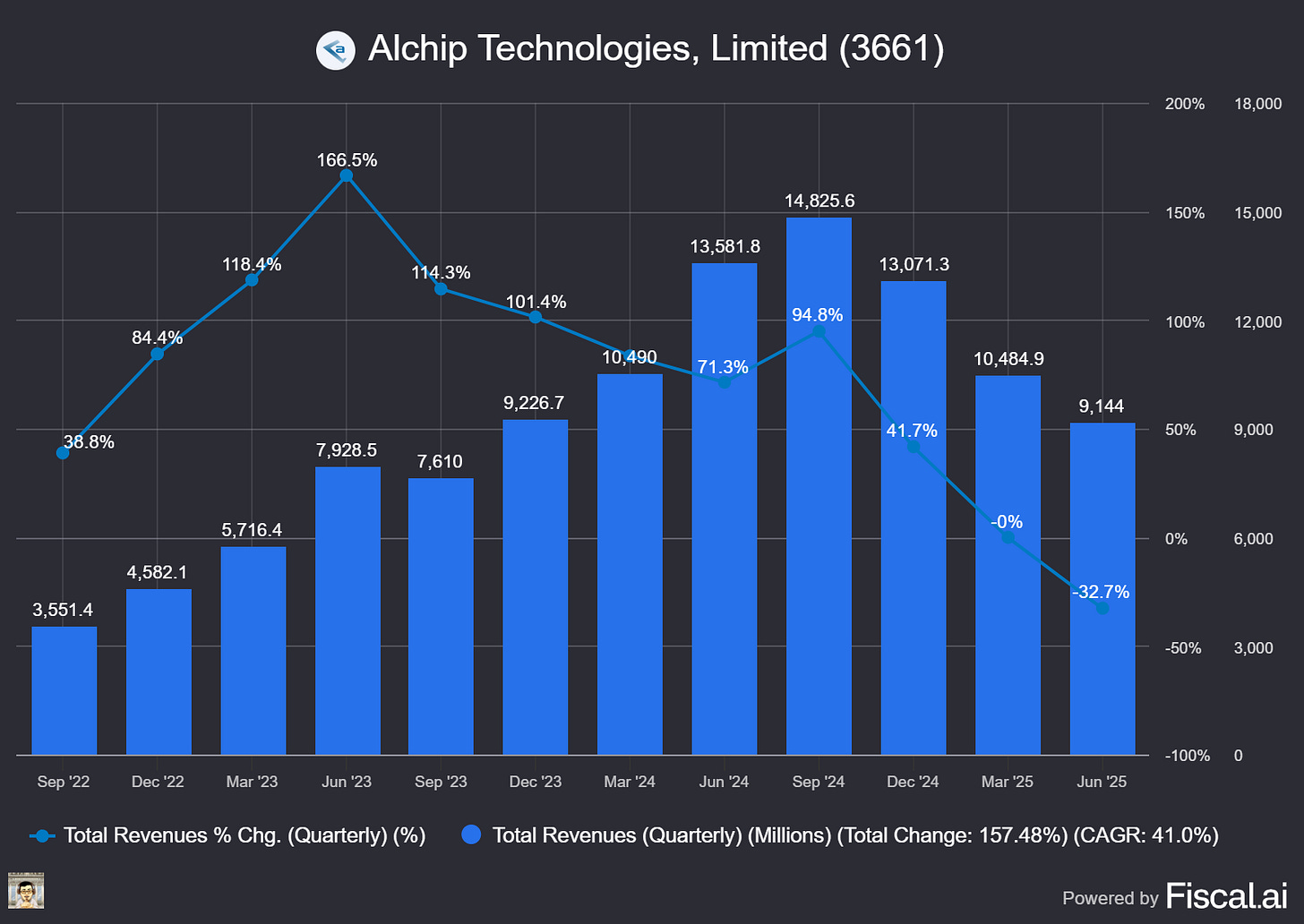

What The Chip: On the Q2 2025 earnings call (mid‑August 2025), Alchip posted $297.4M revenue (‑6.7% QoQ, ‑29.4% YoY) as legacy N7 shipments wound down and a key N3 AI accelerator slipped a few days from June → early July for tape‑out. Management guided flat revenue through year‑end but higher gross margins on rising NRE (one‑time design fees), with N3 volume production revenue slated for late Q1 2026 and N2 NRE starting 2H25.

Details:

📊 Quarter snapshot: Revenue $297.4M; operating income $37.6M; net income $42.9M; EPS 16.4 (FX headwind from a stronger NT$). Management: “Gross margin decreased a bit due to the NRE slip, but we still have good confidence to achieve a notable percentage‑point increase vs. last year.”

🧠 Business mix stays AI‑heavy: HPC/AI = 82% of sales; consumer (gaming) = 14%. North America = 79% of revenue; China ≈ 7% (single‑digit), reflecting deliberate geopolitical diversification.

🧪 N3 milestones & ramp: A “very important” N3 AI accelerator taped out in early July after a slight slip; production revenue to kick in late Q1 2026. “Schedule remains intact,” management reiterated. Multiple additional N3 tape‑outs are slated for 2H25.

🧰 N2 design work begins (2H25): Team expects N2 AI‑related NRE this year. On tech readiness: “No showstoppers” for critical third‑party IP. The company is designing HBM bridges and using UCIe (an open chiplet interconnect) to link compute dies to memory; HBM controllers can remain merchant or be customized per customer needs.

🚗 Auto ADAS moves to production: Prototyping completed “successfully.” The end customer “already placed substantial wafer orders.” Management expects this ADAS chip to rank among top‑3 revenue drivers starting 2026; next‑gen auto designs have kicked off.

🔄 Transition year dynamics: N7 accelerator shipments effectively ended in 1H25; 5nm AI accelerator shipments to a North American IDM will taper in 2H25. That lowers production revenue near‑term, but management expects a meaningful NRE uptick and gross‑margin improvement in 2H25 (“not 100%, but pretty good” offset).

🤝 “Open ecosystem” vs. captive models: Alchip says it welcomes third‑party partners (e.g., Astera Labs for connectivity) and will support NVLink or UALink paths based on customer choice—aimed at faster schedules and lower total cost for cloud customers. Quote: “Completely open… IP and everything is interchangeable.”

🧱 Customer concentration & procurement model: The company continues to work with its “most important account” on cooperation terms for N3 after that customer direct‑procured wafers at N5. Management still targets 2026 blended GM equal to or better than 2024, even as the model evolves.

🌏 Geopolitical risk management: China exposure cut to single digit; hiring ramp outside China—Japan office capacity to ~200; Malaysia + Vietnam already 60+ engineers, targeting ~120 by year‑end. This aligns with 2025 tariff and supply‑chain uncertainty.

📅 2025 outlook & 2026–2029 arc: Management expects flat QoQ revenue for the rest of 2025, but improving margin on NRE mix and pricing support. Big picture: “Highly optimistic for AI from 2026–2029,” aiming to outperform market CAGR in HPC as N3 ramps and N2 programs convert.

Why AI/Semiconductor Investors Should Care

Custom silicon at hyperscalers is accelerating, and Alchip’s N3 tape‑outs now + N2 NRE starting 2H25 point to a multi‑year revenue runway beginning Q1 2026—even as 2025 stays a bridge year. The firm’s open‑ecosystem strategy (UCIe/HBM bridges, NVLink/UALink options) targets time‑to‑market and cost advantages customers care about, while reduced China exposure helps mitigate tariff/export‑control risk. Watch customer concentration, the procurement model shift, and execution on the auto ADAS ramp; if management lands one or two more CSP wins, the growth ceiling lifts materially.

Youtube Channel - Jose Najarro Stocks

X Account - @_Josenajarro

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

Disclaimer: This article is intended for educational and informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

The overview above provides key insights every investor should know, but subscribing to the premium tier unlocks deeper analysis to support your Semiconductor, AI, and Software journey. Behind the paywall, you’ll gain access to in-depth breakdowns of earnings reports, keynotes, and investor conferences across semiconductor, AI, and software companies. With multiple deep dives published weekly, it’s the ultimate resource for staying ahead in the market. Support the newsletter and elevate your investing expertise—subscribe today!

[Paid Subscribers] Applied Materials Q3 FY25: Record Sales, Cautious Q4 Guide

Date of Event: August 14, 2025

Executive Summary

*Reminder: We do not talk about valuations, just an analysis of the earnings/conferences

Applied Materials posted another record quarter, reporting revenue of $7.30 billion (+8% year over year) and record non‑GAAP EPS of $2.48 (+17% YoY). Non‑GAAP gross margin reached 48.9% and operating margin 30.7%. CEO Gary Dickerson summed it up: “Applied Materials delivered record performance in our third fiscal quarter,” and said the company is still “on track to deliver our sixth consecutive year of revenue growth in fiscal 2025.” CFO Brice Hill guided for a sequential step down in Q4, citing “digestion of capacity in China and non‑linear demand from leading‑edge customers,” and modeled Q4 revenue of $6.7B ± $500M and non‑GAAP EPS of $2.11 ± $0.20.

China was a swing factor. Management said China comprised ~35% of Q3 sales and is modeled to ~29% of Q4, assuming no approvals on a “growing” backlog of export‑license applications. The company framed the China slowdown as multi‑quarter “digestion” rather than a structural change, while emphasizing long‑term confidence in AI‑led demand.

Growth Opportunities

Advanced packaging remains the company’s highest‑share beachhead. Management reiterated that Applied’s packaging business is on track to more than double to >$3B annually over the next few years as high‑bandwidth memory (HBM) and heterogeneous integration scale. That growth sits atop a broad materials toolset (deposition, etch, cleans, CMP, plating) and a co‑development model with leading customers.