Semiconductor's Next Frontier: Starcloud’s Space Data Center, AMD’s Hyperscale Ramp, and ASML’s Strategic AI Move

Welcome, AI & Semiconductor Investors,

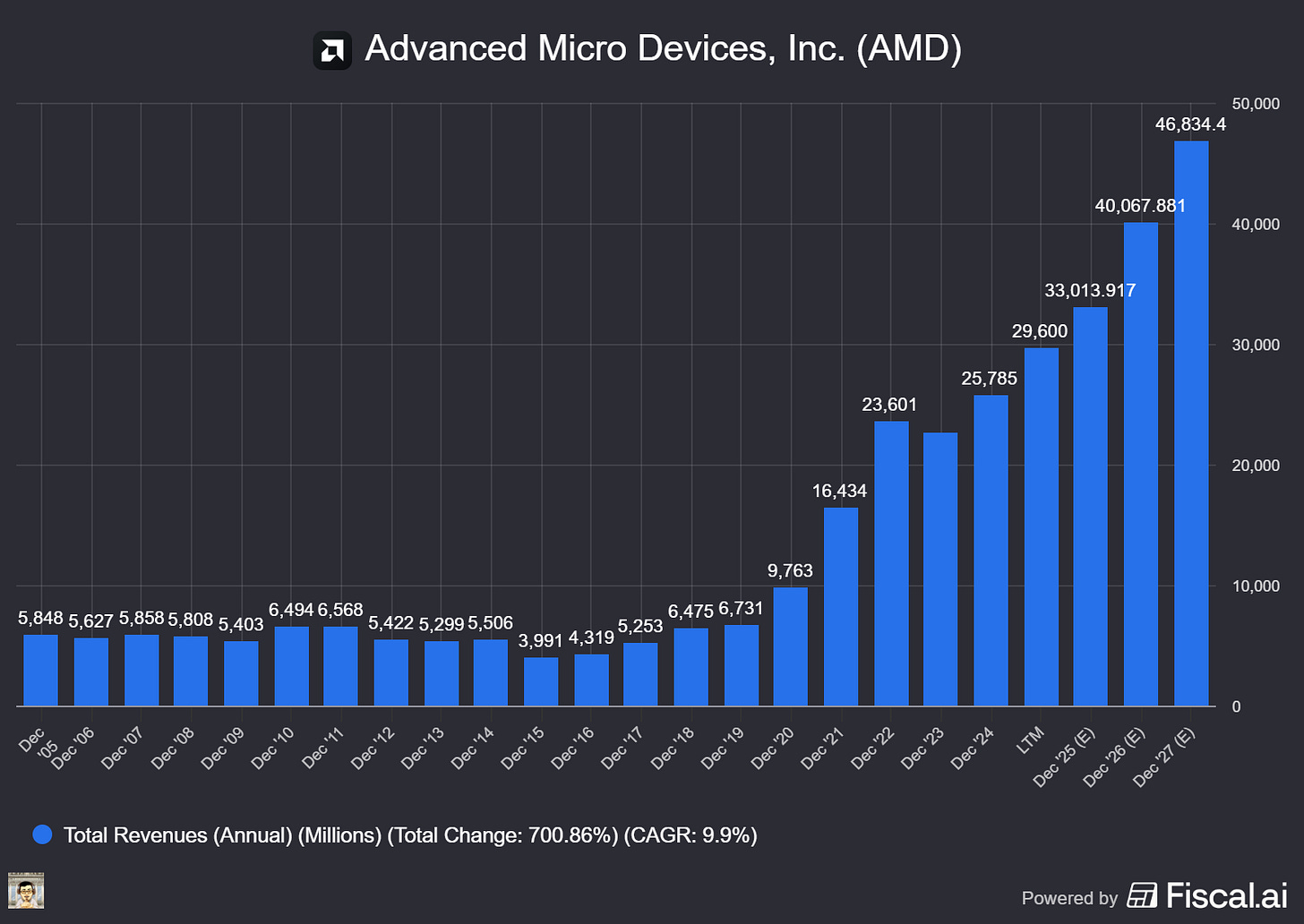

Could AI data centers thrive in orbit? Starcloud’s upcoming launch of an NVIDIA H100-equipped satellite promises to slash energy and CO₂ costs by tenfold, pushing data centers off-planet and potentially revolutionizing infrastructure economics. Back on Earth, AMD’s transformative 6-gigawatt partnership with OpenAI and Oracle’s colossal 50,000-GPU cluster have analysts racing to new highs, while ASML’s confident bet on High-NA EUV and AI-driven lithography signals a bold reshaping of semiconductor manufacturing for the AI age.— Let’s Chip In.

What The Chip Happened?

🚀 Starcloud: Taking Nvidia Data Centers Off‑Planet

💵 AMD Gets Dual Street Highs: HSBC to $310, Wedbush to $270 on AI GPU Momentum

🧠 ASML’s Q3: Big Q4 Setup, High‑NA Matures, and a Bold AI Bet

[ASML Q3 2025: EUV Shines, AI Fuels the Future, China Softens October 15, 2025]

Read time: 7 minutes

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

Starcloud (Private) Nvidia (NVDA)

🚀 Starcloud: Taking Nvidia Data Centers Off‑Planet

What The Chip: On October 15, 2025, Starcloud—a Redmond, WA startup in NVIDIA’s Inception program—detailed plans for Starcloud‑1, launching November 2025 with an NVIDIA H100 on board. The company projects 10× lower energy costs and 10× CO₂ savings over a data center’s life by shifting compute to orbit.

Details:

🛰️ First H100 in space. Starcloud‑1 is a ~60‑kg (small‑fridge‑size) satellite that the company says will deliver ~100× more GPU compute than any prior space mission—marking the H100’s “cosmic debut.”

☀️ Power + cooling advantage. Orbit provides near‑continuous solar exposure (terminator‑line orbit) and the vacuum of space as a heat sink, avoiding evaporative cooling and conserving fresh water that terrestrial data centers would otherwise need.

💸 Cost & carbon math. “In space, you get almost unlimited, low‑cost renewable energy,” said cofounder/CEO Philip Johnston. Starcloud projects 10× cheaper energy (even after launch costs) and 10× CO₂ savings over the facility’s life versus running on Earth.

🧱 Scale vision. The roadmap calls for a ~5‑gigawatt orbital data center with super‑large solar and radiator panels roughly 4 km × 4 km—a size they argue unlocks hyperscale economics off‑planet.

🔥 Real‑time edge in orbit. Initial workloads target Earth observation, including wildfire detection and distress‑signal response—running inference on‑orbit to cut alert times from hours to minutes.

🛰️📡 Data deluge, processed in place. SAR (synthetic‑aperture radar) feeds can reach ~10 GB/s; doing inference in space trims downlink needs and speeds up insights for 3D mapping and monitoring.

🧠 LLMs in orbit. The team plans to run Gemma (Google’s open model) on the H100 to prove large‑model inference off‑planet; they credit NVIDIA Inception for technical support, access to experts, and GPU resources.

🧩 Roadmap & risks. Future missions aim to integrate NVIDIA Blackwell, which Johnston expects could deliver up to 10× the in‑orbit AI performance vs. Hopper (H100). Watch headwinds: radiation hardening, bandwidth/downlink limits, on‑orbit servicing, regulatory/spectrum approvals, debris risk, and launch cadence/capex.

Why AI/Semiconductor Investors Should Care

Energy and cooling now anchor data‑center economics; if Starcloud proves H100‑class compute can operate reliably with dramatically lower OPEX in orbit, it opens a new capex cycle in space‑based AI infrastructure while easing grid and water constraints on Earth. Near‑instant analytics for Earth observation is a real commercial wedge today—and if Blackwell’s step‑function arrives on‑orbit, it extends NVIDIA’s datacenter GPU TAM beyond Earth. The opportunity is bold, but execution will hinge on launch costs, radiation‑tolerant hardware lifetimes, and regulatory throughput—key variables to track before betting big.

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

Advanced Micro Devices (NASDAQ: AMD)

💵 AMD Gets Dual Street Highs: HSBC to $310, Wedbush to $270 on AI GPU Momentum

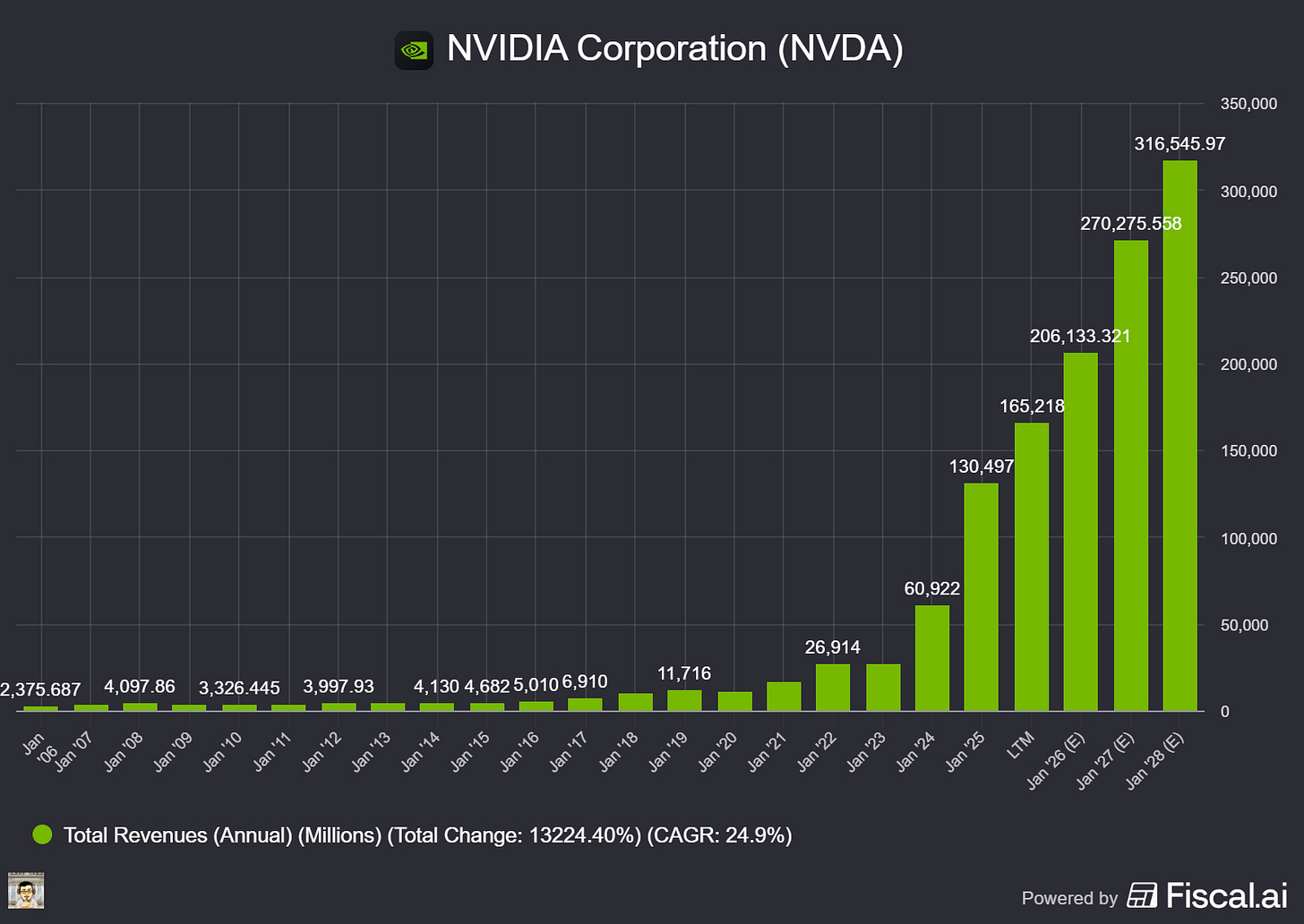

What The Chip: On October 15, 2025, HSBC hiked AMD’s price target to a Street‑high $310 (Buy) and Wedbush raised to $270 (Outperform), citing accelerating visibility from new, large AI GPU deals—most notably OpenAI’s 6‑gigawatt buildout and Oracle’s 50,000‑GPU MI450 cluster.

Details:

📈 Two big upgrades, one day. HSBC’s Frank Lee lifted AMD’s target from $185 → $310 (+~68%) and kept a Buy; Wedbush’s Matt Bryson went $190 → $270 with Outperform. Both moves lean on rising confidence in AMD’s AI GPU pipeline.

🤝 OpenAI x AMD: 6 GW of compute. AMD and OpenAI signed a multi‑year, multi‑generation pact for 6 gigawatts of AMD Instinct GPUs, with the first 1 GW of MI450 deployments starting 2H’26. CEO Lisa Su: “We are thrilled to partner with OpenAI to deliver AI compute at massive scale.” CFO Jean Hu added the deal is “expected to deliver tens of billions of dollars in revenue for AMD.”

☁️ Oracle supercluster: 50,000 MI450s. At Oracle AI World, Oracle said OCI will launch a publicly available AI supercluster with 50,000 AMD Instinct MI450 GPUs beginning Q3’26, expanding through 2027. AMD’s Forrest Norrod said Oracle customers gain “powerful new capabilities for training, fine‑tuning, and deploying the next generation of AI.”

🔎 HSBC’s math is more aggressive. Lee models up to $37.5B in 2027 AI GPU revenue (vs. Street $26.8B), arguing AMD is narrowing the performance gap with Nvidia and gaining supply visibility as TSMC capacity improves.

🧮 Wedbush’s valuation frame. Bryson applies ~30× P/E to FY2027 EPS of $9 (plus net cash) to justify $270, grounded in multi‑year AI hardware ramps. Market commentary also flags AMD’s current rich multiple (around 133× P/E), a reminder execution must land on time.

💵 Deal economics: big per‑watt revenue. Wedbush pegs OpenAI’s expansion as a $20B per gigawatt revenue pool for AI hardware—illustrating the magnitude of the AI buildout if AMD captures meaningful share.

🆚 Competitive backdrop stays fierce. While HSBC argues the gap is closing, independent testing highlighted by Barron’s still shows Nvidia’s latest GB200 NVL72 system leading AMD on inference performance and efficiency—one reason bulls and bears both have ammo.

🧩 Supply & timing risk. The MI450 ramp begins in 2H’26 (OpenAI) and Q3’26 (Oracle); any slip in CoWoS/HBM capacity or platform readiness could push revenue right on the curve that underpins these targets. (Press releases and analyst notes emphasize forward‑looking uncertainties.)

Why AI/Semiconductor Investors Should Care

These calls reflect a step‑change in revenue visibility. The OpenAI (6 GW) and Oracle (50k GPUs) wins move AMD from “credible second source” to strategic supplier at hyperscale—bolstering multi‑year order books and supporting more ambitious 2026–2027 AI revenue and EPS trajectories. The bull case hinges on supply ramp (TSMC/packaging/HBM) and competitive parity trending in AMD’s favor; the bear case points to execution risk and Nvidia’s continued performance lead. Positioning and risk management aside, the size and timing of these deployments explain why targets jumped to $310 and $270 today.

ASML Holding N.V. (NASDAQ: ASML)

🧠 ASML’s Q3: Big Q4 Setup, High‑NA Matures, and a Bold AI Bet

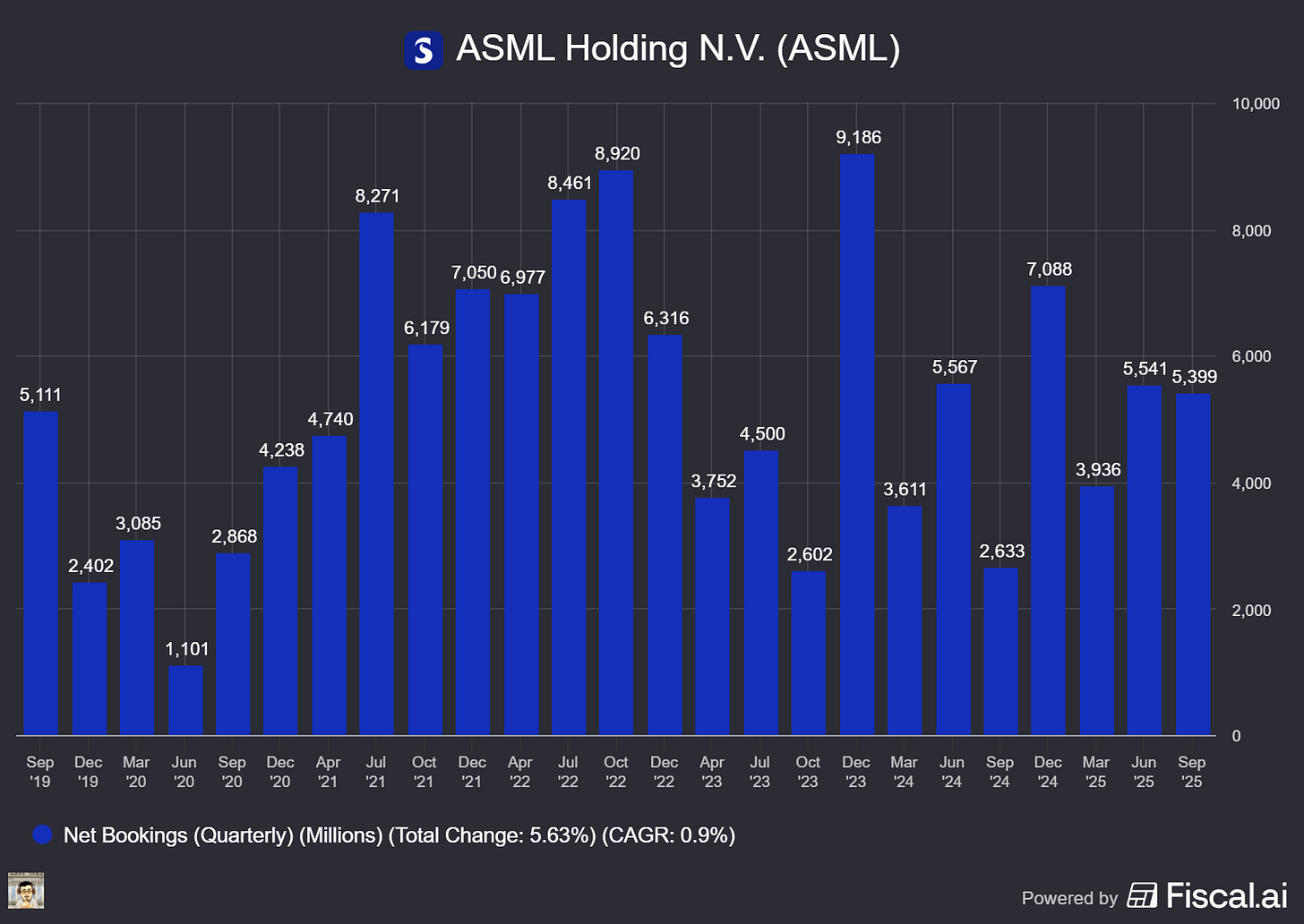

What The Chip: On Oct 15, 2025, ASML reported Q3 net sales of €7.5B, 51.6% gross margin, and €2.1B net income, with €5.4B in bookings (€3.6B EUV). Management guided Q4 sales to €9.2–9.8B (GM 51–53%) and reiterated FY25 ~+15% y/y sales growth and ~52% GM—plus a key line: “We do not expect 2026 total net sales to be below 2025.”

Details:

📊 Quarter in line; bigger Q4 ahead. Q3 sales €7.5B (down ~2.3% QoQ), GM 51.6% (down 210 bps QoQ), EPS €5.49. ASML expects a very strong Q4, with the midpoint implying ~27% QoQ revenue step‑up; FY25 net sales ~€32.5B and ~52% GM. CFO Roger Dassen (ASML’s CFO) said the print was “within guidance” and Q4 is “as planned.”

📦 Bookings healthy and EUV‑heavy. €5.4B of Q3 net bookings, about two‑thirds EUV (€3.6B); mix 53% logic / 47% memory. Net system sales in Q3 skewed 65% logic / 35% memory, with Installed Base Management (service + options) at €2.0B (about 26% of total net sales).

💡 Litho intensity rising—especially in DRAM. CEO Christophe Fouquet (ASML’s CEO) said, “We see litho intensity continue to develop positively as EUV adoption gains momentum.” Management pushed back on fears that DRAM’s move from 6F² to 4F² reduces EUV layers: they do not expect EUV layers to drop; over time, they expect layers to grow, with some boost to advanced DUV masks as structures get more complex.

🔬 High‑NA EUV: maturity improving; two EXE tools in Q4. Customers have now run >300,000 wafers on High‑NA platforms, and early maturity looks ahead of Low‑NA at a similar stage. ASML plans to recognize two High‑NA EXE systems in Q4—helping revenue but dilutive to GM. Dassen said High‑NA margins are “very low positive” today and will improve with volume, though still dilutive through 2030.

🧱 Advanced packaging beachhead—XT:260. ASML shipped its first product for 3D integration, the TWINSCAN XT:260 (i‑line). It offers up to 4x productivity vs. existing solutions and targets advanced packaging—critical as chipmakers stitch together more compute/HBM in 2.5D/3D stacks. Fouquet: “There will be more” products for 3D integration, and customer interest into 2026 looks strong.

🤝 Strategic AI move with Mistral AI. ASML closed a partnership to embed AI across its holistic portfolio (scanners, metrology, and inspection) to boost tool performance, productivity, and customer yield—and to speed ASML’s own development. ASML also invested €1.3B as lead investor in Mistral’s Series C, taking ~11% and a strategic committee seat. Dassen called it a “very strategic partnership.”

🌏 2026 setup: EUV up, DUV down; China normalizes. Management expects China sales to decline significantly in 2026 vs. 2024–25 (after two very strong years), weighing on DUV, while EUV should increase on leading‑edge logic and advanced DRAM demand. ASML flagged that tariff clarity versus last quarter has reduced uncertainty, aiding customer planning.

💸 Cash, dividend, and buyback. Cash & ST investments fell to €5.1B (from €7.2B in Q2), reflecting working capital tied to High‑NA cycle times, the Mistral investment, dividends, and buybacks. ASML will pay a €1.60 interim dividend on Nov 6, 2025. Q3 buybacks totaled ~€148M, bringing 2022–2025 program totals to 9.0M shares / €5.9B; ASML does not expect to finish the €12B program by year‑end and intends to announce a new program in Jan 2026.

CEO Fouquet: “We do not expect 2026 total net sales to be below 2025.”

CFO Dassen on Mistral: “Our partnership allows us to embed AI across our entire portfolio… and improve time to market.”

Fouquet on tech progress: “High‑NA maturity is well ahead of where Low‑NA was at the same stage.”

Why AI/Semiconductor Investors Should Care

EUV demand is broadening (advanced logic and DRAM), lithography layers are rising, and ASML’s Q4 surge plus 2026 ≥ 2025 outlook suggest the AI capex cycle is translating into tools. The High‑NA ramp (though margin‑dilutive near term) and 3D‑integration entry expand ASML’s strategic choke points in performance‑hungry AI chips and HBM stacks. Risks: a China DUV reset could trim mix and gross margin, High‑NA remains volume‑ and cycle‑time‑sensitive, and working capital will stay elevated as ASML builds ahead of demand. Net‑net, the order mix (EUV ~67% of Q3 bookings), technology positioning, and the AI software tie‑in with Mistral put ASML in the critical path of the AI infrastructure build—exactly where investors want it.

Youtube Channel - Jose Najarro Stocks

X Account - @_Josenajarro

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

Disclaimer: This article is intended for educational and informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

The overview above provides key insights every investor should know, but subscribing to the premium tier unlocks deeper analysis to support your Semiconductor, AI, and Software journey. Behind the paywall, you’ll gain access to in-depth breakdowns of earnings reports, keynotes, and investor conferences across semiconductor, AI, and software companies. With multiple deep dives published weekly, it’s the ultimate resource for staying ahead in the market. Support the newsletter and elevate your investing expertise—subscribe today!

[Paid Subscribers] ASML Q3 2025: EUV Shines, AI Fuels the Future, China Softens October 15, 2025

Event date: October 15, 2025

Executive Summary

*Reminder: We do not talk about valuations, just an analysis of the earnings/conferences

ASML just wrapped up its third-quarter earnings for 2025, and the story remains compelling: steady financial execution, promising tech breakthroughs, and some shifting dynamics, especially regarding China. Net sales for the quarter landed neatly at €7.5 billion, right within the company’s previous guidance. Gross margins held firm at 51.6%, while net income clocked in at a robust €2.1 billion, translating to earnings of €5.49 per share. Not bad for a quarter’s work.

CEO Christophe Fouquet summed it up clearly: “Our Q3 results were exactly where we said they’d be, a solid quarter for ASML.” He highlighted exciting momentum around AI-driven investments, particularly boosting demand in cutting-edge logic and advanced memory (DRAM). The continued uptake of ASML’s extreme ultraviolet (EUV) technology underpins this trend, making chips faster, smaller, and smarter. In short, the semiconductor race is hotter than ever, and ASML remains squarely at the center of the action.

Growth Opportunities

The wave of AI continues reshaping the chip market, and ASML is riding high. More customers are now tapping into AI’s immense potential, pushing lithography intensity to new heights. ASML’s EUV systems, critical for the industry’s top-tier chip makers, saw a healthy €3.6 billion in new orders in Q3 alone.