CapEx Supercycle: TSMC’s Massive Expansion, Intel’s Critical Pivot, and Alphabet’s High-Stakes AI Showdown

Welcome, AI & Semiconductor Investors,

Can trillion-dollar AI demand outrun margin pain? TSMC just unleashed the largest simultaneous fab build in semiconductor history—spreading cutting-edge silicon across continents, even as margins take a temporary hit. Intel faces a decisive moment: can its foundry finally deliver growth, or will another pivot spoil the comeback story? And Alphabet confronts an existential AI test—can Gemini protect Search from cannibalization, or is Google’s AI spend chasing diminishing returns? The future of semiconductor dominance hinges on these critical moves. — Let’s Chip In

What The Chip Happened?

🛠️ Building the Global Fab of Fabs – TSMC Cranks Up CapEx for an AI‑Hungry Decade

💡 Intel’s Low‑Bar Thursday Could Flip the Script

🔎 Gemini or Bust — Alphabet’s Q2 AI Showdown

[TSMC Q2 2025: Record AI‑Driven Quarter Lifts Full‑Year Growth Outlook]

Read time: 7 minutes

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

Taiwan Semiconductor Manufacturing (NYSE: TSM)

🛠️ Building the Global Fab of Fabs – TSMC Cranks Up CapEx for an AI‑Hungry Decade

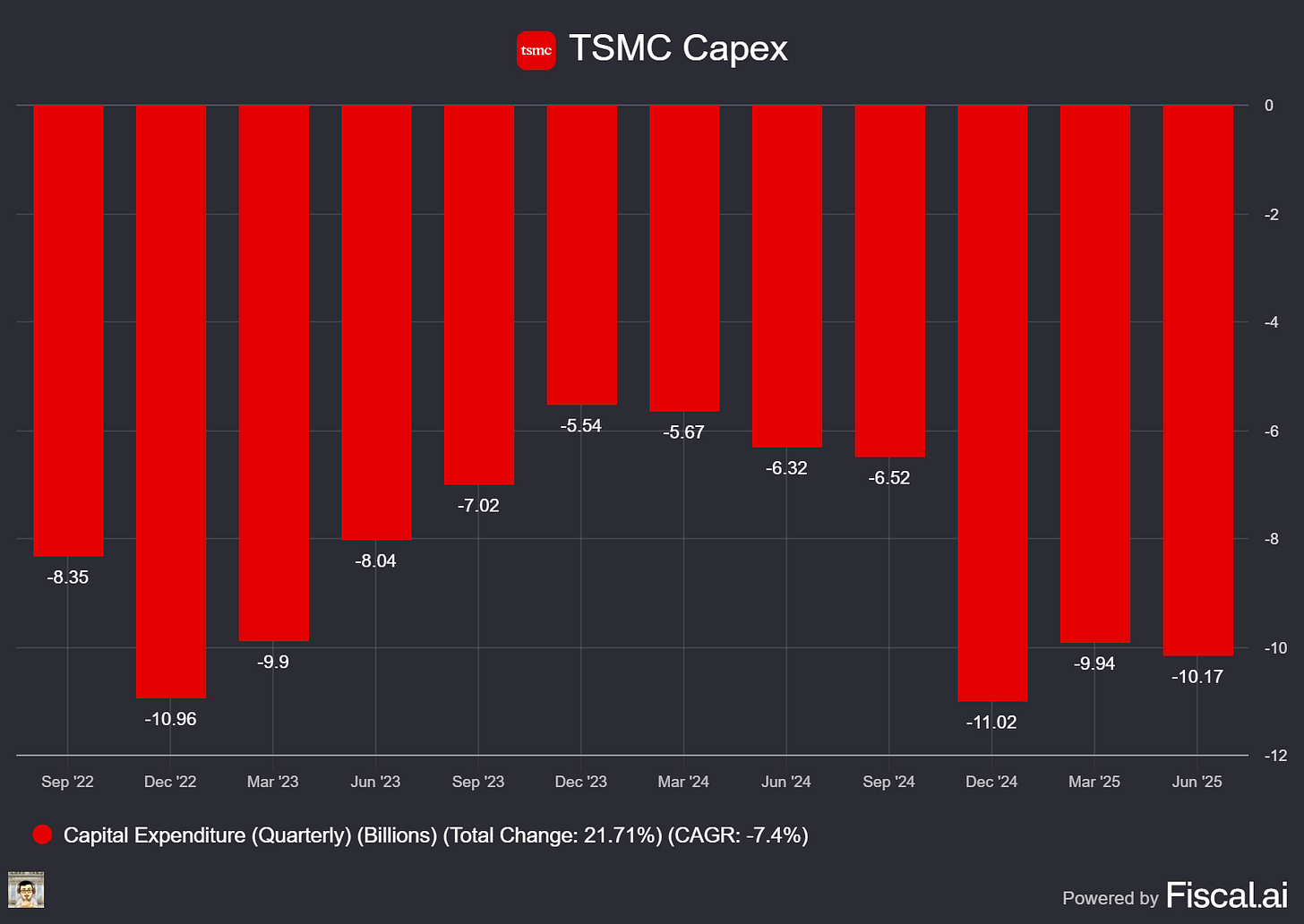

What The Chip: TSMC’s July 17, 2025 earnings call confirmed Q2 CapEx of US$9.63 billion and kept full‑year spending at US$38‑42 billion, even after lifting 2025 revenue growth guidance to roughly 30 %. CFO Wendell Huang reminded investors that today’s outlays “are for the business opportunities in the following years,” and that CapEx “won’t suddenly drop” for a company of TSMC’s scale.

The Situation Explained:

🔹 Historic US$165 B Arizona build‑out. Six wafer fabs, two advanced‑packaging plants and a new R&D center form a complete U.S. AI supply chain. First N4 fab hit high‑volume production in Q4‑24 with yields on par with Taiwan; a second 3 nm fab is ready months early, and a third 2 nm/A16 fab has broken ground. When finished, ~30 % of TSMC’s 2 nm‑and‑beyond capacity will sit in Arizona.

🔸 Taiwan still the mothership. Eleven more wafer fabs plus four advanced‑packaging lines stretch across Hsinchu and Kaohsiung, including multi‑phase 2 nm expansions to preserve home‑field process leadership.

🗾 Japan & Europe for specialty nodes. Kumamoto’s first specialty fab ramped in late 2024; a second breaks ground later this year. Dresden will focus on auto‑grade MCUs and power ICs, backed by German and EU subsidies.

📉 Margin math gets tougher. Overseas ramps shaved “a little over 100 bp” from Q2 gross margin. Management models 2‑3 % dilution annually during early overseas ramp (2025‑26), widening to 3‑4 % over the next five years.

💱 FX stings too. Q2 NT‑dollar strength cost 220 bp; Q3 guidance bakes in another 260 bp headwind. Every 1 % NT appreciation clips revenue 1 % and margins 40 bp.

🔧 Capacity remains “very tight.” Wei said N7 tools now prop up N5, and N5 is being swapped for N3 to relieve shortages. N2 volume starts 2H‑25, with “higher tape‑outs than N5 or N3 in their first two years,” while the A16 variant promises 8‑10 % speed and 15‑20 % power gains over N2P.

⚡ CapEx won’t blink. Huang reiterated that lumpy spending is unlikely; instead, management will “leverage our increasing size in Arizona and work on our operations to improve the cost structure.”

Why AI/Semiconductor Investors Should Care: This is the largest simultaneous fab build in semiconductor history. By scattering leading‑edge capacity across the U.S., Taiwan, Japan and Europe, TSMC reduces geopolitical risk for customers like Apple, NVIDIA and AMD while chasing an AI/HPC wave that CEO Wei calls “strong and structural.” Near‑term, investors must stomach margin dilution and FX pain, yet TSMC still targets 53 %+ long‑run gross margins, banking on scale and first‑mover economics at 2 nm and below. If management executes, today’s record CapEx could lock in a decade‑long moat in power‑efficient AI silicon—exactly where the next trillion dollars of compute demand will reside.

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

Intel (NASDAQ:INTC)

💡 Intel’s Low‑Bar Thursday Could Flip the Script

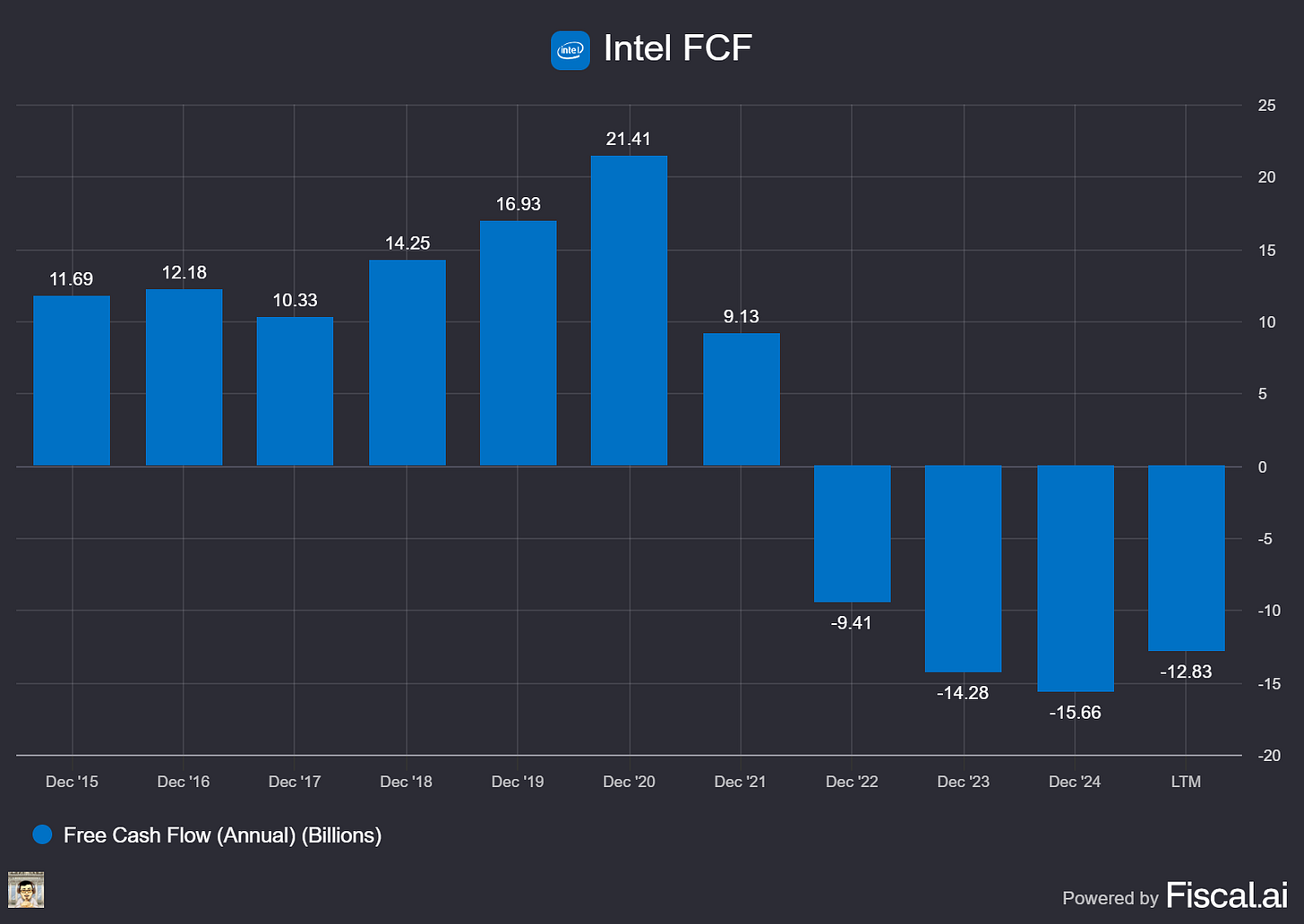

What The Chip: Intel reports Q2‑25 results this Thursday, July 24 2025. Management guided revenue to $11.2 – $12.4 billion and non‑GAAP EPS ≈ $0.00, essentially a breakeven quarter. Sell‑side estimates sit right in the middle, so even a modest beat could spark a relief rally.

The Situation Explained:

🏭 Foundry in Focus — and Flux. Investors want proof Intel Foundry (IFS) can win outside business; yet Reuters says the board is weighing a pivot from the just‑launched 18A node to the even‑newer 14A, with potential write‑offs in the “hundreds of millions.”

📉 Guidance Sets a Low Bar. Q2 revenue midpoint implies a ~7 % Y/Y slide and gross margin of 36.5 %, barely above last year’s trough. Any hint of a road back to > 40 % GM would be a positive surprise.

🚀 Gaudi 3 Finally Shipping. Dell’s AI Factory racks started moving in May; Intel touts 70 % better price‑per‑formance on Llama 3 versus Nvidia’s H100. Early revenue recognition timing will be dissected.

💻 AI‑PC Ambition. Lunar Lake notebooks pack a 48‑TOPS NPU and anchor Intel’s goal of 100 M AI‑PC shipments by end‑2025; attach‑rate color could validate a PC rebound narrative.

✂️ Cost‑Cutting Watch. New CEO Lip‑Bu Tan has already approved ≈ 2.4 k layoffs in Oregon and 584 in California, targeting opex of $17 bn in ’25 and $16 bn in ’26. Progress feeds directly into free‑cash‑flow models.

🏗️ CHIPS‑Act Strings Attached. Last fall’s $7.9 bn federal award bars stock buybacks for five years, so cash returns hinge on margin recovery, not financial engineering.

Why AI/Semiconductor Investors Should Care: Intel’s stock now trades on execution, not expectations. A slight EPS beat or gross‑margin uptick could re‑rate a name priced for stagnation; a miss would amplify fears of costly write‑offs and another roadmap reset. Foundry commentary—especially on 18A versus 14A customer traction—will signal whether Intel can turn its massive fab spend into a real growth engine. Meanwhile, concrete numbers on AI‑PC attach rates and Gaudi 3 revenue will show if Intel can grab incremental share in the two hottest silicon markets of 2025.

Alphabet (NASDAQ: GOOGL)

🔎 Gemini or Bust — Alphabet’s Q2 AI Showdown

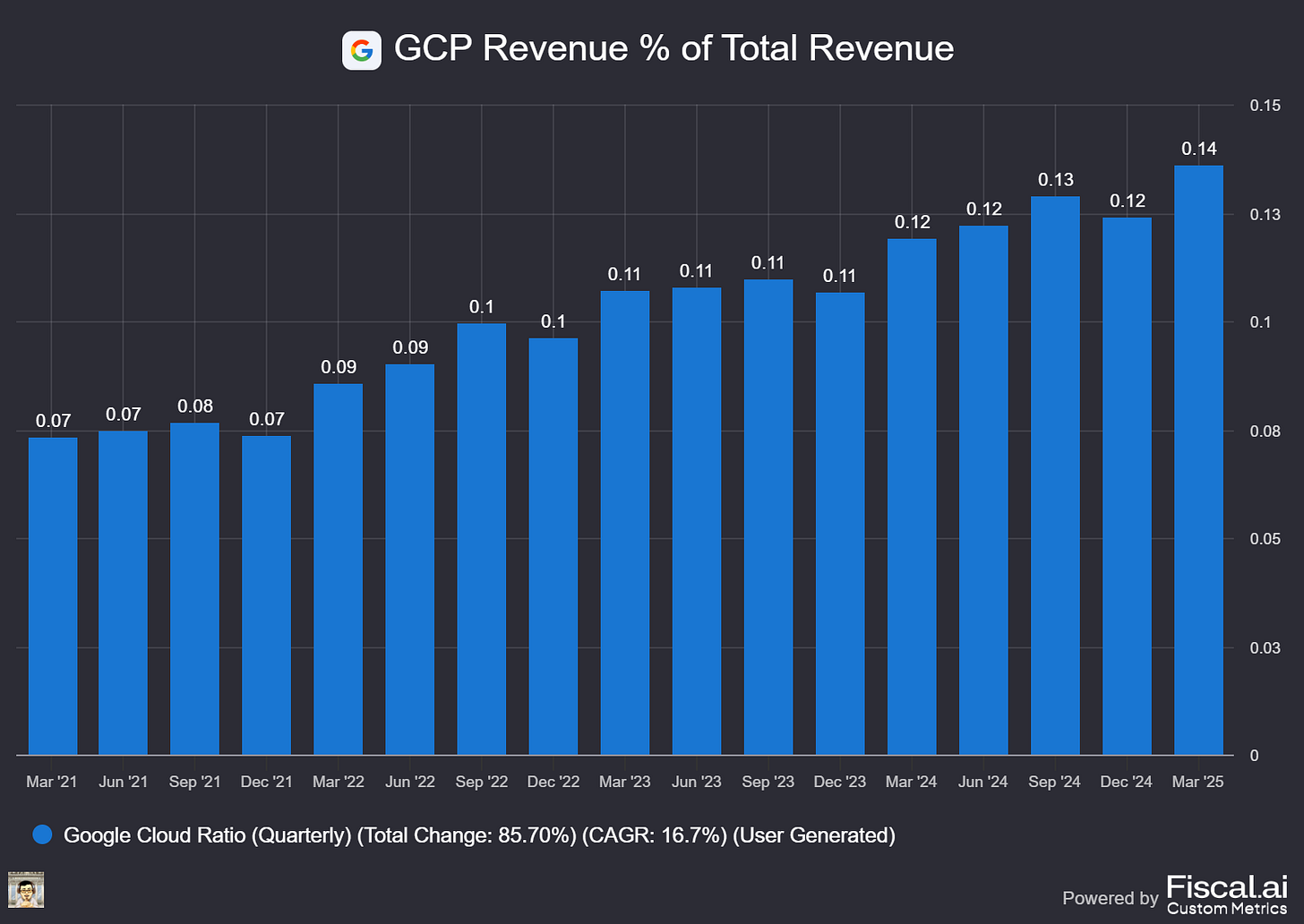

What The Chip: Alphabet reports Q2‑25 results after‑market on July 23. Wall Street bakes in a near 11 % revenue jump and sees EPS topping $2.15 even as the company plows record sums into AI‑centric cap‑ex. Momentum looks solid, but every metric now swings on whether Gemini products grow faster than they cannibalise Search.

The Situation Explained:

📈 Street bar: Analysts model $93.8 bn GAAP revenue (+10‑11 % YoY), $79‑80 bn ex‑TAC, and a 33‑34 % operating margin—leaving only ~4 % implied option move if Alphabet threads the needle.

☁️ Cloud matters more: Google Cloud is expected to add ~26 % YoY to $13.1 bn and hold high‑teens margins. Any miss versus Azure/AWS could erase the stock’s recent 11 % rebound.

🏗️ Cap‑ex watch: Q1 spend hit $17.2 bn with management reaffirming a $75 bn 2025 budget. CFO Anat Ashkenazi warns rising depreciation will be a “headwind we have to manage.”

🤖 Gemini everywhere: Search’s new AI Mode and Deep Search now run on Gemini 2.5 Pro, while Gemini Code Assist gains “agent” powers. Early engagement stats will reveal if AI answers lift—or dilute—ad clicks.

🛡️ $32 bn Wiz deal: Management must reassure investors that the cybersecurity acquisition closes despite a fresh antitrust review and 2026 timetable.

⚖️ Chrome divestiture risk: The DOJ’s remedies trial still entertains forcing Google to spin off Chrome, a move CEO Sundar Pichai says “could be devastating for Search.”

💰 Buy‑back ammo: Roughly $70 bn remains under the current authorisation; CFO decisions here may offset any guidance hiccup.

Why AI/ Semiconductor Investors Should Care: Alphabet’s quarter is a live referendum on whether a proprietary silicon stack (TPU v6+, new Ironwood inference chip) and in‑house models can translate sky‑high $75 bn cap‑ex into durable cash flow before Search margins erode.

A clean Cloud beat plus stable cap‑ex intensity would signal Google can finance AI growth internally—validating the broader thesis that vertical integration trumps pure GPU rent‑seeking. Miss those marks, and the market may conclude hyperscale AI spending is out‑running its returns.

Youtube Channel - Jose Najarro Stocks

X Account - @_Josenajarro

Get 15% OFF FISCAL.AI — ALL CHARTS ARE FROM FISCAL.AI —

Disclaimer: This article is intended for educational and informational purposes only and should not be construed as investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

The overview above provides key insights every investor should know, but subscribing to the premium tier unlocks deeper analysis to support your Semiconductor, AI, and Software journey. Behind the paywall, you’ll gain access to in-depth breakdowns of earnings reports, keynotes, and investor conferences across semiconductor, AI, and software companies. With multiple deep dives published weekly, it’s the ultimate resource for staying ahead in the market. Support the newsletter and elevate your investing expertise—subscribe today!

[Paid Subscribers] TSMC Q2 2025: Record AI‑Driven Quarter Lifts Full‑Year Growth Outlook

Date of Event: Thursday, 17 July 2025

Executive Summary

*Reminder: We do not talk about valuations, just an analysis of the earnings/conferences

Taiwan Semiconductor Manufacturing Company Limited (TSMC) delivered its strongest quarter ever, propelled by insatiable demand for artificial‑intelligence (AI) and high‑performance‑computing (HPC) silicon. Second‑quarter revenue reached US $30.1 billion (NT$933.8 billion), up 17.8 % sequentially and 38.6 % year‑over‑year, while diluted earnings per share (EPS) surged 60.7 % YoY to NT$15.36. Gross margin held at 58.6 %, only 20 basis points lower than Q1 despite an 8 % appreciation of the New Taiwan dollar (NT$) and early losses at overseas fabs.

Chief Executive Officer (CEO) Dr. C.C. Wei highlighted “continued robust AI and HPC‑related demand” and called TSMC’s advanced‑node capacity “very tight.” Chief Financial Officer (CFO) Wendell Huang guided an 8 % sequential revenue increase for Q3 2025 (US $31.8‑33 billion) and lifted full‑year topline growth to “around 30 %,” compared with an April forecast in the mid‑20 percent range. Management reiterated a long‑term gross‑margin floor of 53 % or higher, even as foreign‑exchange (FX) swings and overseas start‑ups shave 210‑260 basis points in the second half.

Growth Opportunities

AI and HPC megatrend

HPC accounted for 60 % of wafer revenue, expanding 14 % quarter‑over‑quarter and roughly 67 % YoY, as cloud providers and hyperscalers accelerated deployment of training and inference accelerators. Dr. Wei pointed to “explosive growth in token volume” and rising sovereign‑AI initiatives as durable tailwinds that should keep 3‑nanometer (nm) and upcoming 2‑nm lines running at full tilt for years.